Renters are staying in the same home for longer periods. This trend reflects several significant factors shaping the current housing market.

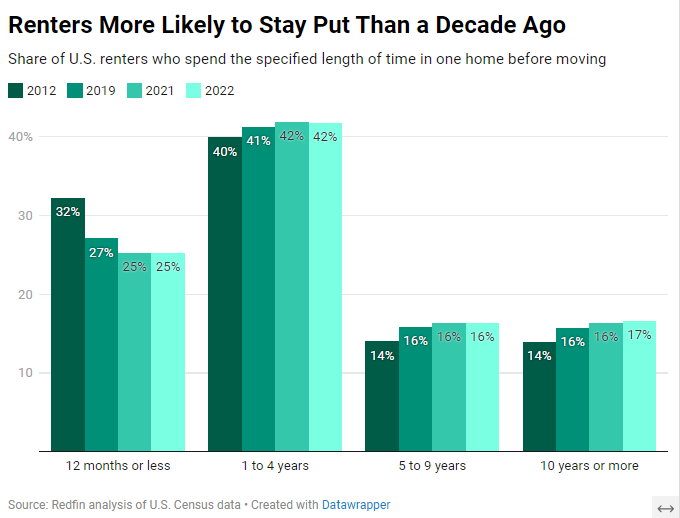

Over the past decade, U.S. renters have shown a marked increase in staying put. A recent Redfin analysis highlights this shift. In 2022, one in six renters stayed in their homes for over 10 years, up from 13.9% a decade earlier.

Reasons Why Renters Are Staying in the Same Home

- Rising Housing Costs The median U.S. home-sale price has more than doubled since 2012. Mortgage rates are near two-decade highs. These factors make it difficult for renters to afford homeownership. Consequently, they opt to stay in their current rentals.

- Increased Rental Prices Asking rental prices have soared, rising over 20% since 2019. This discourages people from moving between rentals due to higher costs.

- Lifestyle Changes The rise of remote work has led many to choose renting for its flexibility. Renters enjoy the ability to relocate easily for job opportunities or lifestyle changes without the commitment of owning a home.

- Supply Shortages The supply of homes for sale has not kept pace with demand. Even renters who can afford to buy may struggle to find available homes. This lack of inventory further encourages renters to stay put.

Benefits of Staying Longer

Renters benefit from staying in the same home. They save on moving costs and application fees. Rent increases are often smaller for long-term tenants. This stability also helps them save money, potentially for a future down payment. Landlords prefer long-term tenants to avoid turnover costs.

Renters are staying in the same home longer due to affordability and lifestyle preferences. This trend has significant implications for the housing market.

Metro-Level Trends

Renters in various metropolitan areas exhibit differing tendencies to stay in their homes longer. These differences highlight the unique economic and lifestyle factors influencing each region.

New York City

In New York City, renters are significantly more likely to stay put. Only 15.8% of renters moved within 12 months in 2022, the lowest percentage among the 50 most populous U.S. metros. Several factors contribute to this trend:

- High Housing Costs: The cost of buying a home in New York City is prohibitively high for many renters, making it more feasible to remain in their current rental homes.

- Stable Rental Rates: Rent regulation policies in New York often lead to more predictable rental costs, encouraging renters to stay longer.

- Urban Amenities: The city offers ample employment opportunities, cultural attractions, and convenient public transportation, making it desirable for long-term residence.

Austin, Texas

Conversely, Austin, Texas, has the highest mobility rate among major metros. In 2022, 38.2% of renters moved within 12 months. This high turnover can be attributed to several factors:

- Booming Real Estate Market: Austin’s rapid growth and development have led to a dynamic housing market. Many renters move to take advantage of new housing developments and changing neighborhoods.

- Job Market Dynamics: The tech industry boom in Austin attracts a young, mobile workforce. These renters often move frequently due to job changes and career opportunities.

- Rental Cost Increases: While Austin is more affordable than cities like New York, rising rental prices still push some renters to seek more cost-effective options.

Other Notable Metros

- Riverside, California: Following New York, Riverside has a relatively low mobility rate, with only 16.5% of renters moving within a year. High costs of living and limited affordable housing options contribute to this trend.

- Denver and Nashville: Both cities have higher mobility rates, with 34.4% of renters moving within 12 months. These cities experience rapid growth and development, similar to Austin, attracting a transient, younger population.

General Observations

Across the U.S., renters are generally less likely to move than a decade ago. Most major metros have seen a decline in renter mobility. This trend is driven by several overarching factors:

- Economic Pressures: Increased home prices and rental rates make moving financially challenging.

- Remote Work: The rise in remote work allows renters to stay in their current homes while still accessing job opportunities.

- Supply Shortages: A limited supply of homes for sale makes it difficult for renters to transition to homeownership.

Future Trends

The future may see a decline in renter tenure. An apartment-building boom in 2023 could offer more rental options. This may cool rental-price growth, leading to increased mobility among renters. Overall, renters are staying in the same home longer than before. This shift is driven by high housing costs, increased rental prices, lifestyle choices, and limited home inventory.

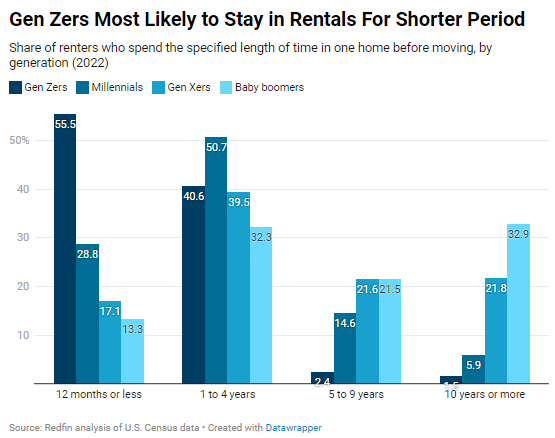

Generational Differences

Younger renters, like Gen Z, are more mobile. Over half of Gen Z renters moved within 12 months in 2022. In contrast, baby boomers are more likely to stay in their rentals for over 10 years.

Renters are staying in the same home longer. This trend reflects economic pressures and changing lifestyle preferences.

Related posts:

Decline in Home Prices: Anticipating a Shift in 2024

Decline in Home Prices: Anticipating a Shift in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building

Navigating the Decline: Florida Condo Prices Dropping Amidst Rising Costs

Navigating the Decline: Florida Condo Prices Dropping Amidst Rising Costs