US luxury homes cost more, reaching unprecedented highs. In the first quarter, the median sale price soared to $1,225,000, an 8.7% increase from last year. This trend highlights a growing divide in the housing market, where luxury properties escalate in value faster than their non-luxury counterparts.

Luxury vs. Non-Luxury Market Trends

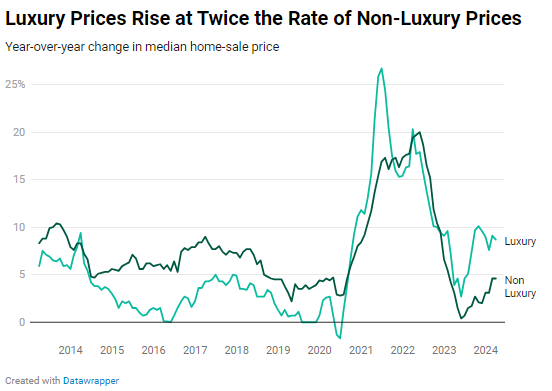

The price of luxury homes in the U.S. has not only outpaced that of non-luxury homes but has done so at a significant rate. While luxury homes saw an 8.7% increase, non-luxury homes had a more modest rise of 4.6%, with median prices reaching $345,000. This pattern underscores the heightened demand for high-end properties, even as overall real estate growth moderates.

Driving Factors Behind the US Luxury Homes Price Surge

Several factors contribute to the steep price increases in the luxury segment. Firstly, limited inventory in desirable locations continues to push prices upward. Additionally, affluent buyers, often less impacted by economic downturns, are purchasing second homes, further straining the supply. The influx of high earners into booming markets has intensified competition, driving prices higher.

Implications for Potential Buyers

For those considering entering the luxury market, the current landscape presents both challenges and opportunities. Prospective buyers need to act swiftly as properties are selling rapidly, often above the asking price. It’s crucial to have financing pre-arranged to make competitive offers quickly.

As we look ahead, US luxury homes cost more and are likely to continue their upward trajectory. The gap between luxury and non-luxury homes may widen further, reflecting broader economic disparities. For buyers and investors, understanding market dynamics and staying informed will be key to navigating this robust market.

Related posts:

Decline in Home Prices: Anticipating a Shift in 2024

Decline in Home Prices: Anticipating a Shift in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

New York’s Affordable Housing: Innovative Solutions Without Tax Hikes

New York’s Affordable Housing: Innovative Solutions Without Tax Hikes

Zillow 2023 Home Sales Analysis: Prime Listing Time for Maximum Profit

Zillow 2023 Home Sales Analysis: Prime Listing Time for Maximum Profit