As we approach the end of 2023, the remodeling industry finds itself at a crossroads, with a complex interplay of factors shaping its trajectory for the upcoming year. Despite a stronger-than-anticipated performance in the closing months of this year, industry experts are signalling a moderate downturn in 2024, marking the first annual decrease since 2011.

Let’s delve into the details and explore what lies ahead for the remodelling sector.

A Closer Look at the Numbers

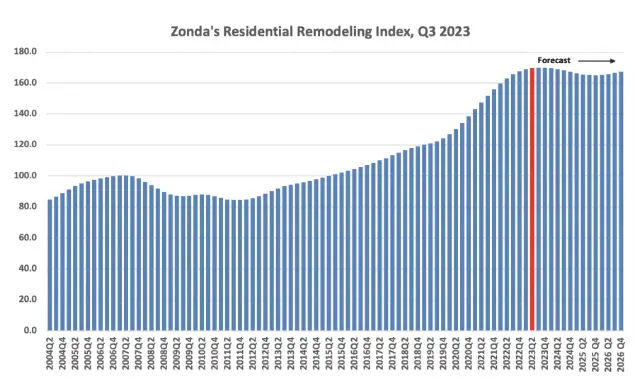

Zonda’s Residential Remodeling Index (RRI), a key indicator of pro-worthy remodeling and replacement levels, delivered promising results in the third quarter of 2023. The RRI increased by 2.4% year-over-year and 0.2% sequentially, reaching an impressive 169.8. This reading not only signifies a 19-year high for the RRI but also reflects a substantial 69.8% increase in remodeling activity since the baseline year of 2007.

While these figures paint a positive picture, the projections for the upcoming years tell a different story. The RRI, when averaged annually, is expected to increase by 3.3% for 2023 but faces a decline of 0.5% in 2024 and a further 1.8% drop in 2025. Zonda projects a return to annual growth in 2026, with a forecasted increase of 0.5%.

Factors Influencing the Remodeling Landscape

The optimistic outlook for 2023 and the relatively milder pullback anticipated for the next two years are attributed to what Zonda describes as “an economy that has proved surprisingly resilient and has a more optimistic outlook.” Moody’s Analytics, responsible for forecasting variables input into the RRI model, believes that the Federal Reserve’s stance on interest rates will contribute to a soft landing for the economy, avoiding a recession.

Housing Market Woes

However, a significant headwind facing the remodeling industry is a weaker housing market. Existing home sales are at their lowest since 2010, and a substantial portion of remodeling activity is closely tied to housing transactions. The housing market, described by Moody’s as being “in a deep freeze,” is expected to thaw out slowly, with projected declines of approximately 10% in home prices needed to restore market health. This decline is anticipated to unfold gradually over several years.

The correlation between remodeling activity and home equity becomes a crucial factor here. The projected decrease in home values becomes a significant drag on the RRI outlook, leading to the anticipated annual decreases in 2024 and 2025.

Remodeling in a Changing Landscape

This projected downturn comes on the heels of several years of robust growth, pushing remodeling activity to record levels. However, the expectation is not that remodeling will vanish altogether; rather, projects may be deferred until interest rates and costs stabilize. The “lock-in effect” with mortgage rates continues to drive remodeling activity, especially for homeowners looking to upgrade while holding onto their low-interest rates.

However, it’s noteworthy that the nature of projects is evolving. Homeowners are opting for smaller, less expensive endeavors, while more extensive and costly projects are being postponed until costs for materials, labor, and financing witness a more favorable shift, according to Zonda.

Local Market Dynamics

On a local market level, the RRI provides insights into remodeling project volume expectations for 2024. Among the 384 analyzed metropolitan statistical areas, 150 are projected to see growth, with an average growth rate of 1.5%. This regional variation highlights the nuanced nature of the remodeling landscape, with certain areas poised for expansion even in the face of broader industry challenges.

Conclusion: Navigating Uncertainty

As we anticipate the remodeling landscape of 2024, it’s crucial for industry stakeholders to navigate the uncertainty with a nuanced understanding of the interconnected factors at play. While the overarching projections signal a downturn, the regional variations and evolving project preferences underscore the dynamic nature of the remodeling sector. Stay tuned as we continue to monitor and analyze the remodeling industry’s journey through the upcoming year.

Related posts:

Affordable Rental Provider Repays $710K to Arlington County

Affordable Rental Provider Repays $710K to Arlington County

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

10 Precautions to Stay Safe During a Home Renovation

10 Precautions to Stay Safe During a Home Renovation

Europe’s Housing Market Squeezed Amidst Cost-of-Living Crisis

Europe’s Housing Market Squeezed Amidst Cost-of-Living Crisis

“Sign & Save Program” Goes Nationwide in 2024: A New Era for Homebuyers with Redfin

“Sign & Save Program” Goes Nationwide in 2024: A New Era for Homebuyers with Redfin