The recent trend of mortgage rate decline has brought a wave of optimism among potential homebuyers. As mortgage rates fall to their lowest levels since February, many are curious about the implications for the housing market and their purchasing power.

The Impact of Mortgage Rate Decline

Mortgage rates have seen a significant decline, reaching the lowest point since February, following a cooler-than-expected inflation report. This decline in mortgage rates offers a bit of relief to homebuyers, providing them with increased purchasing power. For example, a homebuyer with a $3,000 monthly budget can now afford a $450,000 home at a 6.8% mortgage rate, up from $425,000 when the rate was 7.5%.

Increased Affordability and Market Dynamics

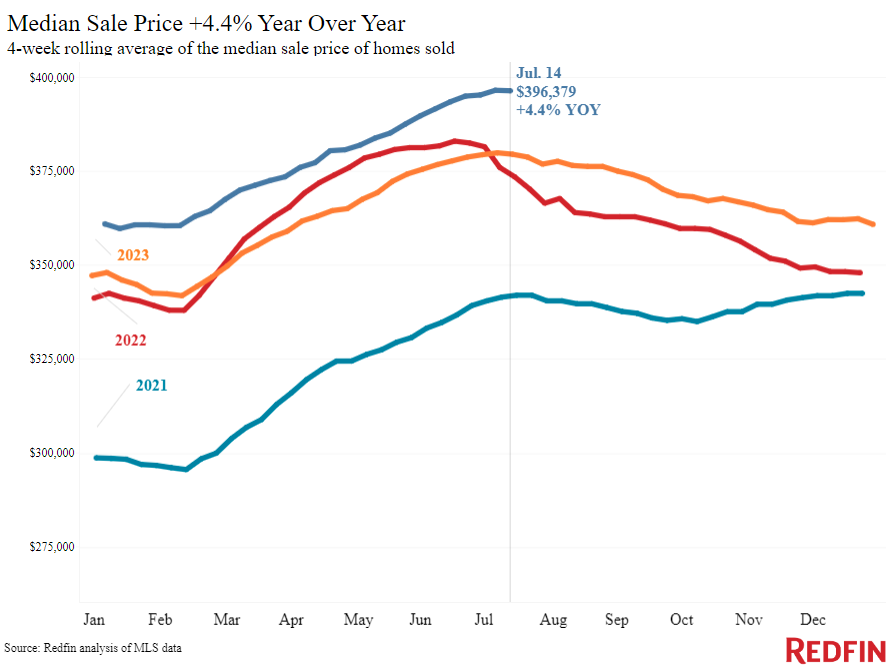

The typical U.S. homebuyer’s monthly housing payment has decreased to $2,722 during the four weeks ending July 14, $115 lower than April’s all-time high. This reduction in monthly payments is a direct result of the mortgage rate decline, despite home prices nearing record highs.

Moreover, the housing market has seen a rise in new listings, with a 6.4% year-over-year increase, bringing the total number of listings to its highest level in almost four years. This increased supply offers more options for buyers, potentially easing some of the competitive pressure in the market.

Buyer Behavior Amid Mortgage Rate Decline

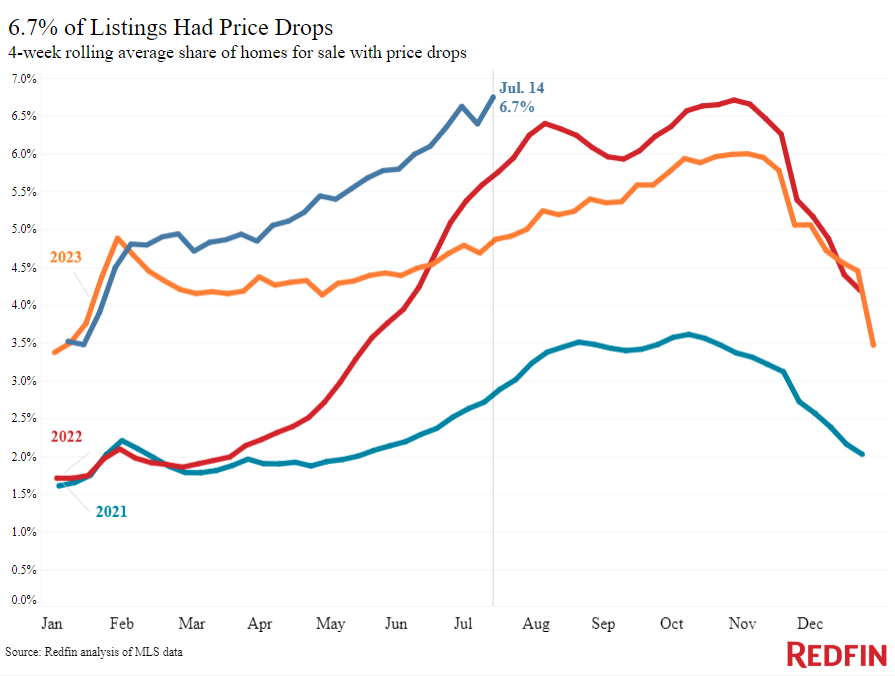

Despite the favorable conditions created by the mortgage rate decline, buyer activity has not surged as one might expect. Pending sales have dropped by 5.6% year-over-year, marking the biggest decline in eight months. Additionally, Redfin’s Homebuyer Demand Index, which measures requests for tours and other buying services, is down 15%.

Many potential buyers remain on the sidelines, hoping for further mortgage rate declines. However, experts suggest that waiting may not be the best strategy, as future rate cuts are already priced into the market. According to Chen Zhao, Redfin’s economic research lead, the current period might be an optimal time for buyers to make offers before prices increase further and competition intensifies.

External Factors Influencing Buyer Decisions

Another factor contributing to the subdued buyer activity is the extreme heat in various parts of the country, which is deterring house hunters from touring homes. Severe heat waves have made outdoor activities, including house tours, less appealing, impacting open house attendance.

The recent mortgage rate decline presents a significant opportunity for homebuyers by increasing affordability and expanding purchasing power. While some buyers are cautiously waiting for further rate cuts, current market conditions suggest that now might be a favorable time to make a move. As always, staying informed and consulting with real estate professionals can help buyers navigate these changes effectively.

Related posts:

Affordable Rental Provider Repays $710K to Arlington County

Affordable Rental Provider Repays $710K to Arlington County

Decline in Home Prices: Anticipating a Shift in 2024

Decline in Home Prices: Anticipating a Shift in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building