In a remarkable shift in the housing market, mortgage refinance demand has spiked by 14%, marking a significant turnaround as interest rates plummet to their lowest since August. This surge signals a growing interest among homeowners to capitalize on favorable lending conditions, illuminating key economic trends.

Mortgage Rates Take a Dip

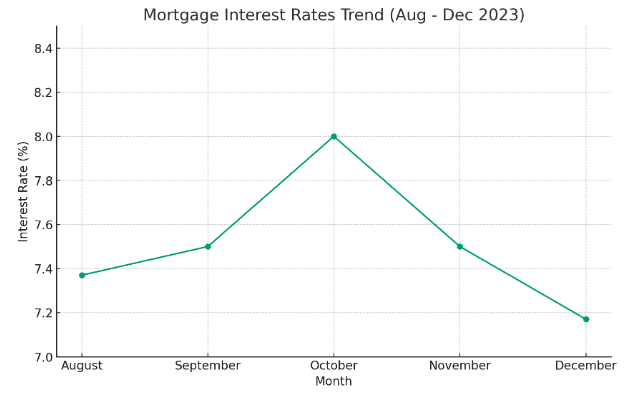

After peaking over 8% in October, mortgage rates have been on a downward trajectory, now hovering around 7%. This decline in rates, according to the Mortgage Bankers Association, has breathed new life into the refinance market. Last week, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances fell to 7.17% from 7.37%, the lowest level seen since the late summer months.

Impact on Mortgage Refinance Applications

The dip in rates has translated into a noticeable uptick in refinance applications. Compared to the previous week, applications jumped 14%, and remarkably, they were 10% higher than the same period last year. This increase marks the strongest week for refinance applications in two months, surpassing year-over-year comparisons for the first time since late 2021.

Driving Factors Behind Rate Reductions

Experts point to a couple of key factors behind the recent rate reductions: slowing inflation and market anticipation of a potential pause in the Federal Reserve’s rate hikes. Joel Kan, MBA’s vice president and deputy chief economist, notes that these dynamics are pivotal in influencing the current trends in mortgage rates.

The Uncertain Path Ahead

While mortgage refinance rates continue to edge lower, the path ahead remains uncertain. Forthcoming economic reports, like the government’s monthly employment report, could either sustain this downward trend or reverse it, depending on the broader economic indicators. This uncertainty underlines the volatile nature of the current financial landscape, where homeowners and potential buyers must navigate cautiously.

Conclusion

The recent jump in mortgage refinance demand, spurred by falling rates, presents both opportunities and uncertainties. Homeowners looking to refinance must stay attuned to the changing economic indicators that influence mortgage rates. As the market responds to these evolving dynamics, the refinance trend could either gain momentum or stabilize, depending on future economic developments.

Related posts:

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

10 Precautions to Stay Safe During a Home Renovation

10 Precautions to Stay Safe During a Home Renovation

Europe’s Housing Market Squeezed Amidst Cost-of-Living Crisis

Europe’s Housing Market Squeezed Amidst Cost-of-Living Crisis

Increase in US Home Construction in 2023 Signals Robust Market Recovery

Increase in US Home Construction in 2023 Signals Robust Market Recovery

Increased Housing Confidence Brightens 2024, But Buying a Home Still Tough

Increased Housing Confidence Brightens 2024, But Buying a Home Still Tough