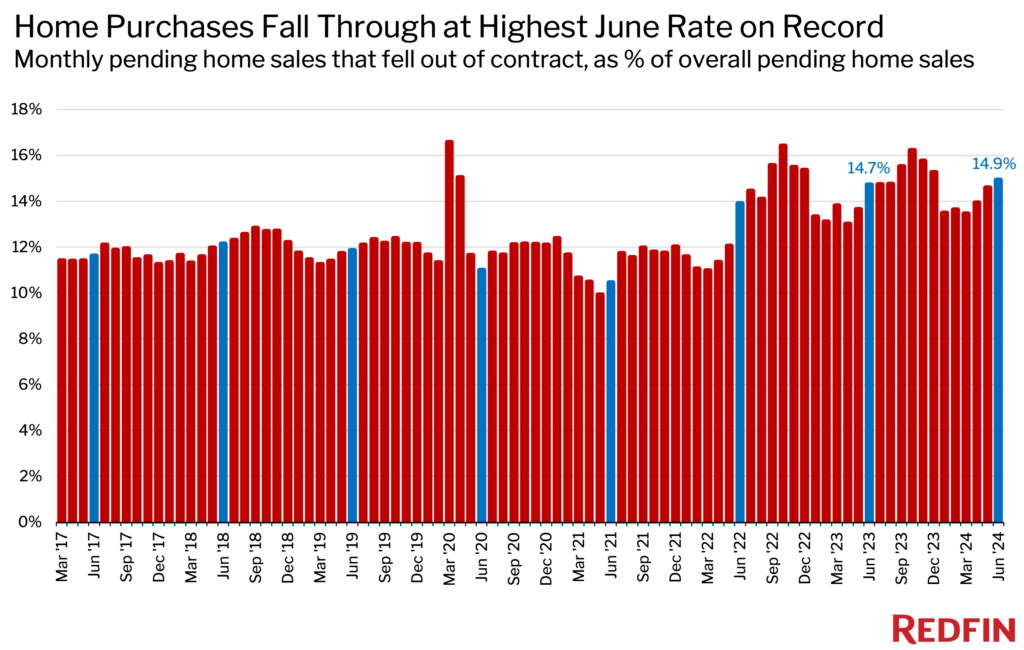

Home buying cancellations reached a record high in June 2024, significantly impacting the housing market. The trend is important for homeowners, potential buyers, and industry professionals. This article will explore the factors behind this surge and its implications.

Understanding the Surge in Home Buying Cancellations

In June 2024, about 56,000 home purchases were canceled, equating to 15% of homes that went under contract. This marks the highest percentage of cancellations for any June on record. Several key factors contribute to this trend:

- Elevated Mortgage Rates: The average interest rate on a 30-year mortgage was 6.92% in June, down slightly from the previous month but still more than double the all-time low during the pandemic. High mortgage rates increase monthly payments, making it challenging for buyers to commit.

- Record-High Home Prices: The median home sale price rose 4% year-over-year to a record $442,525. The increased cost of homes has deterred many buyers, leading to higher cancellation rates.

- Buyer Selectivity: Buyers are becoming more selective due to the high costs associated with purchasing a home. Many back out of deals for minor issues that previously might have been overlooked.

Implications for the Housing Market

The increase in home buying cancellations has several implications for the housing market:

- Price Reductions: Approximately 20% of homes for sale in June had a price cut, the highest share on record for any June. Sellers are dropping prices as homes sit on the market longer, leading to an increase in active listings.

- Market Slowdown: Home sales fell by 1% from the previous month, marking the biggest drop since October. The sluggish market is a result of affordability issues, with many potential buyers waiting on the sidelines for more favorable conditions.

- Regional Variations: The cancellation rates vary significantly by region. For instance, Orlando saw the highest percentage of cancellations among major metropolitan areas, with 20.8% of home-purchase agreements falling through in June.

What This Means for Homeowners and Buyers

For homeowners looking to sell, the current market conditions may require more flexibility in pricing and expectations. Buyers, on the other hand, should be prepared for a competitive market but also have the leverage to negotiate better deals, especially in areas with high cancellation rates.

Home buying cancellations in June 2024 highlight the challenges and uncertainties in the current housing market. Elevated mortgage rates and record-high home prices are the primary drivers of this trend. As the market continues to evolve, staying informed and adaptable will be crucial for both buyers and sellers.

Related posts:

Affordable Rental Provider Repays $710K to Arlington County

Affordable Rental Provider Repays $710K to Arlington County

Surge in US Housing: A Close Look at the November 2023 Boom

Surge in US Housing: A Close Look at the November 2023 Boom

Seattle Fort Lawton Housing Plan Revision: A New Vision for Affordable Living

Seattle Fort Lawton Housing Plan Revision: A New Vision for Affordable Living

2024 Real Estate Recession Warning: A Closer Look at the Housing Market Dynamics in Arizona

2024 Real Estate Recession Warning: A Closer Look at the Housing Market Dynamics in Arizona

Affordable Housing in Highland Park: A Sustainable Approach to Homeownership

Affordable Housing in Highland Park: A Sustainable Approach to Homeownership