Understanding the mortgage landscape for younger generations is crucial in today’s housing market. Gen Z and millennial mortgages have become a significant topic of interest. This article provides detailed insights into the trends and factors influencing these groups’ mortgage behaviors.

The Rise of Gen Z and Millennial Mortgages

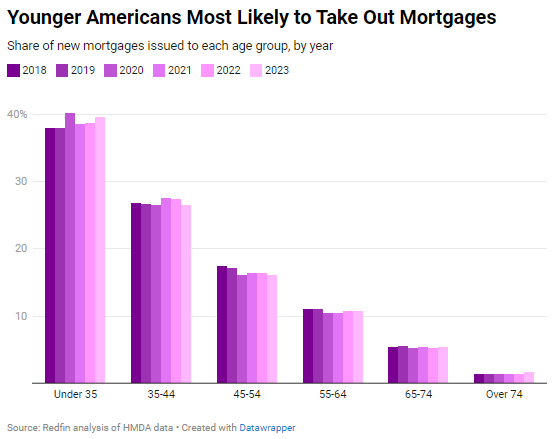

Two in five new mortgages issued last year went to buyers under 35. Additionally, 27% of mortgages went to buyers aged 35-44. Young people are of prime homebuying age, gaining financial stability, and growing families. They also prefer mortgages over cash payments due to their lower accumulated wealth.

Mortgage Trends in Major Metros

Buyers under 35 took nearly half of new mortgages in Pittsburgh last year. This was the highest share among major metros. In the Bay Area, 35-44 year-olds took out roughly two in five new mortgages. Home purchases declined as housing costs rose, with mortgages dropping 20% year-over-year across all age groups.

Age Distribution in Mortgage Borrowing

The largest share of mortgages last year went to young people. Homebuyers under 35 accounted for 39.7% of new mortgages, while those aged 35-44 made up 26.5%. The 45-54 age group took 16.1%, 55-64 took 10.8%, and 65-74 took 5.4%. The likelihood of taking out a mortgage declines with age.

Reasons for Younger Buyers Leading the Mortgage Market

Several factors contribute to younger buyers dominating the mortgage market. Gen Z and millennials are entering their prime homebuying years. They view real estate as a safer investment compared to the stock market. Younger buyers are more likely to take out loans instead of paying cash due to less accumulated wealth.

Impact of Mortgage Rates on Younger Buyers

Younger buyers are less affected by high mortgage rates than older generations. Despite rates reaching a two-decade high of 7.8%, first-time buyers remain optimistic. They are not locked into low rates from previous years and are eager to transition from renting to homeownership.

Homeownership Rates Among Generations

Gen Z and millennials have lower homeownership rates compared to older generations. Only 26% of adult Gen Zers and 55% of millennials owned homes in 2023. In contrast, 72% of Gen Xers and 79% of baby boomers owned homes. However, Gen Zers are catching up, with higher homeownership rates than previous generations at the same age.

Financial Support for Young Homebuyers

Some young homebuyers receive financial help from family members. In 2023, 3.3% of homebuyers under 35 had a co-borrower over 55. Many expect cash gifts from family to help with down payments. This trend highlights the importance of family support in the homebuying process for younger generations.

Geographic Variations in Mortgage Trends

Mortgage trends vary significantly across different regions. In affordable Rust Belt metros like Pittsburgh, nearly half of new mortgages went to buyers under 35. In contrast, popular Florida retirement destinations saw the smallest share of mortgages going to young buyers. The Bay Area saw the highest share of mortgages issued to 35-44 year-olds, driven by high housing costs.

Conclusion

Gen Z and millennial mortgages are shaping the future of the housing market. These younger generations are stepping into homeownership with determination and optimism. Understanding their mortgage behaviors and trends is essential for navigating today’s real estate landscape.

Related posts:

Affordable Rental Provider Repays $710K to Arlington County

Affordable Rental Provider Repays $710K to Arlington County

Decline in Home Prices: Anticipating a Shift in 2024

Decline in Home Prices: Anticipating a Shift in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building