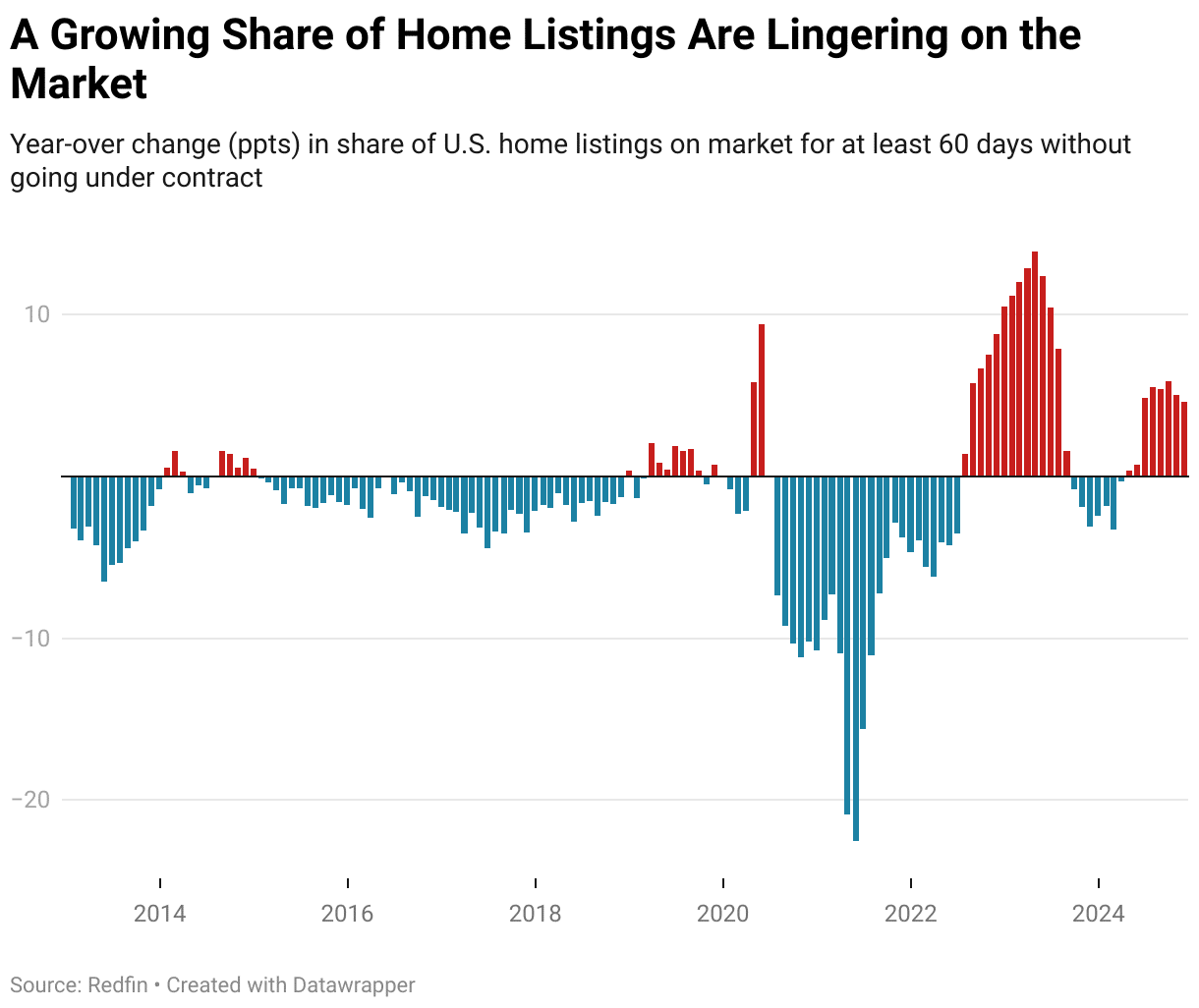

The unsold housing inventory is becoming an increasingly pressing issue in the U.S. housing market. Recent data from Redfin highlights a significant rise in housing supply, with many homes lingering on the market longer than ever before. This trend raises important questions about market dynamics and the factors contributing to this surplus of unsold homes.

The State of Unsold Housing Inventory

November 2024 saw a sharp increase in unsold housing inventory. Over 54.5% of home listings remained on the market for at least 60 days, the highest share recorded for any November since 2019. This stagnant inventory has contributed to a 12% year-over-year jump in active listings. While on the surface this might appear to counteract the narrative of a housing shortage, the underlying reasons paint a more complex picture.

Many of these unsold homes are perceived as overpriced or in less-than-desirable condition. According to Redfin Premier real estate agent Meme Loggins, overpriced homes can sit on the market for months, whereas well-priced and move-in-ready properties often sell within days. Homes priced at $650,000 or below, which typically attract more competition, are ironically among the most common to remain unsold due to sellers’ overpricing.

Regional Disparities in Unsold Housing Inventory

The issue of unsold housing inventory is more pronounced in certain regions. Florida and Texas lead the nation in the share of stale listings, partly due to their high levels of new construction. In Miami, for example, 63.8% of homes listed in November stayed on the market for over 60 days. Similarly, Austin, TX, and Fort Lauderdale, FL, report figures exceeding 60%.

Factors such as rising HOA fees, high insurance costs, and the impact of natural disasters further deter potential buyers in these areas. On the other hand, regions like Providence, RI, and Milwaukee, WI, report significantly lower shares of stale listings, reflecting more balanced local markets.

What This Means for the Housing Market

The growing unsold housing inventory has implications for both buyers and sellers. Buyers may find opportunities to negotiate better deals on stale listings, while sellers face increasing pressure to price their homes competitively and address any issues that might deter potential buyers. Additionally, the surplus could signal a shift in market dynamics, with potential cooling effects on home price growth in oversupplied areas.

The Path Forward

To address the unsold housing inventory, sellers need to be more attuned to market realities. Proper pricing and ensuring homes are in good condition will be critical to reducing time on the market. For buyers, this surplus presents opportunities to secure properties at potentially better values.

The latest insights from Redfin’s report underscore the importance of understanding regional trends and market conditions. As the housing market continues to evolve, stakeholders must remain adaptable to these changes.

The rise in unsold housing inventory highlights a shifting landscape in the U.S. real estate market. While increased supply offers opportunities, it also reflects challenges in pricing and desirability that sellers must address. By navigating these dynamics thoughtfully, buyers and sellers alike can make the most of the current market conditions.

Related posts:

Affordable Cities for Gen Z Buyers: Where to Find Your Dream Home Without Breaking the Bank

Affordable Cities for Gen Z Buyers: Where to Find Your Dream Home Without Breaking the Bank

2024 Election Impact on the Housing Market

2024 Election Impact on the Housing Market

Southwest Housing Market Trends in 2025: What to Expect

Southwest Housing Market Trends in 2025: What to Expect

5 Expensive Cities That Are Breaking the Bank for Gen Z Renters

5 Expensive Cities That Are Breaking the Bank for Gen Z Renters

West Coast Home Sales Surge in 2024: A Market on the Rise

West Coast Home Sales Surge in 2024: A Market on the Rise