The housing vacancy rates in the United States have shown notable trends in the second quarter of 2024. According to the latest report from the U.S. Census Bureau, the national vacancy rates for rental and homeowner housing reflect both stability and slight increases compared to previous quarters. This article delves into the specifics of these changes and their implications for the housing market.

Overview of Housing Vacancy Rates

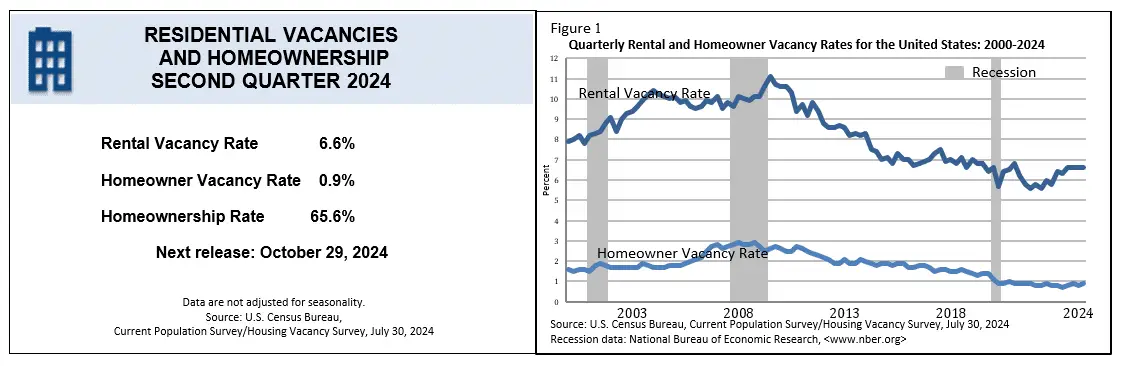

In the second quarter of 2024, the rental vacancy rate stood at 6.6%, marking an increase from 6.3% in the same quarter of 2023. This rate has remained consistent with the first quarter of 2024, indicating a stable yet slightly elevated demand for rental properties. On the other hand, the homeowner vacancy rate was reported at 0.9%, up from 0.7% in the second quarter of 2023 and 0.8% in the first quarter of 2024.

The homeownership rate during this period was 65.6%, virtually unchanged from both the first quarter of 2024 and the second quarter of 2023, where it was 65.9%. These housing vacancy rates provide a clear picture of the current housing market dynamics and consumer behavior.

Factors Influencing Rental and Homeowner Vacancy Rates

Several factors contribute to the changes in housing vacancy rates:

- Economic Conditions: Economic stability often leads to increased demand for housing, affecting vacancy rates. As the economy continues to recover from recent downturns, more people are seeking rental accommodations, impacting rental vacancy statistics.

- Interest Rates: Fluctuations in interest rates can influence homebuying decisions, affecting homeowner vacancy rates. Lower rates typically encourage buying, while higher rates might increase rental demand.

- Urban vs. Suburban Trends: Urban areas often experience different vacancy trends compared to suburban regions. Urban areas may see higher rental vacancy rates due to higher living costs, while suburban areas might reflect lower homeowner vacancy rates as more families seek affordable living spaces.

- Housing Supply: The availability of housing units plays a crucial role in determining vacancy rates. A surplus of properties can lead to higher vacancy rates, while a shortage might reduce them.

Implications for the Housing Market

The current housing vacancy rates highlight some important implications for the U.S. housing market:

- Rental Market Stability: The consistent rental vacancy rate suggests stability in the rental market, potentially leading to steady rental prices and limited availability in certain areas.

- Homeownership Opportunities: The slight increase in homeowner vacancy rates could present opportunities for potential homebuyers, especially if market conditions become more favorable.

- Investment Prospects: Investors in real estate should consider these trends when making decisions, as changing vacancy rates can influence property values and rental income.

Analyzing Housing Vacancy Rates

The housing vacancy rates for the second quarter of 2024 reflect significant trends in the rental and homeowner sectors. With rental vacancy rates showing a slight increase and homeowner rates also rising, these statistics provide valuable insights into the housing market’s current state. Understanding these rates is essential for stakeholders, including renters, homeowners, and investors, as they navigate the ever-changing landscape of the U.S. housing market.