The housing bubble in Southern states has become a hot topic among real estate experts. This bubble, characterized by an oversupply of new homes and rapidly rising prices, is now on the verge of bursting. During the COVID-19 pandemic, many Americans relocated to the Southern states seeking cheaper housing and greater flexibility in their living arrangements. This migration led to a surge in demand, prompting home builders to escalate construction. However, as the pandemic-driven demand slows, a significant drop in home prices appears imminent.

Factors Contributing to the Bubble

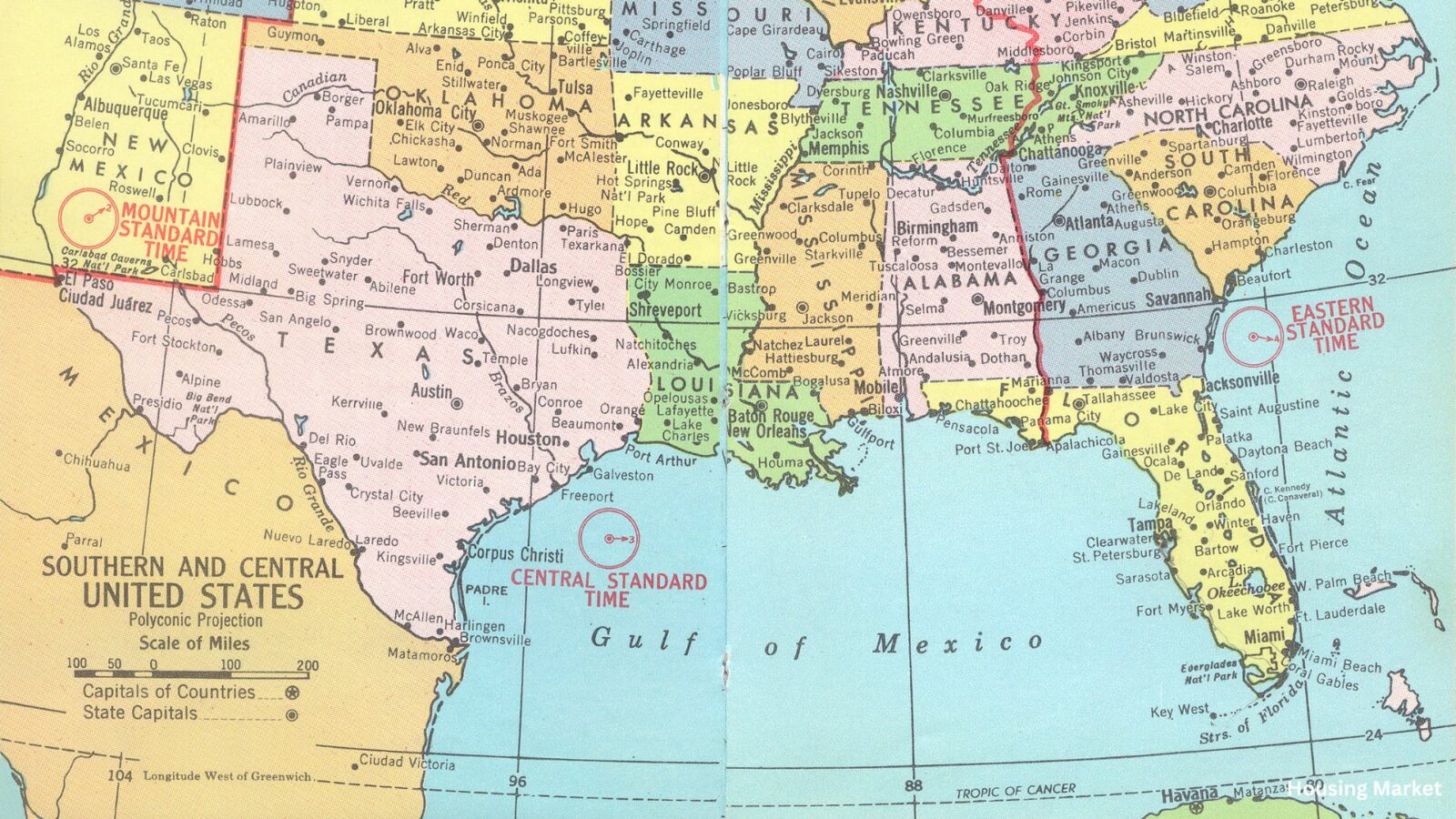

According to Newsweek, one of the primary factors contributing to the housing bubble in Southern states is the overproduction of new homes. Home builders responded aggressively to the increased demand during the pandemic, leading to a substantial oversupply. According to Nick Gerli, CEO of Reventure Consulting, the number of new homes for sale in the Southern Region, including states like Florida, Georgia, Tennessee, and Texas, has reached nearly 300,000. This figure surpasses the previous peak in August 2006, right before the massive housing crash.

A massive housing bubble has developed, and is about to pop, in the South.

The number of new homes for sale in the Southern Region (FL, GA, TN, TX, etc.) has spiked up to nearly 300,000.

This is the highest level of all-time. Even higher than the previous bubble peak in August… pic.twitter.com/bVB9vCQl4I

— Nick Gerli (@nickgerli1) July 8, 2024

Waning Demand and Declining Prices

As the trend of relocating to the South slows, the demand for new homes is dropping. This decline in demand is causing home prices to fall. Gerli notes that the COVID-inspired demand led to inflated prices, which are now adjusting downward. In areas like Austin, the median listing price has already decreased by 3 percent compared to a year ago. This adjustment is a clear indicator that the housing market in the South is undergoing a significant correction.

Regional Variations in Market Stability

While the Southern states are experiencing the brunt of the housing bubble, other regions in the U.S. are faring better. The Northeast and Midwest, for example, have lower levels of new home construction and speculative activity. Consequently, these regions have lower housing inventory levels and less overvaluation of home prices. Gerli emphasizes that a housing crash is unlikely in these areas, although a market correction may eventually occur.

The Future of the Southern Housing Market

Looking ahead, the future of the housing bubble in Southern states remains uncertain. Some experts, like Danielle Hale, chief economist at Realtor.com, suggest that the market may be normalizing after the volatility witnessed during the pandemic. She points out that there is greater availability of homes for sale now compared to pre-pandemic levels, particularly in cities like Austin and San Antonio. This increased availability is expected to stabilize prices and prevent a severe crash.

Navigating the Housing Bubble

The housing bubble in Southern states is a complex issue driven by a combination of overproduction, speculative activity, and shifting demand. While the market is currently undergoing a correction, it is essential for potential buyers and investors to stay informed and make cautious decisions. The Southern housing market’s relative affordability will continue to attract households, but it is crucial to monitor market trends closely as the situation evolves.

Related posts:

Decline in Home Prices: Anticipating a Shift in 2024

Decline in Home Prices: Anticipating a Shift in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Maryland Governor Legislative Agenda: Military Families, Housing, and Public Safety in 2024

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Nashville’s Zoning Bills for Middle-Income Housing Spark Contentious Debate

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building

Tampa Affordable Housing Initiative Breaks Ground on New 188-Unit Building

Navigating the Decline: Florida Condo Prices Dropping Amidst Rising Costs

Navigating the Decline: Florida Condo Prices Dropping Amidst Rising Costs