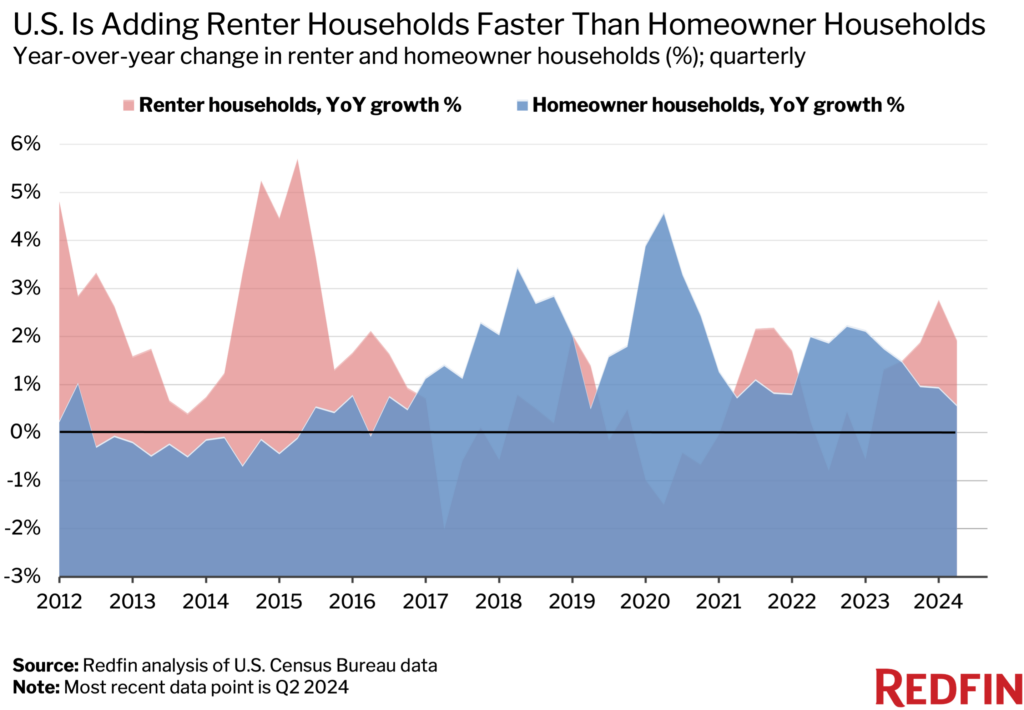

In recent years, the growing renter population in America has become a significant trend, reflecting a profound shift in the nation’s housing dynamics. As of the second quarter of 2024, the number of renter households increased by 1.9%, marking one of the most substantial gains in recent years. This trend highlights the changing landscape of homeownership in the United States, where the number of homeowner households rose by only 0.6% during the same period, marking the smallest increase since 2022. This article explores the reasons behind this shift and its implications for the housing market.

The Rise of the Renter Population

The rapid growth of the growing renter population can be attributed to several factors, including the rising costs of homeownership. Mortgage payments have soared by 90% since the pandemic, while asking rents have increased by 23%. This disparity in cost escalation has made renting a more appealing option for many Americans, especially those who find the affordability crunch less severe in the rental market.

