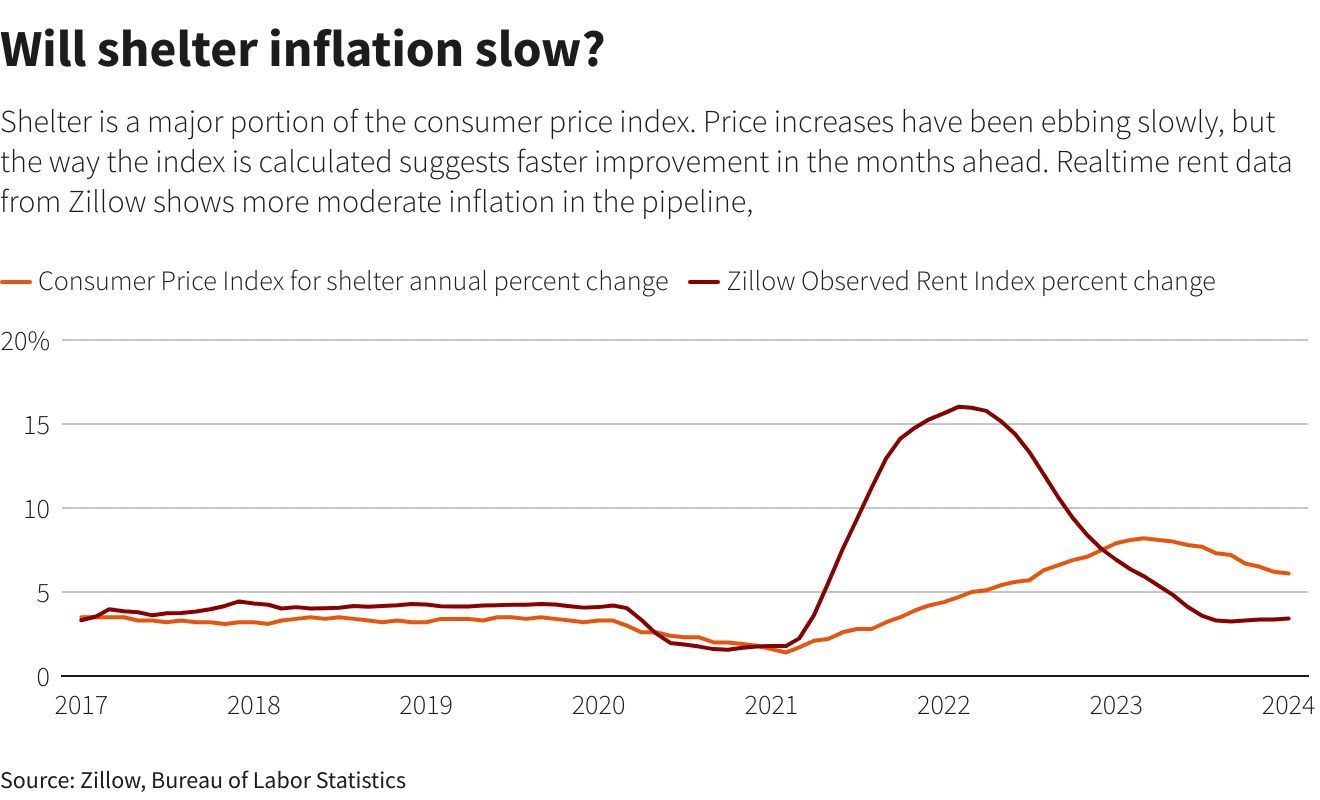

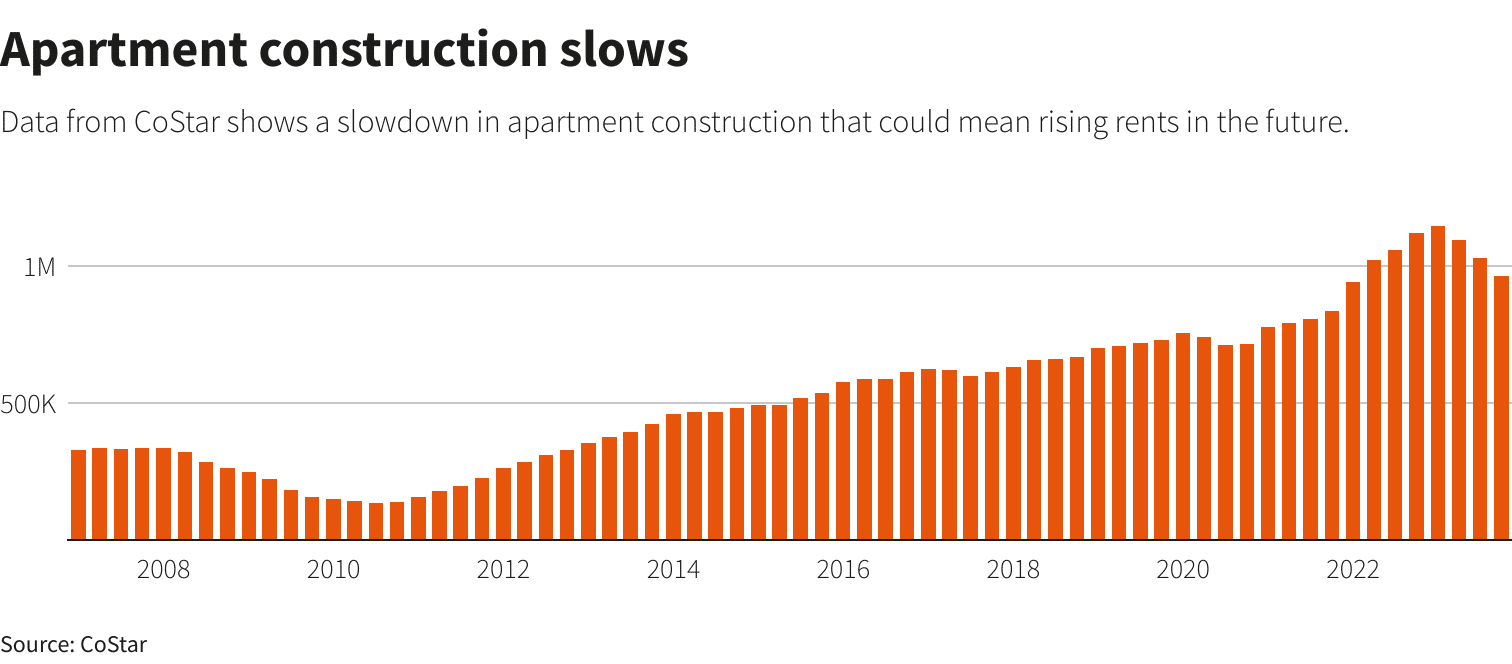

U.S. Federal Reserve officials express optimism about cooling housing inflation, a pivotal element in their strategy to manage overall price increases and implement necessary interest rate cuts. However, a significant challenge looms on the horizon: as the pipeline of new apartments dwindles, and the stock of single-family homes remains scarce, it sets the stage for potential future price pressures in a category constituting about a third of the Consumer Price Index (CPI).

Pipeline Dynamics: A Complex Scenario

While acknowledging the complexity of finding the right rate setting to balance demand and housing supply, concerns arise that policymakers may have leaned too hard against the economy. Jay Lybik, national director of multifamily analytics for real estate data firm CoStar, emphasizes the impracticality of instant housing creation, debunking the notion of a quick fix.

“You think you can snap your fingers and housing can be created… The reality is that is not the case,” Lybik cautions.

Housing Affordability in the Spotlight

Amid the pandemic, housing affordability concerns soared, witnessing a 50% surge in median home prices. Calls for Fed rate cuts to lower mortgage costs and stimulate construction have grown louder. However, the challenges extend beyond the immediate control of the Federal Reserve.

“We have longer-run problems with the availability of housing,” notes Fed Chair Jerome Powell.

Current Trends and Challenges: A Closer Look

Despite anticipations of a coming “disinflation” in shelter costs, challenges persist. Inflation remains “bumpy,” with shelter costs displaying unexpected resilience. An unexpected jump in the Consumer Price Index (CPI) accentuates ongoing pressure in the housing sector.

