The idea that a mortgage payment can be cheaper than rent is gaining traction in several U.S. metros. In 22 of the 50 largest U.S. cities, homeowners can save hundreds of dollars each month compared to renters. This shift is driven by recent dips in mortgage rates and the stability of monthly payments.

Why Mortgages Can Be Cheaper Than Rent

In many cities, rent prices continue to rise, whereas mortgages offer a consistent payment, especially with fixed-rate loans. A recent analysis shows that cities like New Orleans, Chicago, and Pittsburgh offer significant savings for homeowners. In New Orleans, homeowners save an average of $446 per month compared to renters, while Chicago residents save about $434 and Pittsburgh residents around $321.

U.S. Cities were Mortgage is Cheaper than Rent

If you’re considering buying a home, these are the top cities where mortgage is cheaper than rent:

| Metro Area | Typical Rent Payment | Typical Mortgage Payment | Monthly Savings |

|---|---|---|---|

| New Orleans | 1652 | 1206 | 446 |

| Chicago | 2074 | 1640 | 434 |

| Pittsburgh | 1413 | 1092 | 321 |

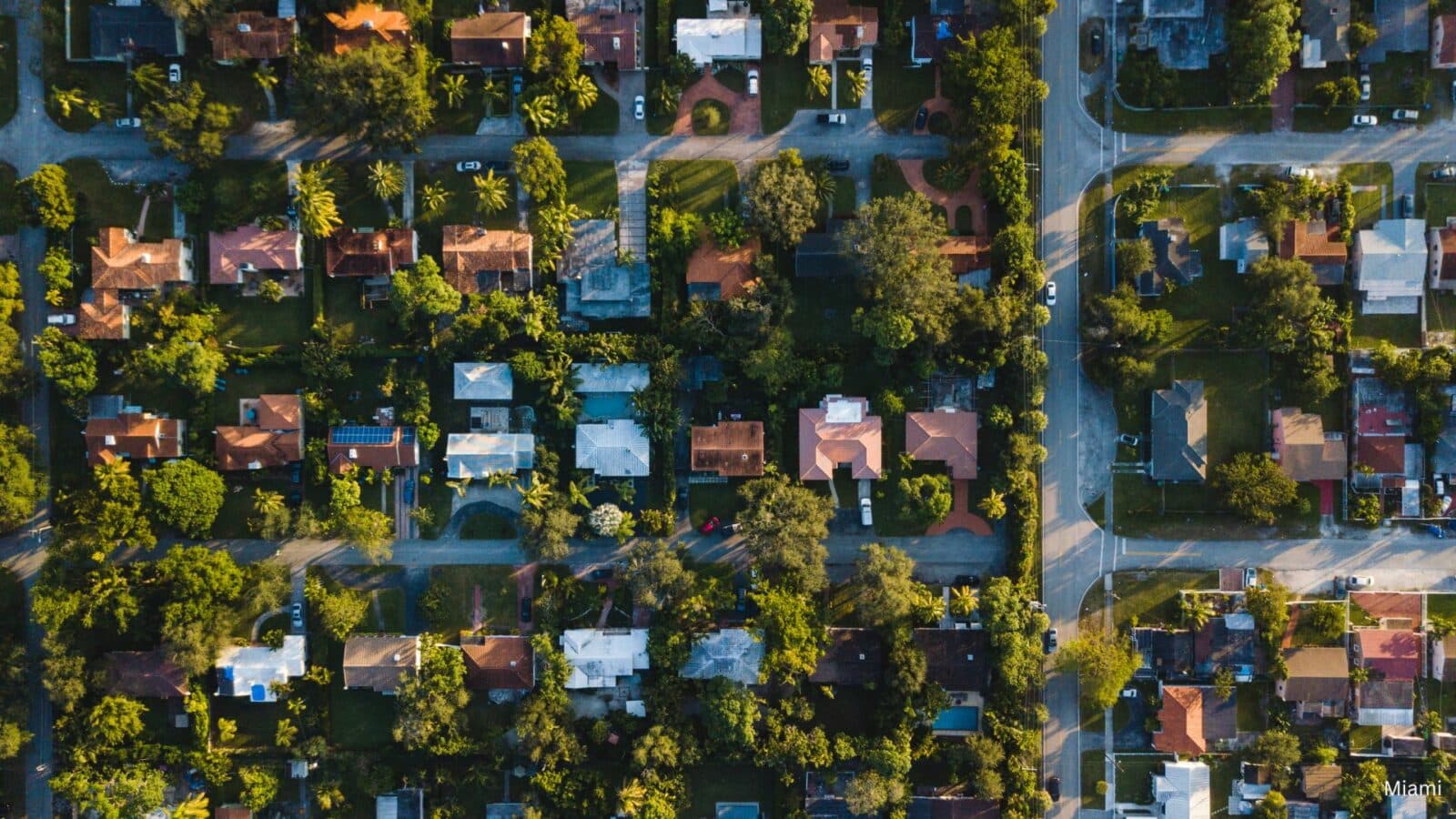

| Miami | 2787 | 2473 | 314 |

| Memphis | 1499 | 1209 | 290 |

| Cleveland | 1436 | 1171 | 265 |

| Detroit | 1499 | 1286 | 213 |

| Tampa | 2106 | 1914 | 191 |

| Oklahoma City | 1373 | 1185 | 188 |

| Houston | 1735 | 1553 | 182 |

| Birmingham | 1418 | 1265 | 153 |

| Indianapolis | 1569 | 1417 | 152 |

| St. Louis | 1413 | 1273 | 139 |

| Louisville | 1395 | 1305 | 89 |

| Cincinnati | 1527 | 1446 | 81 |

| Orlando | 2089 | 2008 | 81 |

| New York | 3471 | 3399 | 72 |

| Hartford | 1916 | 1846 | 70 |

| San Antonio | 1505 | 1439 | 66 |

| Philadelphia | 1870 | 1846 | 24 |

| Virginia Beach | 1787 | 1777 | 10 |

| Buffalo | 1361 | 1354 | 8 |

These savings are based on a 20% down payment and a 6.5% interest rate, assuming a 30-year fixed mortgage. Homeowners can also benefit from building equity, something renters miss out on.

Is It the Right Time to Buy?

If you’re contemplating whether to buy or rent, consider how long you plan to stay in your new home. Buying generally makes more financial sense if you stay for several years, as it allows you to build home equity and potentially benefit from rising property values.

Additionally, using tools like Zillow’s BuyAbility can help potential homeowners understand their purchasing power and see if their mortgage would be cheaper than rent in their area. With mortgage rates decreasing, this may be the ideal time to explore homeownership.

The Long-Term Benefits of Owning

In cities like New Orleans, Chicago, and Pittsburgh, it’s clear that mortgages can be cheaper than rent, offering not only monthly savings but also long-term financial benefits. For renters able to afford a down payment, homeownership could provide more stability and potential wealth-building opportunities.