In a notable shift within the housing market, pending home sales decline has hit its most significant point in four months, marking a major downturn. This whole situation boils down to two big headaches: mortgage rates that just won’t stop climbing and the inclement weather. But even with these bumps in the road, there’s still a bunch of hopeful buyers out there, tiptoeing through the market with their eyes wide open. They’re not letting anything stop them from house hunting; they’re just being a bit more careful about it.

The Impact of Mortgage Rates and Weather on Pending Home Sales Decline

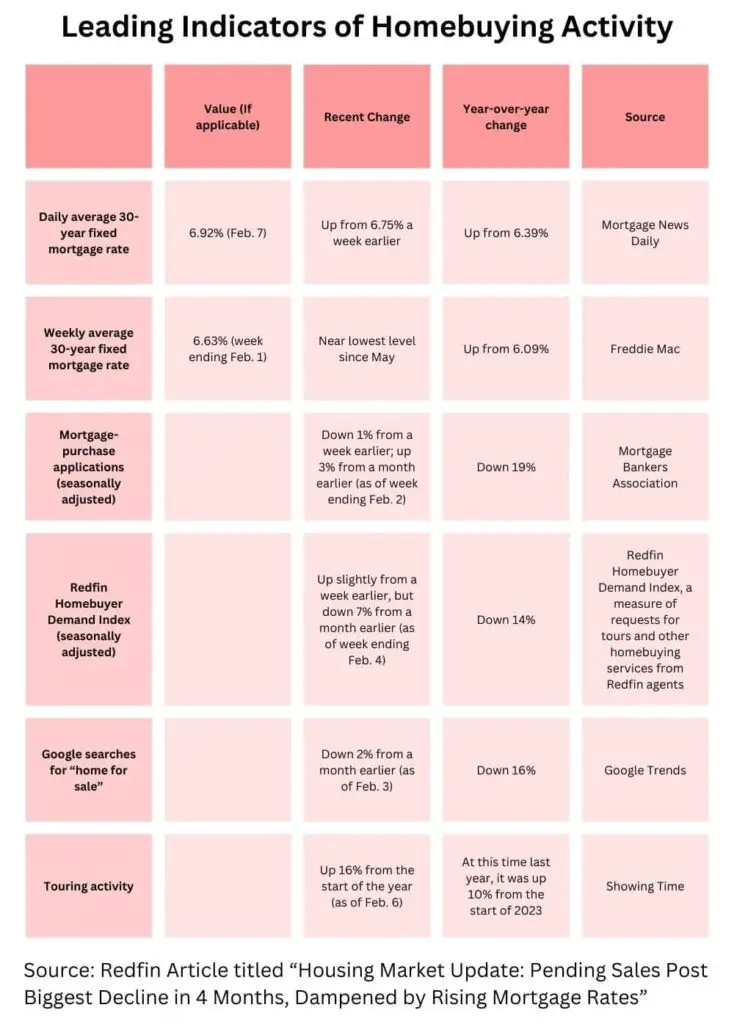

Sky-high mortgage rates are throwing a wrench in the dreams of many who are hoping to snag a new home. It’s simple, really: as the rates climb, the cost of borrowing cash to buy a house goes up too, making it tougher to leap into homeownership. And it’s not just the steep rates; Mother Nature hasn’t been playing nice either. From coast to coast, bad weather is putting a damper on house hunting, making it a double whammy for the housing market.

Navigating the Surge in Home Prices Amidst Climbing Rates

The squeeze in the housing market continues as rising home prices join forces with climbing rates, pushing the typical monthly mortgage payment perilously close to last October’s record high. In the span of just four weeks ending February 4, the median U.S. sale price jumped by 5.4% compared to last year, marking the steepest rise in over 12 months. This spike in home values is more than just numbers on a page—it’s a barrier that’s sidelining a growing number of potential buyers.

Caught in the crossfire of high housing costs, many would-be homeowners are finding themselves priced out of a chance at the American Dream. The impact is clear and present: pending home sales have plummeted by 8%, the most significant drop we’ve seen in the last four months. It’s a telling sign that the market’s heat is not just warming the homes but also melting away the opportunities for many.

A Tentative Rebound in Home Tours Amidst Climbing Rates and Harsh Weather

The real estate landscape is witnessing a fragile form of resilience as more house hunters cautiously step out to tour homes. Yet, this uptick in initial demand isn’t hitting the levels that we typically anticipate for the season. Chen Zhao, the economic research lead at Redfin, encapsulates the current sentiment, stating, “We’re seeing a bit of recovery with house hunters touring homes, but even demand at the earliest stages isn’t up as much as we would expect at this time of year.” This observation reflects a market still in recovery mode, with potential buyers warily navigating the twin hurdles of rising mortgage rates and an exceptionally brutal winter.

Zhao’s take on the market is like watching someone on a tightrope between hope and second-guessing. Those creeping mortgage rates are looming large, putting a real damper on the little bit of bounce-back we’ve started to see. And with winter being extra tough this year, it’s thrown a real cold spell over house hunting—plenty of folks are choosing to hunker down and wait it out instead of bundling up to go home shopping.

Market Dynamics and Homebuyer Adaptation

Even amidst these deterrents, a subset of house hunters remains undeterred, actively touring homes and acquainting themselves with the current market landscape. This shows just how tough and flexible homebuyers can be. Even when things look grim, with interest rates going through the roof and the weather throwing curveballs, some aren’t giving up. They’re out there, rain or shine, looking for that perfect spot to call their own. It proves that the dream of owning a home is alive and well, no matter how rough the economic weather gets.

The Persistent Challenge of Pending Home Sales Decline

The recent decline in pending home sales serves as a clear indicator of the housing market’s sensitivity to external economic forces, particularly mortgage rates, and environmental factors. As everyone in the housing game—buyers and sellers alike—tries to make sense of what’s happening, we’re at a crossroads. What happens next in the housing market is really going to depend on whether we can get the economy to steady itself and if the weather decides to play nice. The whole pending home sales decline situation sums up where we’re at right now and is a big deal for anyone trying to figure out their next move in this unpredictable market.

“High mortgage rates brought the local market to a near-standstill from August through November, activity picked up when rates dropped a bit in mid-December, and now it’s slowing down again as rates rise. I’m advising buyers–especially first-timers–that the mortgage rates they see in the news aren’t the be-all and end-all. Some local lenders are willing to give rates in the 5% range for new construction projects because any business is better than no business.” –Luis Rojas, a Redfin Premier agent in Florida

Related posts:

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

10 Precautions to Stay Safe During a Home Renovation

10 Precautions to Stay Safe During a Home Renovation

Surge in US Housing: A Close Look at the November 2023 Boom

Surge in US Housing: A Close Look at the November 2023 Boom

Increased Housing Confidence Brightens 2024, But Buying a Home Still Tough

Increased Housing Confidence Brightens 2024, But Buying a Home Still Tough

Canada Bans Foreign Homeownership Until 2027 to Help People Afford Homes

Canada Bans Foreign Homeownership Until 2027 to Help People Afford Homes