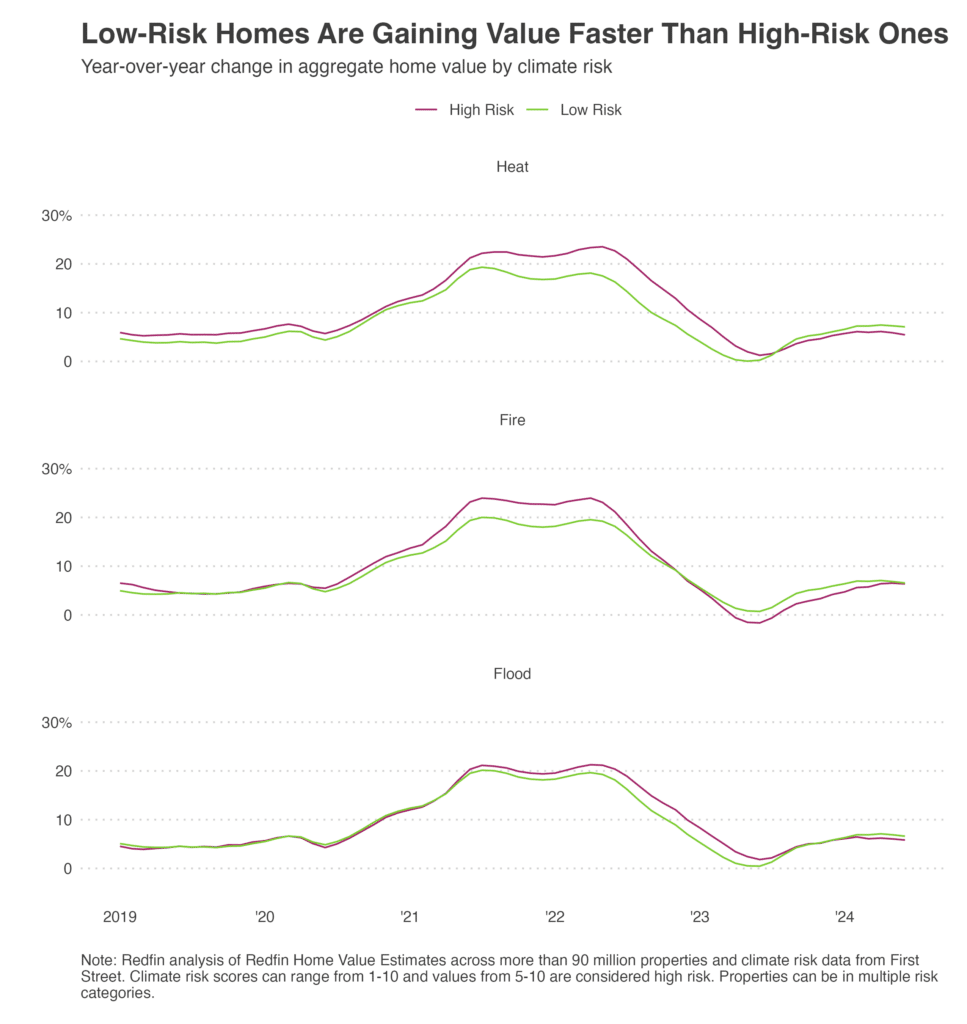

The real estate market is shifting, and homes with low natural disaster risk are seeing their values climb faster than those in high-risk areas. A recent Redfin analysis shows that 2024 is the first time since 2010 that low-risk homes—whether from heat, flood, or fire—have gained value quicker than high-risk ones. It’s clear that buyers are starting to prioritize safety, with natural disaster risk playing a bigger role in their decisions.

Why Low Natural Disaster Risk Matters to Homebuyers

As climate catastrophes grow more frequent and severe, many homeowners and buyers are prioritizing areas with minimal exposure to risks like extreme heat, flooding, and wildfires. The Redfin study reveals that the total value of homes in low-risk zones for heat, flood, and fire has risen by 6.7% year-over-year as of June 2024, compared to 6.3% in high-risk zones. This shift is partially driven by rising insurance premiums and property taxes, which make disaster-prone areas less affordable for many buyers.

Redfin’s Senior Economist, Elijah de la Campa, noted that “the reality of climate change is setting in,” prompting buyers to place disaster risk higher on their list of considerations when purchasing a home. With regions like California and Florida witnessing population declines in high-risk areas, this movement highlights a growing awareness of climate risks in housing decisions.

The Growing Value of Low-Risk Properties

From a financial perspective, homes with low natural disaster risk offer better stability and long-term value. While high-risk homes still hold significant value due to persistent demand and limited inventory, the gap is narrowing. For example:

- Heat Risk: Low-risk home values rose 7% year-over-year, reaching $17.7 trillion, outpacing high-risk heat zone growth at 6.3%.

- Flood Risk: Homes in low flood-risk areas saw a 6.7% increase in value, compared to 6% for high-risk properties.

- Fire Risk: Low fire-risk homes experienced a 6.6% annual value rise, slightly above the 6.4% increase in high-risk zones.

These trends indicate that buyers are increasingly favoring properties in safer areas, partly due to reduced insurance costs and improved peace of mind.

Regional Insights on Climate Risk and Home Value

While low-risk areas are gaining momentum, some regions with high natural disaster risk continue to see growth in home values, albeit at a slower rate. States like Florida and Texas, known for extreme weather conditions, remain popular for affordability and job opportunities despite their challenges. However, these areas are also experiencing slower growth due to rising insurance costs and higher property taxes.

Interestingly, the Redfin report highlights that while low-risk homes are rising faster in value, high-risk homes still command significant demand. Factors like the Sun Belt’s affordability and the ongoing housing shortage contribute to sustained growth in high-risk zones.

A Look Ahead: The Future of Low-Risk Housing

The shift towards homes with low natural disaster risk reflects a broader societal change. As climate awareness continues to grow, these properties are likely to maintain their upward trajectory in value. With the added benefits of lower insurance costs and fewer weather-related disruptions, low-risk homes are becoming increasingly attractive to buyers across the U.S.

However, the Redfin analysis also reminds us that housing trends are complex. For many Americans, affordability remains the most critical factor, which means that demand for high-risk homes in budget-friendly areas like the Sun Belt will persist. Ultimately, while low-risk properties are gaining value faster than ever, the housing market remains a mix of risk tolerance and financial considerations.

The rising value of homes with low natural disaster risk is reshaping the real estate landscape, marking a turning point for buyers and sellers alike. As homeowners seek safer investments and insurance costs climb in high-risk zones, properties in low-risk areas are poised to become even more desirable. This trend, underscored by data from Redfin, signals a new era in climate-conscious homebuying.

Related posts:

September Pending Home Sales See Biggest Increase Since 2023

September Pending Home Sales See Biggest Increase Since 2023

Top 10 U.S. Cities with Home Price Reductions in 2024

Top 10 U.S. Cities with Home Price Reductions in 2024

October 2024 National Rent Trends: What’s Happening Now in the U.S. Rental Market

October 2024 National Rent Trends: What’s Happening Now in the U.S. Rental Market

Presidential Housing Policy: A Vision for Affordable and Accessible Housing in the U.S.

Presidential Housing Policy: A Vision for Affordable and Accessible Housing in the U.S.

Rome Housing Crisis: A Growing Challenge Ahead of Holy Year 2025

Rome Housing Crisis: A Growing Challenge Ahead of Holy Year 2025