In 2023, the US home-buying demand has witnessed significant fluctuations. Various factors, including economic conditions, interest rates, and market trends, play a crucial role in shaping buyer interest and activity.

Mortgage Trends and Their Impact on Home-Buying in Early 2023

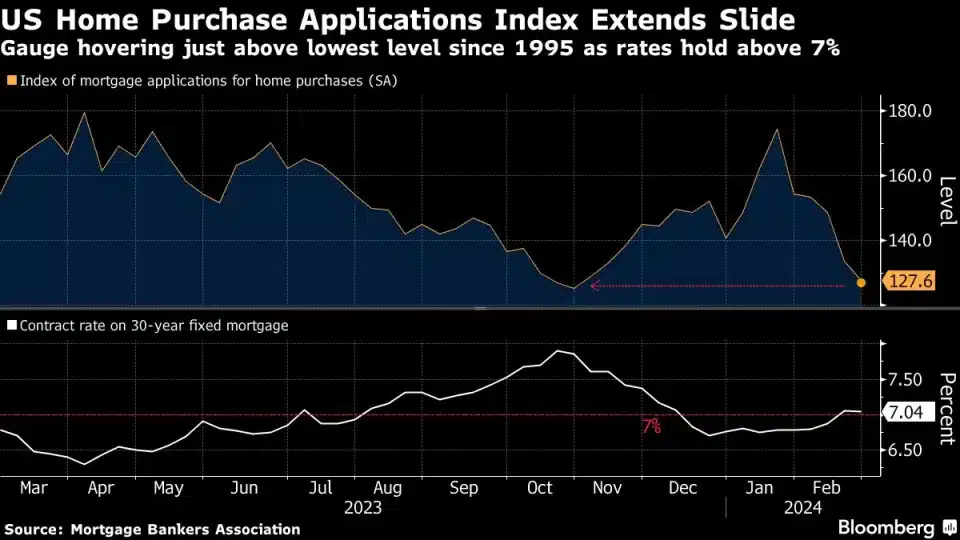

The recent data from the Mortgage Bankers Association highlights a decline in mortgage applications for home purchases by 4.5% for the week ending February 23, indicating a weakening housing market momentum. The index dropped to its lowest since October, a near three-decade low. Despite a slight ease in the contract rate for 30-year fixed mortgages to 7.04%, mortgage rates remain high, affecting home-financing costs. Early 2023 saw a brief boost in home sales with rates below 7%, but the Federal Reserve’s stance on maintaining higher interest rates in light of economic conditions has contributed to the rising costs of home financing.

Key Influences of the US Home-Buying Demand

Interest rates, notably mortgage rates, significantly influence US home-buying demand. High rates can deter buyers by increasing loan costs, while lower rates make mortgages more affordable, boosting demand. Economic policies, such as tax incentives or lending regulations, also impact buyer behavior and market dynamics. Furthermore, overall market confidence, driven by job security, economic growth, and future outlooks, affects individuals’ willingness to invest in real estate. Together, these factors shape the landscape of home buying, influencing trends and buyer activity in the market.

Looking Ahead

As the year progresses, monitoring these trends will be crucial for buyers, sellers, and investors alike. Adapting to the changing environment is key to navigating the 2024 housing market successfully.

Related posts:

Affordable Rental Provider Repays $710K to Arlington County

Affordable Rental Provider Repays $710K to Arlington County

Surge in US Housing: A Close Look at the November 2023 Boom

Surge in US Housing: A Close Look at the November 2023 Boom

Seattle Fort Lawton Housing Plan Revision: A New Vision for Affordable Living

Seattle Fort Lawton Housing Plan Revision: A New Vision for Affordable Living

2024 Real Estate Recession Warning: A Closer Look at the Housing Market Dynamics in Arizona

2024 Real Estate Recession Warning: A Closer Look at the Housing Market Dynamics in Arizona

Affordable Housing in Highland Park: A Sustainable Approach to Homeownership

Affordable Housing in Highland Park: A Sustainable Approach to Homeownership