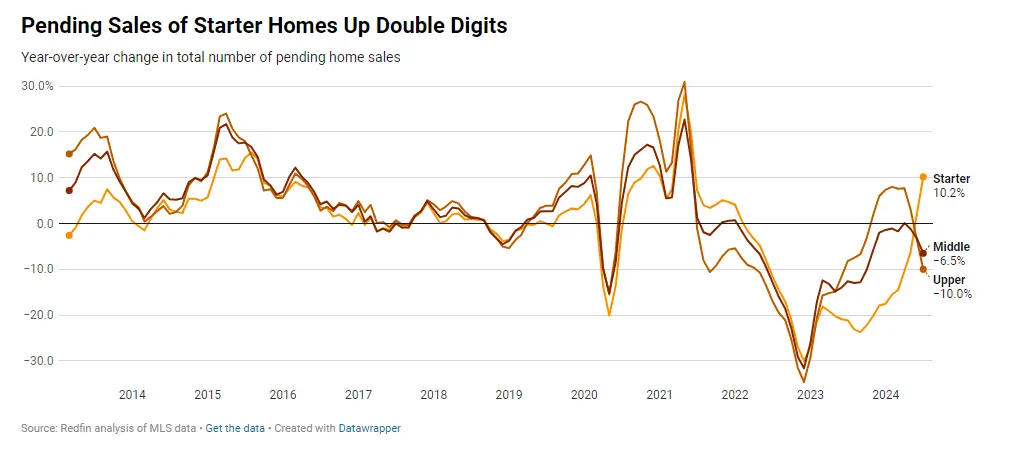

The U.S. housing market has been sluggish in recent months, but starter homes have emerged as a bright spot amid this trend. With mortgage rates settling near a 15-month low, first-time homebuyers are moving off the sidelines, taking advantage of lower rates and increasing inventory. In July 2024, pending sales of starter homes grew by 10.2% year over year, marking the highest level since October 2022.

Mortgage Rates and Starter Homes

One of the key factors driving the renewed interest in starter homes is the recent decline in mortgage rates, which began in mid-July. This rate drop has had a significant impact on first-time homebuyers, who are typically more sensitive to changes in mortgage rates. With lower rates, monthly payments become more affordable, making it easier for these buyers to enter the housing market.

According to Redfin’s analysis, the median price for a U.S. starter home climbed to $250,000 in July 2024. While this represents a 4.2% increase from the previous year, it is important to note that price growth for starter homes was slower than for middle- and upper-tier homes. This slower growth can be attributed to the rising inventory levels, which increased by 18.9% year over year, providing more options for buyers and helping to keep prices in check.

Inventory Surge and Price Stability

The surge in starter homes inventory is a significant development in the housing market. In July 2024, the number of starter homes on the market reached its highest level since October 2022. This increase in inventory has helped to moderate price growth, making starter homes more accessible to first-time buyers. In contrast, inventory growth in middle- and upper-tier homes was much lower, leading to higher price increases in those segments.

The increase in inventory is particularly noteworthy because it comes at a time when the overall housing market is still recovering from the effects of the pandemic. Despite the recent gains, the inventory of starter homes remains well below pre-pandemic levels. For example, in July 2019, there were approximately 30% more starter homes on the market than there were in July 2024.

Regional Variations in Starter Home Sales

While the overall trend for starter homes is positive, there are regional variations in sales and price trends. Major metros in Texas and Florida, such as Austin, San Antonio, and West Palm Beach, saw significant declines in home prices due to large increases in inventory. In San Antonio, for example, active listings of starter homes spiked by 50.2%, leading to a 2.6% decline in the median sales price.

On the other hand, metros like Detroit, Newark, and Pittsburgh experienced strong price growth in the starter home segment, with year-over-year increases of 15.6%, 15.4%, and 13.6%, respectively. These variations highlight the importance of local market conditions in shaping the performance of starter homes across the country.

A Positive Outlook

The renewed interest in starter homes is a promising development for the housing market, particularly for first-time homebuyers. With mortgage rates at a 15-month low and inventory levels rising, the market for starter homes is becoming more accessible. While price growth has been slower compared to other segments, the increase in inventory has helped to stabilize prices, making it easier for buyers to find affordable options. As we move further into 2024, the outlook for starter homes remains bright, offering a glimmer of hope in an otherwise sluggish market.