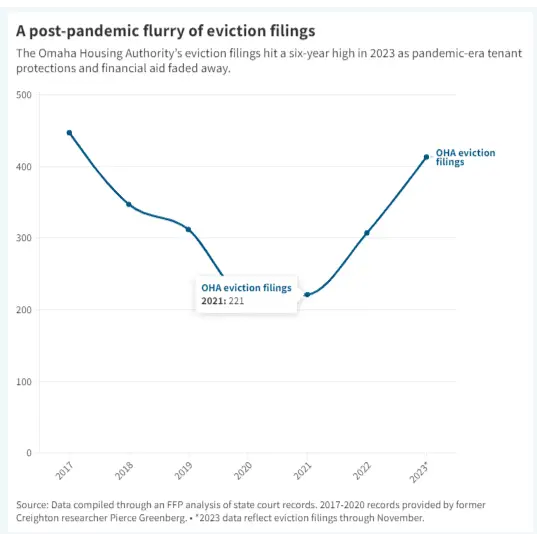

Omaha’s public housing residents encounter increased evictions, sometimes over minor Debts. Against the backdrop of a startling 60% surge in eviction filings, concerns mount regarding the Omaha Housing Authority’s (OHA) commitment to its mission of serving the city’s most vulnerable residents. Fueled by financial constraints and federal regulations, OHA’s eviction practices have come under scrutiny, prompting advocates to question the agency’s alignment with its humanitarian objectives.

Individual stories, like that of Bob Peniska, highlight the stark realities faced by public housing residents. Peniska, a long-time resident with physical disabilities, found himself thrust into homelessness after a decade at Benson Tower. His poignant experience epitomizes the human toll exacted by OHA’s decisions.

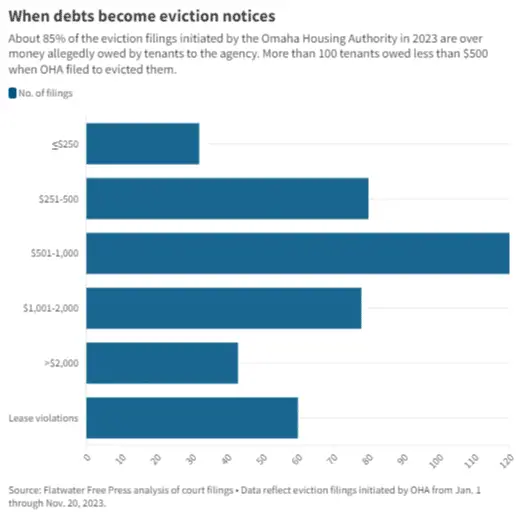

The statistics paint a troubling picture, with OHA filing over 400 eviction notices this year, a staggering 85% of which are linked to alleged debts. Shockingly, some cases involve trivial amounts, as low as $35, raising serious questions about the proportionality and compassion in the agency’s actions.

The eviction surge disproportionately affects Omaha’s public housing residents, a demographic that includes people of color, single-parent families, and individuals with disabilities. OHA administrators contend that financial constraints and federal regulations necessitate uniform treatment for all tenants, even as advocates argue that this approach conflicts with the agency’s core mission.

The eviction surge disproportionately affects Omaha’s public housing residents, a demographic that includes people of color, single-parent families, and individuals with disabilities. OHA administrators contend that financial constraints and federal regulations necessitate uniform treatment for all tenants, even as advocates argue that this approach conflicts with the agency’s core mission.

Calls for alternative measures, such as pre-court mediation and payment plans, grow louder as OHA grapples with the delicate balance between its humanitarian goals and fiscal viability. The inflation of legal fees, often exceeding initial debts, adds another layer of complexity, raising ethical concerns and sparking debate over the agency’s financial practices.

Personal narratives, like Mendy Race’s eviction over a $60 debt, underscore the broader consequences beyond immediate housing challenges. Her story, intertwined with struggles with addiction, homelessness, and COPD, serves as a poignant example of individuals navigating the aftermath of evictions. The potential for homelessness and the enduring impact on tenants’ records emerge as critical facets of the crisis.

As OHA navigates financial pressures and federal regulations, a deeper examination is warranted. The evolving situation prompts reflection on the delicate equilibrium between the agency’s social responsibility and the practicalities of its operations. Advocates emphasize the urgency for transparency, accountability, and proactive measures to prevent eviction filings, stressing the need to protect the city’s most vulnerable residents amidst this unfolding crisis.

As OHA navigates financial pressures and federal regulations, a deeper examination is warranted. The evolving situation prompts reflection on the delicate equilibrium between the agency’s social responsibility and the practicalities of its operations. Advocates emphasize the urgency for transparency, accountability, and proactive measures to prevent eviction filings, stressing the need to protect the city’s most vulnerable residents amidst this unfolding crisis.

Related posts:

Increase in US Home Construction in 2023 Signals Robust Market Recovery

Increase in US Home Construction in 2023 Signals Robust Market Recovery

Increased Housing Confidence Brightens 2024, But Buying a Home Still Tough

Increased Housing Confidence Brightens 2024, But Buying a Home Still Tough

Canada Bans Foreign Homeownership Until 2027 to Help People Afford Homes

Canada Bans Foreign Homeownership Until 2027 to Help People Afford Homes

Housing Market Crash in 2024: Unpacking the Truth Behind Rising Concerns

Housing Market Crash in 2024: Unpacking the Truth Behind Rising Concerns

New Construction Homes Sales Increase in 2024: A Look into the Rising Trend

New Construction Homes Sales Increase in 2024: A Look into the Rising Trend