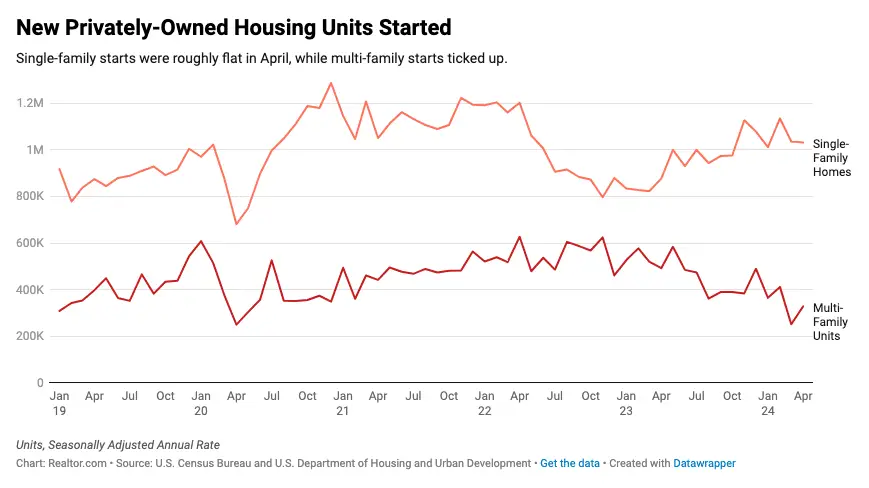

April 2024 housing starts have demonstrated intriguing trends that reflect broader shifts in the real estate market. This month has seen a blend of rising inventory, regional price adjustments, and economic influences shaping the housing landscape.

Market Dynamics in April 2024 Housing Starts

The market for new home construction has shown mixed signals throughout April 2024. Active listings increased by 33.3% compared to the previous year, giving potential buyers more options to choose from. However, the pace of new listings has fluctuated, with the week ending April 27, 2024, showing a 10.4% increase from the previous year. Despite the increase in listings, homes are taking slightly longer to sell, indicating a more balanced market.

Regional Variations in Housing Starts

- South: The South has experienced the most significant increase in competitive home inventory. Despite a slight decline in listing prices (-0.1%), the region remains a key area for new listings.

- Northeast and Midwest: Both regions saw price growth, with the Northeast experiencing a 5.6% increase and the Midwest a 1.9% increase in median listing prices compared to last year. Cities like Buffalo, Cleveland, and Rochester saw substantial price hikes, highlighting regional disparities.

- West: The West recorded a 1.9% increase in listing prices, although inventory growth was more moderate compared to the South.

Economic Influences on April 2024 Housing Starts

Economic factors, particularly mortgage rates, have significantly influenced the housing market dynamics. The rise in mortgage rates has dampened buyer enthusiasm, causing homes to stay on the market longer than in previous months. However, this has resulted in a broader selection of homes for buyers.

Income Requirements and Market Adjustments

Sellers have adjusted their expectations, leading to an increase in price reductions. The share of homes with price cuts rose from 12.3% in April 2023 to 15.5% in April 2024. This adjustment reflects a shift towards more realistic pricing amidst changing market conditions. Additionally, the required household income to afford a median-priced home varies significantly across regions. Affordable metros like Pittsburgh, Detroit, and Cleveland require less than $100,000, while high-cost areas such as San Jose and Los Angeles require over $200,000.

April 2024 housing starts reveal a complex and evolving real estate market. As we progress through the year, these trends suggest that sellers may continue to adapt their strategies to match market conditions, and buyers might benefit from increased inventory and potential price adjustments in certain regions. Monitoring these developments will be crucial for both buyers and sellers navigating the housing market.

Related posts:

Affordable Rental Provider Repays $710K to Arlington County

Affordable Rental Provider Repays $710K to Arlington County

Decline in Home Prices: Anticipating a Shift in 2024

Decline in Home Prices: Anticipating a Shift in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building