There are more costs associated with homeownership than just the mortgage, taxes, and utilities. Unfortunately, the different components of your home will not survive indefinitely. You can’t call the landlord for repairs like a tenant can, so you’ll have to budget for home repairs by yourself.

But how do you determine how to budget for home repairs? An excellent place to start is with the 1% rule of thumb. This entails putting aside 1% of the home’s purchase price for maintenance and replacement.

This general rule, however, may not be appropriate for all situations. Other considerations, such as the age and condition of the house, influence how much money you should set aside for repairs. Let’s look at the 1% rule of thumb, average lifespan, and strategies to fine-tune your numbers.

Why Do You Need Home Repairs?

Obviously, you want your home to be beautiful. Aligning that idea with your budget, on the other hand, can be a challenge. That’s why, when it comes to keeping track of house maintenance bills, having a good budget is crucial.

If you’ve set aside money for planned projects — and saved with each paycheck — you’ll most likely be able to complete the work. Furthermore, you’ll be able to increase the value of your home as well as its visual appeal.

So how does one calculate these home repairs? Here’s how to budget for home repairs without going broke.

How to Budget For Home Repairs

The first rule when you want to budget for home repairs is don’t come with empty wallets. Make a home repair or emergency fund out of a percentage of your monthly budget. Separating the money also makes it more difficult to spend it on something else. Even a modest sum can soon accumulate.

A good rule of thumb is to set aside 1% to 4% of your house’s value for home maintenance. For example, if your home is worth $200,000, you should budget $2,000 to $8,000 per year for regular maintenance.

Knowing how long something will last is one thing; calculating how much to save is quite another. Prioritizing based on age is often beneficial. If your roof is 20 years old, for example, you only have a few years before you need to replace it.

1% Rule of Thumb for a Home Maintenance Budget

When it comes to budgeting for house repairs, the 1 percent rule of thumb is an excellent place to start. Using 1% as a rule of thumb for home upkeep is a perfect example of when conventional knowledge is quite close to the mark.

According to the most recent Home Spending report, average [year] upkeep spending is $3,192, or about 1% of the median home value in the United States, which is just over $300,000.

Follow the $1/Sq.Ft Rule

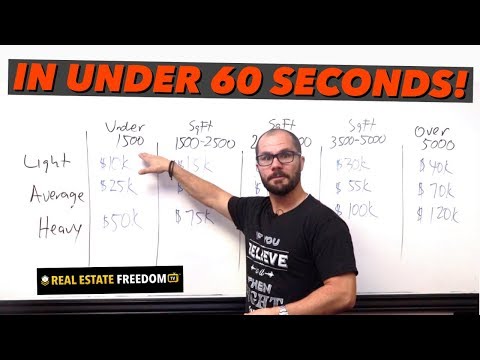

Rather than the value, this rule of thumb budgets for your home repair fund based on the size of your home. So, if your home is 2,500 square feet, you’ll need to set aside at least $2,500 per year for home upkeep and repairs.

If you’re concerned that neither of these guidelines will allow you to save sufficient money to pay the high costs of house repairs in your location, conduct some research. In the next five years, what parts of your home would you need to replace? A fence in the backyard? Do you want new flooring? Do you have any old pipes? Do you need a new roof? Is there a problem with excessive moisture build-up or perhaps flooding in your area?

You may obtain a decent estimate of how much your most urgent home repairs will cost by getting quotes from construction companies or asking other homeowners in your vicinity about the expenses of their own current house repairs.

You can always hire a qualified home inspector to analyze your property, assist you in discovering its most significant flaws, and offer you estimates for repair and replacement costs in your neighborhood if you wish to do less legwork.

Average Lifespan of a Home

Of course, wear and tear, upkeep, climate, and the existing items or material’s quality all have an influence on how long window frames to your air conditioners survive. Here are some averages compiled from a variety of sources:

- Roof: 15-30 years (asphalt shingles)

- Furnace: 20-30 years

- Central Air Conditioner: 12-17 years

- Water Heater: 8-12 years (tank type)

- Garage door openers: 10 to 15 years.

- Wooden windows: 20-year warranty.

The average appliances’ lifespan is:

- Washing machine: 13 years

- Dryer: 10 years

- Refrigerator: 12-15 years

- Dishwasher: 9 years

Never-Ending Repairs

You are accountable for all maintenance and upgrades on your home when you own it.

If you’ve never renovated your home before, this may seem like a minor detail. However, as many homeowners will confirm, this drains your finances or even necessitates a second loan.

That’s why some people say that a house is nothing more than a giant pit into which you pour all of your money.

What are the different types of repairs and maintenance that we’re talking about?

- Replacing the roof every 20 to 25 years

- Trimming the trees and the tree limbs

- Cleaning the gutters

- Installing an irrigation system in the lawn

- Installing fences

- Tearing out fences

- Replacing vinyl windows every 35 years

- Replacing the siding

- Painting or rebuilding the deck

- Painting the home exterior every 5-10 years

- Replacing all of the appliances

- Replacing the carpet every 8 to 10 years

You get the idea. It’s possible that the list might continue indefinitely.

How to budget for home repairs and the sum when you have no idea what repairs your home will require and when you will require those repairs? It’s simple, just follow our 1% rule.

The Biggest Mistake

One of the most common misconceptions first-time homebuyers make is that they assume the amount of their mortgage represents their total home-related expenditures.

After all, they didn’t have any more home-related expenses beyond rent when they were tenants. They compare rent and mortgage on a one-to-one basis and conclude that the tale ends there. Regrettably, it does not. Hence, it becomes all the more important to budget for home repairs.