“What’s going to happen to the price?… Long run, there’s definitely built-in inflationary pressure,” warns Mark Fleming, chief economist at First American bank.

Future Outlook: Balancing Act

Shelter inflation peaked in March 2023, with the median home price experiencing a rapid surge. While recent interventions stabilized prices temporarily, the housing market remains a missing “puzzle piece” in the Fed’s quest for lower inflation.

Chicago Fed President Austan Goolsbee calls housing a missing “puzzle piece” in the Fed’s hope for broadly lower inflation.

Seeking Equilibrium: Fed’s Scrutiny

Fed officials, including Richmond Fed President Thomas Barkin, scrutinize construction patterns and seek evidence of demand-supply equilibrium. Despite near-term projections of declining shelter inflation, uncertainties loom for the future, emphasizing the impact of supply shortages.

“Fast forward another six to 12 months… and it may actually move the other direction… That’s where the lack of supply comes in,” warns EY Chief Economist Gregory Daco.

In decoding the housing inflation dilemma, the intricate balance between demand, supply, and policy interventions emerges as a critical factor shaping the trajectory of the U.S. housing market.

Related posts:

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

10 Precautions to Stay Safe During a Home Renovation

10 Precautions to Stay Safe During a Home Renovation

Surge in US Housing: A Close Look at the November 2023 Boom

Surge in US Housing: A Close Look at the November 2023 Boom

Seattle Fort Lawton Housing Plan Revision: A New Vision for Affordable Living

Seattle Fort Lawton Housing Plan Revision: A New Vision for Affordable Living

2024 Real Estate Recession Warning: A Closer Look at the Housing Market Dynamics in Arizona

2024 Real Estate Recession Warning: A Closer Look at the Housing Market Dynamics in Arizona