The issue of stale housing inventory is becoming a significant concern in the current real estate market. As record-high housing costs dampen demand, more homes are sitting on the market for extended periods. This article, with insights from Redfin News, delves into the reasons behind the rise in stale housing inventory and its implications for buyers and sellers alike.

Understanding Stale Housing Inventory

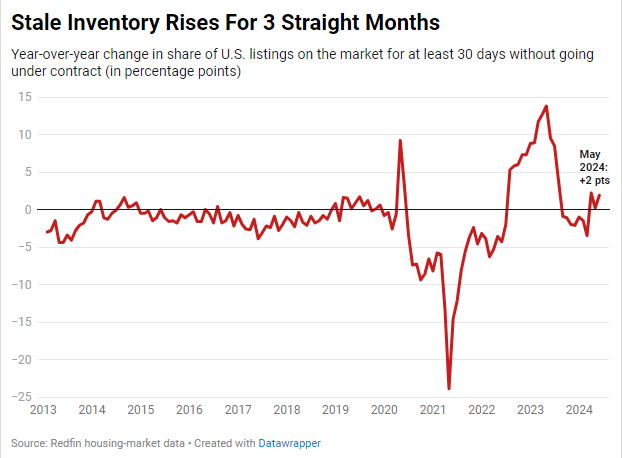

Stale housing inventory refers to homes that have been listed on the market for an extended period without going under contract. According to Redfin, more than three in five (61.9%) homes listed in May 2024 had been on the market for at least 30 days without a buyer. This is a notable increase from previous years, indicating a growing trend of homes remaining unsold for longer periods.

Causes of Stale Housing Inventory

Several factors contribute to the increase in stale housing inventory. High mortgage rates and record-high home prices are primary culprits. The average 30-year fixed mortgage rate stands at 6.99%, more than double the pandemic-era low. This steep rise in mortgage rates has priced out many potential homebuyers, leading to a significant drop in demand. Additionally, the median U.S. monthly housing payment is near its record high, further discouraging buyers.

Moreover, the market has seen a surge in new listings without a corresponding increase in demand. As more homes enter the market, less-desirable listings tend to pile up, contributing to the stale inventory issue. This phenomenon is particularly evident in states like Texas and Florida, where rapid home construction and natural disaster concerns have led to a surplus of available homes.

The Impact of Stale Housing Inventory

The rise in stale housing inventory has several implications. For sellers, it means longer waiting times and potentially having to lower prices to attract buyers. Homes that do not sell quickly may develop a stigma, making them even harder to sell. For buyers, the increased inventory provides more options, but it also indicates a market where desirable homes may still command high prices, while less-desirable ones linger.

Redfin’s data shows that while move-in ready homes in desirable neighborhoods are still selling quickly, those that do not meet these criteria are increasingly sitting on the market. For instance, in Dallas, over 60% of listings in May had been on the market for at least 30 days, up from 53% the previous year. Similarly, in Florida metros like Fort Lauderdale and Tampa, the share of stale listings has also risen significantly.

Looking Ahead

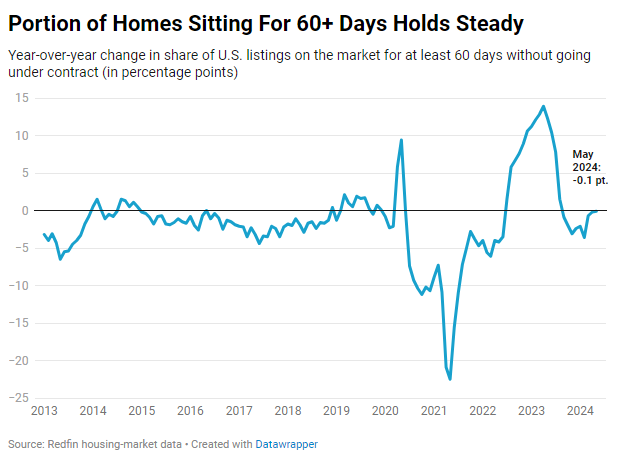

The trend of stale housing inventory is likely to continue if mortgage rates remain high and housing prices do not stabilize. Redfin economists predict that the share of homes sitting on the market for at least 60 days will start to increase in the coming months. As the market adjusts, both buyers and sellers will need to navigate this challenging landscape carefully.

The issue of stale housing inventory is a growing concern in today’s real estate market. With high mortgage rates and record-high home prices, more homes are remaining unsold for extended periods. Understanding the causes and implications of this trend is crucial for anyone involved in the housing market.

Related posts:

Decline in Home Prices: Anticipating a Shift in 2024

Decline in Home Prices: Anticipating a Shift in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building

Navigating the Decline: Florida Condo Prices Dropping Amidst Rising Costs

Navigating the Decline: Florida Condo Prices Dropping Amidst Rising Costs