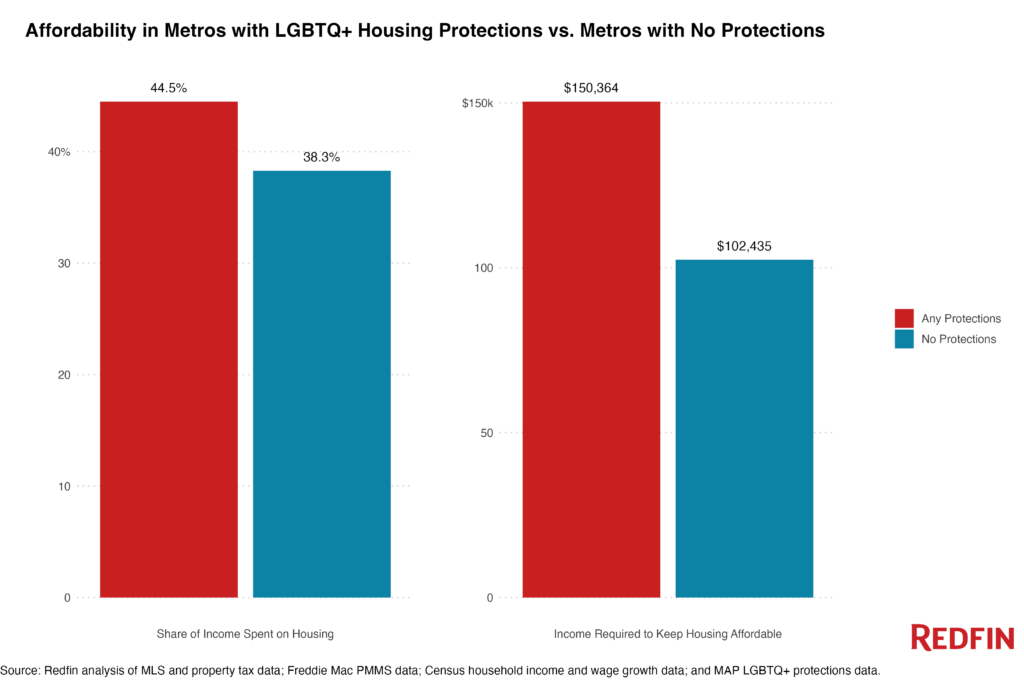

Finding a home in LGBTQIA+ friendly areas can be challenging due to rising housing costs. These communities offer a welcoming environment but require significant financial resources. This article explores why at least $150k is needed to afford a home in these inclusive areas.

The Appeal of LGBTQIA+ Friendly Areas

LGBTQIA+ friendly areas provide a safe, welcoming environment. These neighborhoods often have vibrant social scenes and supportive networks. The demand for housing in these areas has driven up prices.

Housing Costs in LGBTQIA+ Friendly Areas

LGBTQIA+ friendly areas often have higher living costs. The inclusive culture and amenities attract many, pushing prices upward. On average, a home in these neighborhoods requires a minimum of $150k.

Key Factors Driving Housing Prices

Several factors contribute to high housing costs in LGBTQIA+ friendly areas:

- Demand: High demand for homes in welcoming areas increases prices.

- Amenities: These neighborhoods offer unique amenities and a vibrant social scene.

- Safety: Safety and inclusivity attract many buyers, driving up demand and prices.

Barriers to Homeownership

According to Redfin Senior Economist Elijah de la Campa, “LGBTQ+ Americans face disproportionately large barriers to homeownership.” Many LGBTQ+ individuals earn less than the typical U.S. worker and face discrimination despite laws prohibiting it. Additionally, they often pay a premium to live in safe, inclusive areas.

Cities with Largest LGBTQ+ Populations and Least Affordable Homes

In the metros where LGBTQ+ people make up the largest share of the adult population, less than 10% of home listings are affordable for someone earning the median local household income:

San Francisco, CA

-

LGBTQ+ Population: 6.7%

-

Affordable Listings: 5.1%

Portland, OR

-

LGBTQ+ Population: 6%

-

Affordable Listings: 6.7%

Austin, TX

-

LGBTQ+ Population: 5.9%

-

Affordable Listings: 2.9%

Seattle, WA

-

LGBTQ+ Population: 5.2%

-

Affordable Listings: 4.8%

Los Angeles, CA

-

LGBTQ+ Population: 5.1%

-

Affordable Listings: 1.9%

In all five aforementioned metros, someone making the median local income in 2023 would’ve had to spend more than 45% of their earnings on monthly housing costs to buy the median-priced home. All five metros also had a median home sale price above the national level of $410,252.

Cities with Lower LGBTQ+ Populations and More Affordable Homes

A much larger share of listings are affordable in metros with lower shares of LGBTQ+ adults:

Pittsburgh, PA

-

LGBTQ+ Population: 3.3%

-

Affordable Listings: 57.4%

Raleigh, NC

-

LGBTQ+ Population: 3.3%

-

Affordable Listings: 17.8%

Omaha, NE

-

LGBTQ+ Population: 3.4%

-

Affordable Listings: 30%

Milwaukee, WI

-

LGBTQ+ Population: 3.5%

-

Affordable Listings: 38.9%

Houston, TX

-

LGBTQ+ Population: 3.5%

-

Affordable Listings: 16.7%

Most Affordable Places with LGBTQ+ Protections

Of the 30 metros analyzed in states with protections for LGBTQ+ people, the most affordable are in the Northeast and Midwest:

Rochester, NY

-

Affordable Listings: 55.5%

Detroit, MI

-

Affordable Listings: 55.3%

Buffalo, NY

-

Affordable Listings: 50.3%

Baltimore, MD

-

Affordable Listings: 48%

Albany, NY

-

Affordable Listings: 41.1%

In all five of those metros, the median home sale price was below the national level of $410,252, and the typical buyer would’ve had to spend roughly 30% of their income on monthly housing payments.

LGBTQIA+ friendly areas offer a supportive and vibrant community but come with high housing costs. To afford a home in these inclusive neighborhoods, a budget of at least $150k is necessary. Understanding these financial requirements helps prospective buyers plan better and find suitable homes.