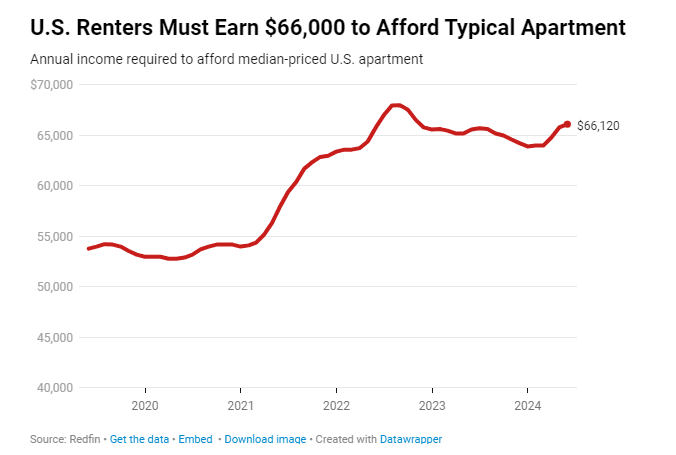

The income needed to afford rent in the United States has reached $66,120, highlighting the ongoing affordability crisis. The typical renter now earns significantly less than this threshold, exacerbating the financial strain on households nationwide.

Affordability Gap

As of the latest data from Redfin, the typical U.S. renter earns $54,712 annually, which is $11,408 less than the income needed to afford rent. This gap underscores the financial burden faced by renters, with only 39% making enough to cover the median-priced apartment.

Rents and Wage Growth

Despite recent rent growth slowing, the income needed to afford rent has surged to its highest since 2022. The median apartment rent now stands at $1,653 per month. Although wage growth has outpaced rent increases recently, many renters still struggle to meet the required income threshold.

Metro Area Disparities

Rent affordability varies widely across different metro areas. In cities like New York and Miami, renters earn significantly less than needed, with income gaps exceeding 40%. In New York, the typical renter earns $67,358, 43.5% less than the $119,120 needed to afford the median-priced apartment. Miami follows closely, with renters earning 42.2% less than the required $99,440. Boston, Los Angeles, and Riverside, CA, also show significant gaps between renter income and the income needed to afford rent.

Income Needed to Afford Rent

The income needed to afford rent at $66,120 remains a significant challenge for the majority of renters. Addressing this affordability crisis requires comprehensive policy solutions and sustained economic growth to ensure more households can secure affordable housing.

Related posts:

Tenant-Based Rental Subsidies: A $7.9M Initiative in Montgomery County, Dayton

Tenant-Based Rental Subsidies: A $7.9M Initiative in Montgomery County, Dayton

Mortgage Rate Surge: Navigating the April 2024 Increase

Mortgage Rate Surge: Navigating the April 2024 Increase

New Home Sales in March 2024 Increase

New Home Sales in March 2024 Increase

KBIS 2024’s DesignBites 10 Kitchen and Bath Innovators

KBIS 2024’s DesignBites 10 Kitchen and Bath Innovators

Kentucky Rental Investment: $223 Million Boost for Housing in Four Counties

Kentucky Rental Investment: $223 Million Boost for Housing in Four Counties