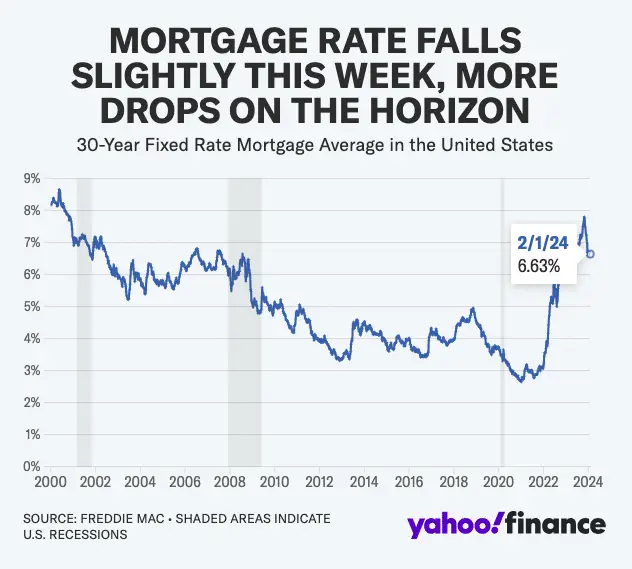

The year 2024 marks a pivotal moment as we witness the second drop in mortgage rates, according to Freddie Mac. This decline, particularly in the average rate for a 30-year loan, signals a potentially revitalizing effect on the housing market amidst moderating inflation.

Second Drop in Mortgage Rates: What is the Impact on the Housing Market?

When mortgage rates go down for the second time, as they have in 2024, it’s like a big sale sign going up for houses. This makes a lot of people interested in buying a home because loans are cheaper. At the same time, people wanting to sell their homes might decide it’s a good time because there are more buyers out there. This situation creates a busy market in the spring, where more people are buying and selling homes. Experts suggest this rate decrease could ignite a more vibrant spring buying season. The anticipation of lower rates is expected to balance housing supply and demand, offering a boon to both sellers and buyers.

The recent report by Freddie Mac highlighted a decrease in the average rate for a 30-year loan, moving from 6.69% to 6.63%. This marks the second time in 2024 that mortgage rates have fallen. This trend is seen as a positive signal for the housing market, suggesting that as inflation slows, further reductions in mortgage rates could occur. Such changes are anticipated to encourage a revival in housing activity, offering potential relief and opportunities for both buyers and sellers in the market.

Housing Supply and Demand Dynamics:

Imagine this: when loans become cheaper because interest rates drop again, it’s like a door opening wider for both people wanting to sell their homes and those wishing to buy. Sellers are more likely to put their homes up for sale, thinking they can get a good deal. At the same time, buyers, seeing lower costs to borrow money, jump at the chance to purchase. This means more homes are available for sale, and more people are looking to buy, making the housing market busier and more dynamic.

Recent Trends in Mortgage Application Activity:

Despite these optimistic projections, there’s a noted dip in mortgage application activity. This trend underscores the complex interplay of factors influencing potential homebuyers’ decisions. The decline in mortgage applications, despite the positive housing market outlook, can be explained by people’s caution due to job and income concerns, a wait-and-see attitude for even lower interest rates, rising property prices, the complexity of the mortgage process, and limited affordable housing options in desirable areas. These factors together create a hesitation among potential homebuyers.

As we navigate through 2024, the second drop in mortgage rates presents a ray of hope for rejuvenating the housing market. This movement is not just a numerical change but a catalyst for broader economic and social dynamics affecting communities nationwide.

Related posts:

UVM-Burlington Student Housing Agreement: A Collaborative Solution to Campus Housing Challenges

UVM-Burlington Student Housing Agreement: A Collaborative Solution to Campus Housing Challenges

Understanding Redlining in Las Vegas and Its Impact on the Westside

Understanding Redlining in Las Vegas and Its Impact on the Westside

Boomers Staying Put and Not Leaving Their Large Homes. Why?

Boomers Staying Put and Not Leaving Their Large Homes. Why?

Deciphering the Housing Market’s Future Amidst Inflationary Trends

Deciphering the Housing Market’s Future Amidst Inflationary Trends

Rising Mortgage Rates in 2024: A Challenge for the Spring Housing Market

Rising Mortgage Rates in 2024: A Challenge for the Spring Housing Market