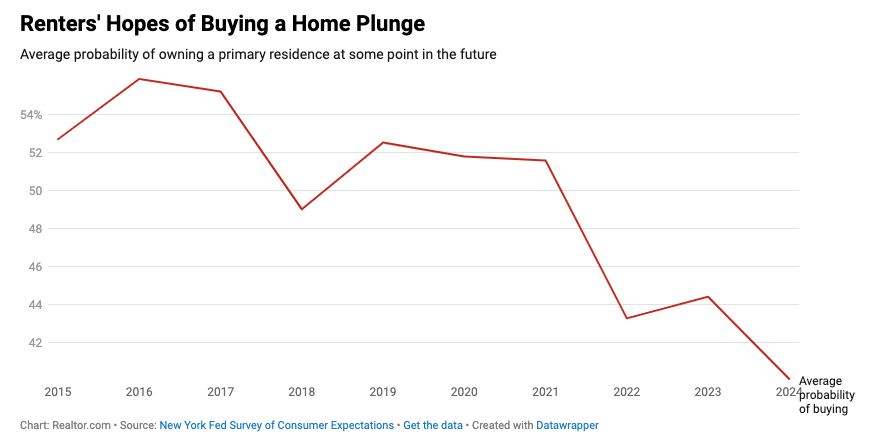

In recent years, Renters’ Outlook on Home Buying has grown increasingly pessimistic. According to a survey conducted by Avail, many renters are concerned that economic challenges and high home prices will continue to limit their ability to buy a home. As these trends persist, it’s important to explore the challenges renters face and their outlook on the future of homeownership.

The Growing Pessimism Among Renters

Many renters have expressed growing skepticism about the feasibility of homeownership. The survey revealed:

- Economic Hurdles: Over 80% of renters cited high home prices as a significant barrier.

- Rising Mortgage Rates: Increased interest rates have made monthly payments unaffordable for many renters.

- Stagnant Income Growth: Stagnant wage growth has left renters unable to save for a down payment.

Key Factors Influencing Renters’ Outlook on Home Buying

Several factors contribute to renters’ pessimistic outlook on home buying:

- Student Loan Debt: Many renters are burdened by student loans, limiting their ability to save.

- Lack of Affordable Homes: With inventory shortages, finding a reasonably priced starter home is challenging.

- Inflation and Rising Living Costs: Rent increases, coupled with inflation, leave little room for saving.

Changing Perceptions of Homeownership

The pessimistic outlook has also led to changing perceptions about the value of homeownership. The survey found that many renters:

- See Renting as a Long-Term Solution: Nearly 60% are resigned to renting indefinitely.

- Prioritize Flexibility Over Stability: Younger renters prioritize flexibility and are less concerned with owning property.

- Question the Financial Benefits: Renters are increasingly questioning whether homeownership is worth the financial burden.

Efforts to Improve Renters’ Outlook on Home Buying

Despite the challenges, some initiatives aim to improve renters’ outlook on home buying:

- Government Assistance Programs: First-time homebuyer programs offer down payment assistance and tax credits.

- Financial Education: Nonprofits and financial institutions provide resources to help renters build credit and save.

- Employer Assistance: Some employers offer housing assistance to attract and retain talent.

Renters’ Outlook on Home Buying reflects growing concerns about the affordability and attainability of homeownership. As economic challenges persist, many renters remain pessimistic about buying a home in the near future. However, continued efforts to provide financial assistance and education could help shift renters’ perceptions and bring them closer to achieving their dream of homeownership.

Related posts:

Affordable Rental Provider Repays $710K to Arlington County

Affordable Rental Provider Repays $710K to Arlington County

Decline in Home Prices: Anticipating a Shift in 2024

Decline in Home Prices: Anticipating a Shift in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

New York’s Affordable Housing: Innovative Solutions Without Tax Hikes

New York’s Affordable Housing: Innovative Solutions Without Tax Hikes