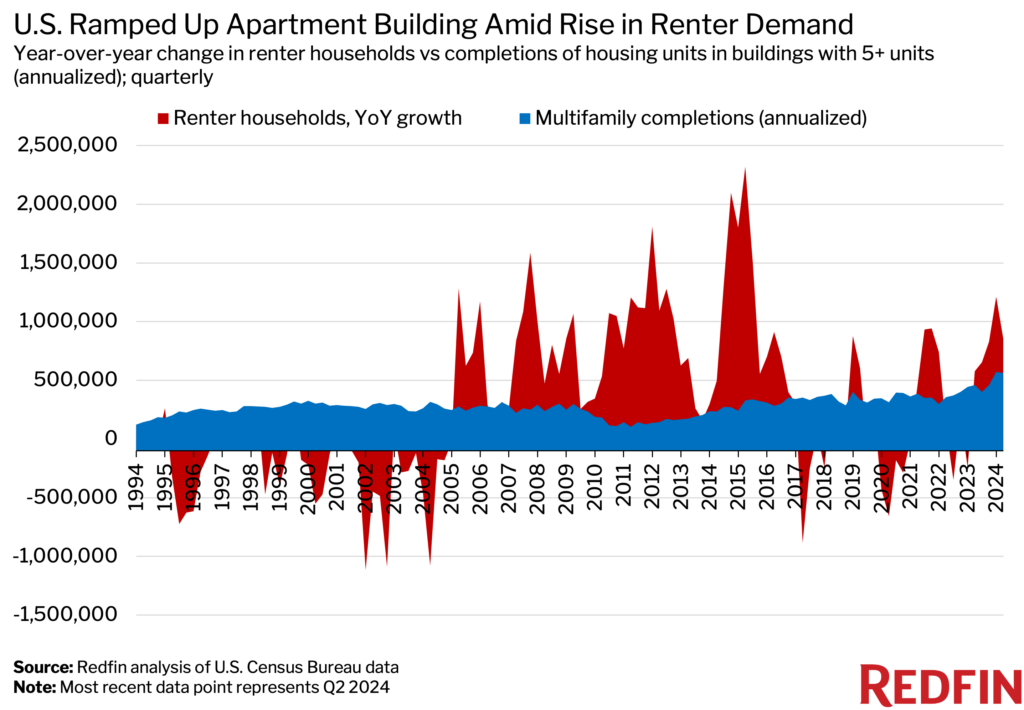

The U.S. has been building a significant number of apartments to keep pace with the robust demand from renters, alleviating some of the affordability pressures. However, the struggle to cover housing costs remains a challenge for many renters, indicating that while renting may be a more feasible option than buying, it is not without its difficulties.

Geographic Differences in Rentership

The growing renter population is more pronounced in coastal metros where the cost of buying a home is exceptionally high. Cities like Los Angeles, San Diego, and New York have the highest shares of renter households, with Los Angeles leading at a rentership rate of 53%. Conversely, areas like Worcester, MA, North Port, FL, and Albany, NY have the lowest rentership rates, reflecting more affordable housing markets where homeownership remains attainable for a larger portion of the population.

Impact on the Housing Market

The rise in renter households outpacing homeowner growth is partly due to the significant increase in homebuying costs. In the first quarter of 2024, the growth in the number of renter households peaked at 2.8%, the largest gain since 2015. According to Redfin’s analysis of U.S. Census Bureau data, this trend is likely to continue, influenced by ongoing economic conditions and housing market dynamics.

The U.S. has witnessed a boom in multifamily construction, with an annual rate of 563,000 new units added as of the second quarter. This construction boom has helped accommodate the rise in demand and limit rent growth. However, with multifamily building permits and starts slowing significantly, there is concern that asking rents may rise again in the coming years, further affecting the growing renter population.

Economic and Social Implications

The economic implications of the growing renter population are vast. The construction of new rental units has been a driving force in the real estate market, contributing to job creation and economic growth. However, the potential slowdown in new construction could lead to increased rents, affecting affordability.

Socially, the trend signifies a shift in the American dream of homeownership. Nearly two in five renters express doubts about ever owning a home, reflecting changing attitudes towards homeownership and financial priorities.

The growing renter population in America is reshaping the housing landscape. With homebuying costs rising and rents becoming a more practical choice for many, the trend towards renting is likely to persist. Policymakers and industry leaders must focus on creating affordable housing solutions to address the challenges faced by both renters and potential homeowners.

This trend underscores the importance of strategic planning and investment in the housing sector to ensure that the dream of homeownership remains achievable for future generations.

Related posts:

Affordable Rental Provider Repays $710K to Arlington County

Affordable Rental Provider Repays $710K to Arlington County

Northern Virginia Housing Market – March 2023

Northern Virginia Housing Market – March 2023

Seattle-Area Housing Market: 2023 Trend and 2024 Prediction

Seattle-Area Housing Market: 2023 Trend and 2024 Prediction

Portland Affordable Housing and Code Amendments: Big Changes for the City

Portland Affordable Housing and Code Amendments: Big Changes for the City

Monthly Payments Drop in 2024: A Fresh Perspective on the Housing Market

Monthly Payments Drop in 2024: A Fresh Perspective on the Housing Market