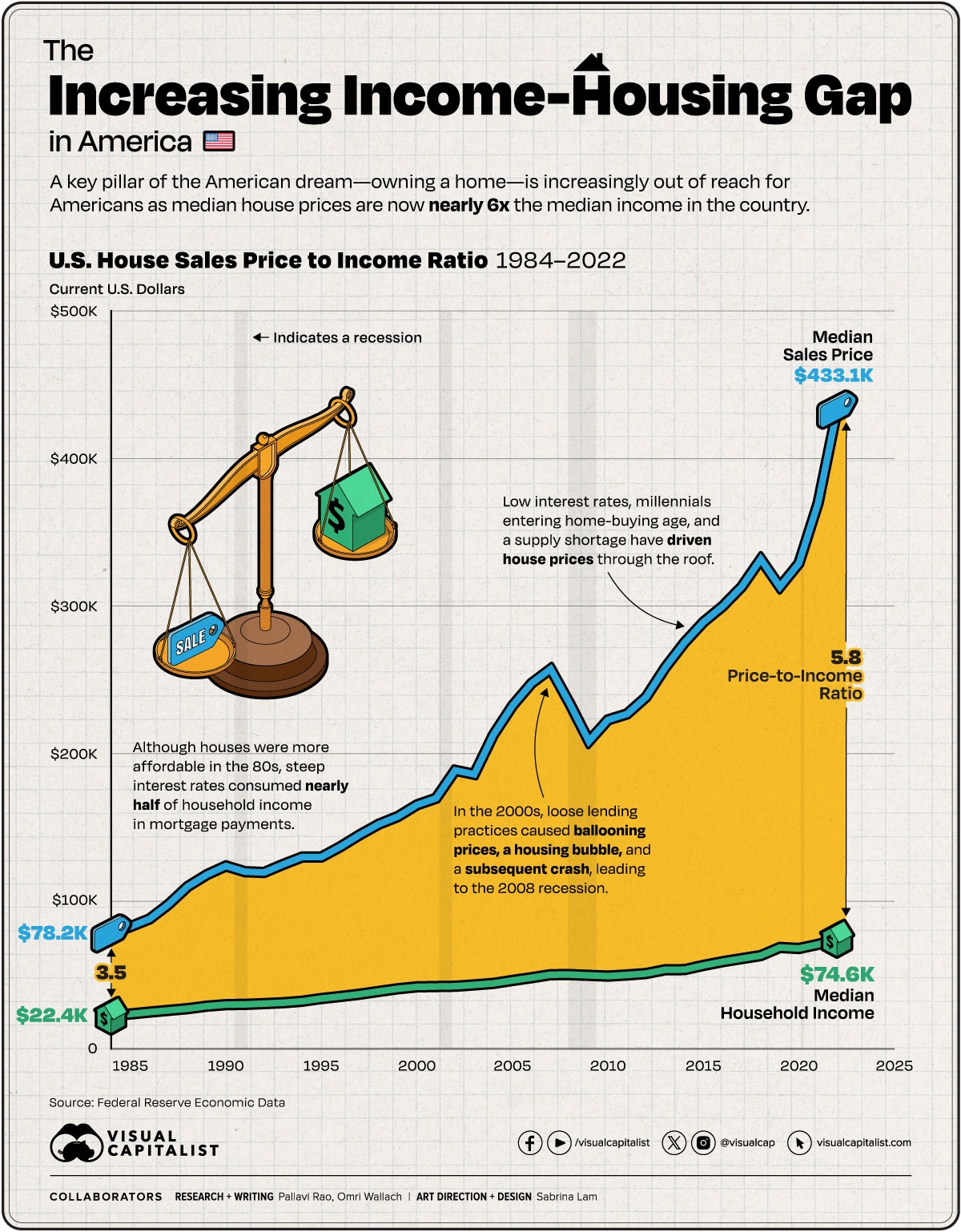

In 2023, the dream of owning a median-priced home in America requires an annual income of at least $100,000, leaving many households struggling. Some cities demand nearly 3–4 times that amount. Let’s delve into the trends between median incomes and house prices using data from the Federal Reserve and understand housing affordability crisis in the U.S.

The Data Snapshot

We analyzed two crucial datasets:

- Median household income (1984–2022)

- Median Sales Price of Houses Sold (1963–2023)

Notably, this analysis does not consider actual disposable income or the impact of changing interest rates on monthly mortgage payments. Both datasets are presented in current U.S. dollars, without adjusting for inflation.

The Historical Timeline

In 1984, the median annual household income was $22,420, with a median house sales price of $78,200, resulting in a house sales price-to-income ratio of 3.49—the most affordable ratio since data tracking began.

However, inflation, particularly in the late ’70s and early ’80s, cast a shadow. Despite a significant drop in inflation in the following years, the 30-year fixed rate in 1984 was nearly 14%, consuming a substantial portion of household income in interest payments.

The 2008 Recession and Housing Bubble

The mid-2000s saw an explosive surge in home prices, culminating in a housing bubble and subsequent crash, a catalyst for the 2008 recession. Subprime mortgages, issued to buyers with poor credit, played a pivotal role, bundled into seemingly attractive securities for financial institutions.

In response, the Federal Reserve reduced interest rates to stimulate economic demand, inadvertently contributing to a spike in housing prices. A surge in demand from a new generation, coupled with a shortage in supply due to limited construction and increased investment in rental properties, led to a significant imbalance.

Now, median house prices are nearly 6 times the median household income in America.

Economic Impact

Unaffordable housing creates a ripple effect, forcing families to cut essential expenditures, hampering consumer spending. The irony lies in how expanding housing supply once drove U.S. economic growth, now constrained by affordability issues.

Additionally, unaffordable housing restricts mobility, as individuals hesitate to relocate for better job opportunities. Conversely, cities face labor shortages as lower-wage workers cannot afford city living, impacting market efficiency and productivity growth. The repercussions of the housing affordability crisis extend beyond individual households, shaping the broader economic landscape.

Related posts:

Affordable Rental Provider Repays $710K to Arlington County

Affordable Rental Provider Repays $710K to Arlington County

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

10 Precautions to Stay Safe During a Home Renovation

10 Precautions to Stay Safe During a Home Renovation

Surge in US Housing: A Close Look at the November 2023 Boom

Surge in US Housing: A Close Look at the November 2023 Boom

Increased Housing Confidence Brightens 2024, But Buying a Home Still Tough

Increased Housing Confidence Brightens 2024, But Buying a Home Still Tough