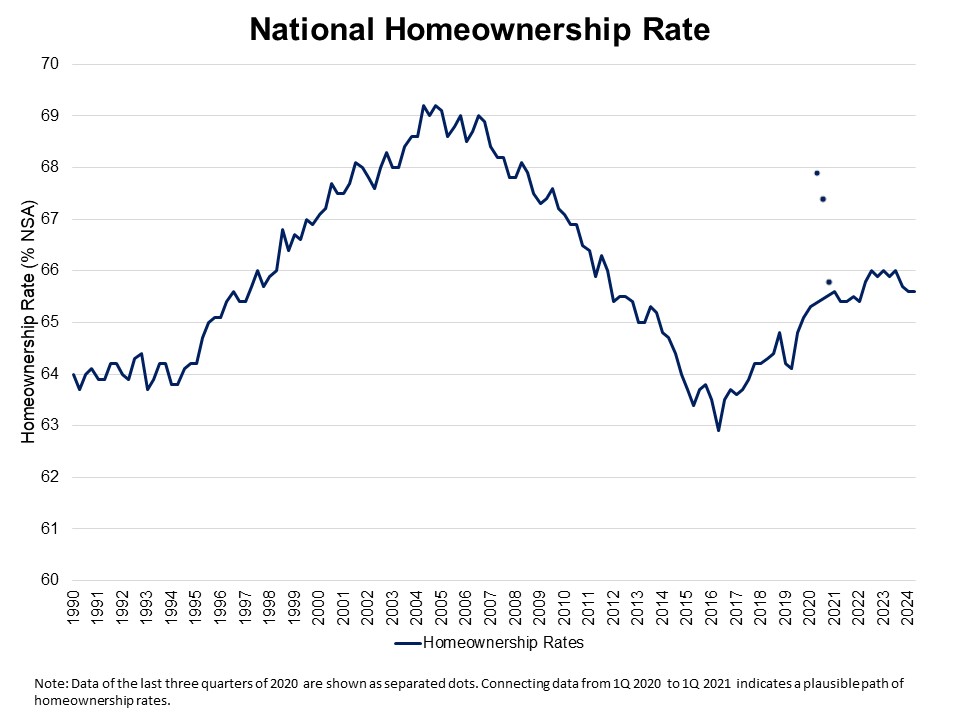

The lowest homeownership rate in America has become a growing concern in 2024. According to the Census’s Housing Vacancies and Homeownership Survey (HVS), the national homeownership rate was 65.6% in the second quarter of 2024. This figure remains unchanged from the first quarter but marks the lowest rate in the last two years. With a multidecade low in housing affordability, the U.S. is witnessing an alarming trend that affects different age groups, particularly younger householders.

Understanding the Current Landscape

The homeownership rate for householders under the age of 35 decreased to 37.4% in the second quarter of 2024. This marks a 1.1 percentage point decrease from 38.5% in the previous year. Elevated mortgage interest rates and a tight housing supply have made affordability a challenge for first-time homebuyers, contributing to the lowest homeownership rate among this age group.

For householders aged 35-44, the homeownership rate saw a decrease from 63.1% to 62.2%, while the rate for those aged 65 and over experienced a modest 0.3 percentage point decline. Conversely, the 45-54 age group saw a slight increase, reaching 71.1% in the second quarter of 2024 from 70.8% a year ago. Similarly, the rate for 55-64-year-olds edged up to 75.8%.

Housing Vacancy Rates

The national rental vacancy rate held steady at 6.6% in the second quarter of 2024, while the homeowner vacancy rate slightly increased to 0.9%. Despite this rise, the homeowner vacancy rate remains near the survey’s 67-year low of 0.7%. This stability in vacancy rates suggests that the issue is not with the number of homes available but with their affordability.

Impact on Different Demographics

The lowest homeownership rate particularly impacts younger age groups, who are most sensitive to changes in mortgage rates and home prices. The lack of affordable entry-level homes continues to deter first-time buyers, pushing them toward renting options. Meanwhile, older age groups have shown resilience, likely due to established equity and financial stability.

Year-on-Year Household Formation

The HVS revealed an increase in total households to 131.4 million in the second quarter of 2024 from 130 million a year ago. This growth includes an 855,000 increase in renter household formation and a 515,000 increase in owner-occupied households. These figures highlight the growing demand for housing but also underscore the challenges faced by potential homebuyers in today’s market.

Addressing the Lowest Homeownership Rate

The lowest homeownership rate in America highlights a significant economic challenge that requires urgent attention. With declining rates among younger householders and a broader affordability crisis, policymakers and industry leaders must collaborate to find sustainable solutions.