September pending home sales surged by 2.5% month over month, marking the most significant rise since January 2023. This increase comes at a time when mortgage rates dropped to a two-year low, giving potential homebuyers a much-needed break from historically high rates. According to a recent report by Redfin, this jump is attributed to the Federal Reserve’s decision to cut interest rates, a move that encouraged many buyers to lock in more favorable mortgage rates before they climbed again. Despite challenges such as high home prices and a tight inventory, September’s numbers provide a glimmer of hope for the housing market.

The Impact of Mortgage Rates on Pending Home Sales

The rise in pending home sales is largely due to the recent dip in mortgage rates. In September, rates fell to 6.08%, the lowest in two years, providing buyers with increased purchasing power. However, mortgage rates have since ticked up slightly, hovering at 6.44% as of mid-October. Redfin reports that some buyers rushed to close deals before rates could rise again, leading to the 2.5% increase in pending home sales. Even with this temporary rise in rates, they remain below the 7% peak seen last year, keeping the housing market active despite broader economic uncertainty.

Housing Market Dynamics: Hurricanes and Regional Variations

While the national figures for September pending home sales look promising, regional variations tell a more nuanced story. In states like Florida, which recently faced the devastation of two major hurricanes, home sales plummeted. Redfin notes that sales in cities like Miami and Tampa saw double-digit declines due to weather-related disruptions. Many homes were taken off the market for repairs, and closings were delayed as lenders required re-inspections post-storm. Despite this, the broader market has remained resilient, with areas like Phoenix and Seattle seeing substantial year-over-year increases in pending sales.

Data from Redfin:

September 2024 Housing Market Highlights: United States

| September 2024 | Month-over-month change | Year-over-year change | |

|---|---|---|---|

| Median sale price | $428,212 | -1.1% | 3.9% |

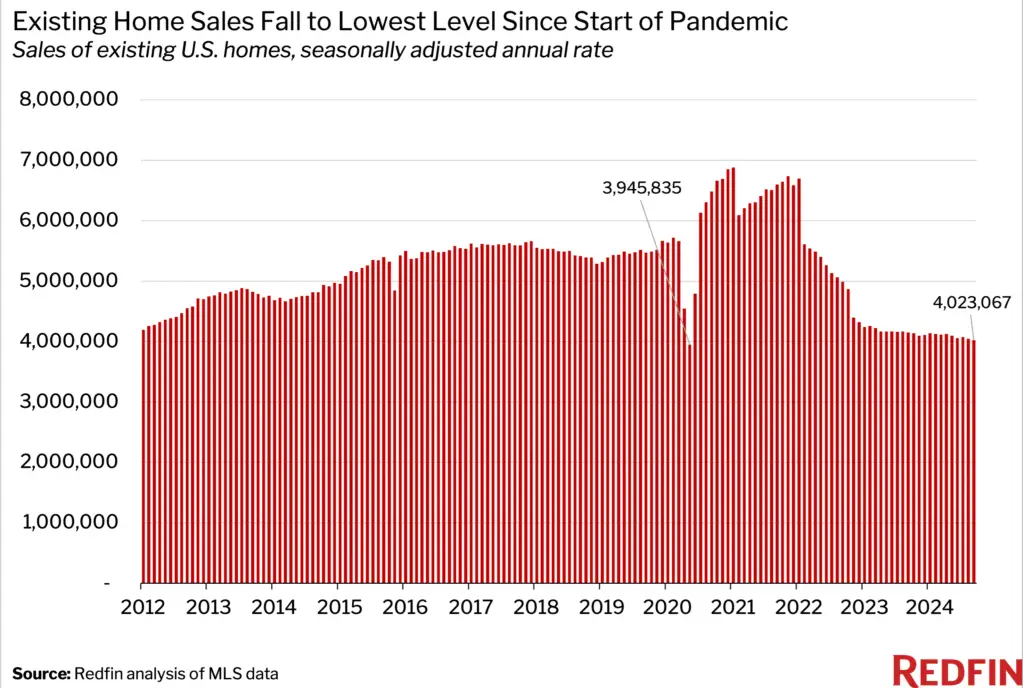

| Existing home sales, seasonally adjusted annual rate | 4,023,067 | -0.5% | -3.0% |

| Pending home sales, seasonally adjusted | 478,074 | 2.5% | 3.1% |

| Homes sold, seasonally adjusted | 412,635 | -0.2% | -1.6% |

| New listings, seasonally adjusted | 513,345 | 0.8% | -0.7% |

| Total homes for sale, seasonally adjusted (active listings) | 1,651,244 | 0.2% | 14.9% |

| Months of supply | 3.1 | 0.4 | 0.5 |

| Median days on market | 39 | 2 | 6 |

| Share of homes sold above final list price | 28.4% | -1.8 ppts | -4.8 ppts |

| Average sale-to-final-list-price ratio | 99.1% | -0.2 ppts | -0.5 ppts |

| Pending sales that fell out of contract, as % of overall pending sales | 14.8% | -0.3 ppts | -0.6 ppts |

| Monthly average 30-year fixed mortgage rate | 6.18% | -0.32 ppts | -1.02 ppts |

What This Means for Buyers and Sellers Moving Forward

Redfin’s senior economist, Elijah de la Campa, advises buyers not to try to “time the market.” While mortgage rates have fluctuated, there are still good deals to be found, particularly as homes linger longer on the market. The median home sale price in September was $428,212, up 3.9% from the previous year, highlighting the continuing challenge of affordability. However, with inventory levels remaining tight, sellers are still in a strong position, though they may need to price their homes competitively to attract offers in a more cautious market.

September Pending Home Sales Signal Market Stability

The 2.5% increase in September pending home sales offers a positive outlook for the housing market, especially in light of the recent drop in mortgage rates. While regional challenges, such as natural disasters and fluctuating rates, continue to affect the market, the overall trend suggests that buyers and sellers are finding opportunities to engage when conditions are right. According to Redfin, the Federal Reserve’s future rate cuts could further stabilize mortgage rates, giving the market more predictability in the coming months. For now, September’s pending home sales data highlights the resilience of the housing market amidst broader economic uncertainty.