The U.S. rental market has seen significant shifts in recent years, and 2024 is no exception. The trend of rising asking rents has become a focal point for both renters and market analysts. As rental prices climb, understanding the underlying factors and regional differences becomes crucial for anyone navigating the housing market.

The Surge in Rental Prices

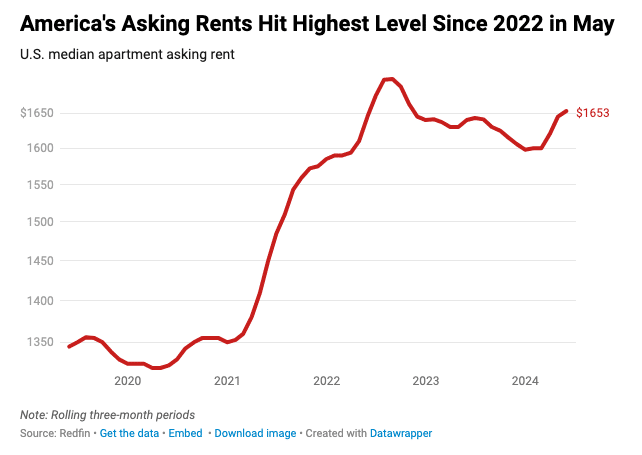

Rising asking rents have been a prominent feature of the 2024 rental market. According to recent data from Redfin, the median asking rent in the U.S. rose by 0.8% year over year in May, reaching $1,653. This marks the highest level since October 2022, with May representing the second consecutive month of increases following a prolonged period of decline. The month-over-month increase of 0.5% further highlights the upward trend.

One of the primary drivers of rising asking rents is the balance between supply and demand. Multifamily construction surged during the pandemic, leading to a temporary dip in rent prices as building owners competed for tenants. However, with construction starts now below their 10-year historical average, the backlog of new units is hitting the market, limiting the extent of price growth.

Regional Variations in Rising Asking Rents

While the national trend points to rising asking rents, regional variations reveal a more complex picture. Washington, D.C., has experienced the most significant jump, with a year-over-year increase of 11.1% in May. Other metropolitan areas with double-digit gains include Cincinnati (10.9%), Chicago (10.8%), Virginia Beach, VA (10.3%), and Minneapolis (10.3%).

Conversely, some regions have seen declines in asking rents. Notably, the Sun Belt, which includes cities like Jacksonville, FL (-10.1%), San Diego (-8.7%), Austin, TX (-7.2%), Seattle (-5.9%), and Phoenix (-5.5%), has experienced a cooling in rental prices. This decline is partly due to a higher rate of apartment construction in these areas during the pandemic, leading to increased vacancies and reduced rents.

Factors Influencing the Rental Market

Several factors contribute to the current trend of rising asking rents. Demand from young renters remains high as they opt to rent rather than buy in an increasingly unaffordable homebuying market. Redfin Senior Economist Sheharyar Bokhari notes that while demand is robust, rent price growth is restrained by the availability of new apartments, even during peak rental seasons.

The rental vacancy rate also plays a significant role. For the past three quarters, the vacancy rate has remained steady at 6.6%, the highest since 2021. This stability indicates a balanced market, with sufficient supply to meet demand, preventing excessive rent hikes.

Affordability Challenges and Future Outlook

Despite the rise in asking rents, they are still relatively stable compared to the dramatic fluctuations seen during the pandemic. At $1,653, the median asking rent in May was just $47 below the record high of $1,700 set in August 2022. However, this poses affordability challenges for many renters, particularly in high-demand areas.

Looking ahead, the trend of rising asking rents is likely to continue, driven by persistent demand and constrained supply. Renters should stay informed about regional market conditions and consider the long-term implications of renting versus buying.

The trend of rising asking rents in 2024 underscores the dynamic nature of the U.S. rental market. As median rents reach new heights, understanding regional variations and the factors influencing these trends is essential for both renters and market observers. With demand remaining strong and supply limited, the upward trajectory of rental prices is poised to persist, shaping the housing landscape in the years to come.

Related posts:

Decline in Home Prices: Anticipating a Shift in 2024

Decline in Home Prices: Anticipating a Shift in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building

Navigating the Decline: Florida Condo Prices Dropping Amidst Rising Costs

Navigating the Decline: Florida Condo Prices Dropping Amidst Rising Costs