Lock-in mortgages have significantly altered the financial landscape for American consumers, offering a protective shield against the economic turbulence induced by rising interest rates. As of 2022, these mortgages have provided an estimated $600 billion in extra spending cash to homeowners, showcasing their profound impact on the economy.

The Financial Cushion of Lock-In Mortgages

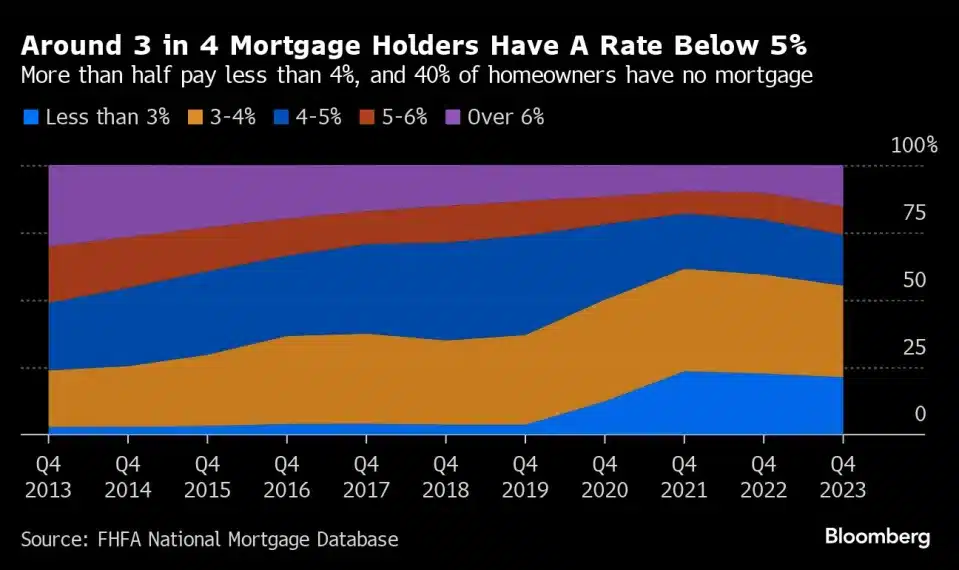

Since 2022, the financial relief provided by lock-in mortgages has amounted to nearly 2% of all personal consumption spending. This financial cushion has not only enhanced consumer spending but also softened the blow of the Federal Reserve’s interest-rate hikes. By securing lower interest rates, homeowners have effectively insulated themselves from the monetary tightening cycle that has affected other sectors of the economy, particularly renters who do not benefit from such fixed rates.

Impact on Monetary Policy and Consumer Behavior

The resilience of consumer demand, bolstered by lock-in mortgages, has complicated the Federal Reserve’s efforts to control inflation through interest rate hikes. Despite the Fed’s aggressive monetary policy, the locked-in rates on mortgages have dispersed the impact of these moves, forcing the Fed to raise rates higher than initially anticipated. This situation highlights a critical shift in the transmission of monetary policy, where a significant portion of household debt remains unaffected by rate hikes, thus muting their intended effects.

Future Implications of Lock-In Mortgages

Looking forward, lock-in mortgages may continue to play a crucial role as the Federal Reserve contemplates potential rate cuts. However, the same mechanism that shielded consumers from rate hikes might also limit the effectiveness of future rate cuts. As the Fed aims to stimulate consumer demand in a slowing economy, the persistence of these fixed-rate mortgages could necessitate more aggressive monetary easing than currently forecasted.

Lock-in mortgages have provided homebuyers with substantial financial relief and have reshaped the dynamics of monetary policy. As the economy evolves, the role of these mortgages in both consumer behavior and policy-making will likely remain significant.