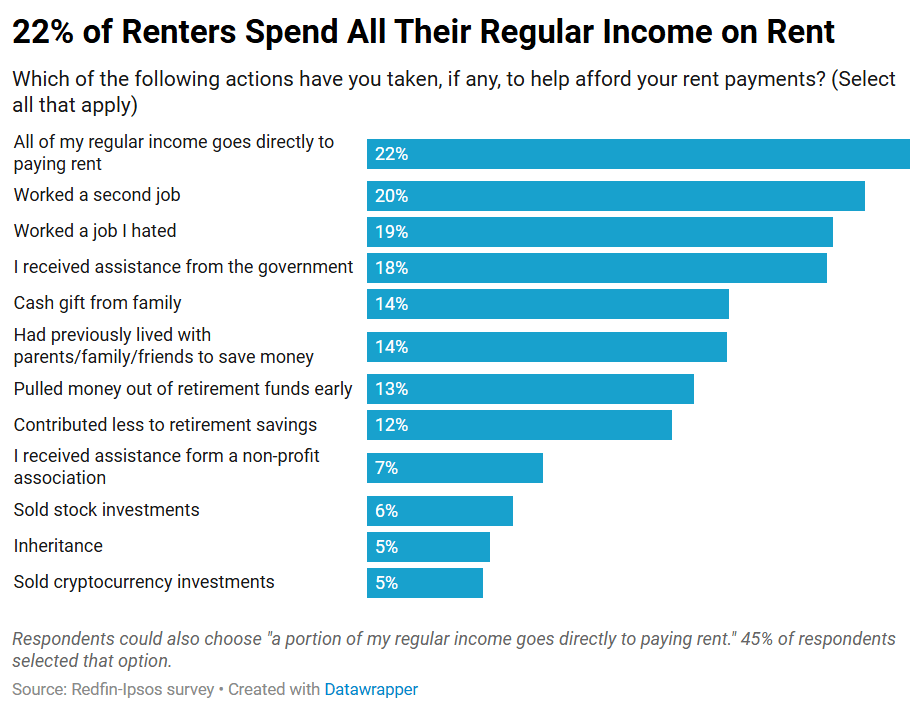

How renters afford rent is a big question these days as rising costs make it harder for Americans to get by. A recent Redfin survey found that 22% of renters spend their entire paycheck on rent, showing just how tough things have gotten. With rent growing faster than wages, people are finding creative—and sometimes difficult—ways to cover their housing costs.

Creative Ways How Renters Afford Rent

According to the Redfin survey, renters have adopted a variety of strategies to keep up with rent payments:

- Working Multiple Jobs: Nearly 20% of renters reported taking on a second job, while 19% admitted to working a job they hated just to meet their housing costs. These statistics highlight the lengths to which people go to stay afloat in today’s rental market.

- Family and Retirement Support: Some renters rely on external financial support, with 14% receiving cash gifts from family members. Others are digging into retirement savings, with 13% pulling money out of retirement funds early and 12% reducing their contributions to retirement plans.

- Government Assistance and Nonprofits: While less common, 18% of renters received government assistance, and 7% turned to nonprofit organizations for help.

- Asset Liquidation: Selling off personal investments has also become a necessity, with 6% selling stock investments and 5% turning to cryptocurrency sales or inheritance funds to pay rent.

The Bigger Picture: Why Renters Struggle

Despite a recent slowdown in rent growth, the long-term effects of the pandemic-era rental surge continue to impact affordability. With rental prices growing faster than wages, low- and middle-income renters are hit hardest. Many renters, particularly younger generations, are delaying homeownership due to the rising costs of buying a home, with renter households growing three times faster than homeowner households.

The Redfin survey further illustrates that renting, while costly, remains the only viable housing option for many Americans. This is driven by rising interest rates and unaffordable home prices, forcing individuals to prioritize rent over other financial goals like retirement or savings.

What the Future Holds for Renters

While recent data suggests some hope for renters, such as newly constructed apartments entering the market, the financial sacrifices required to afford rent underscore the need for systemic solutions. Until wages catch up with housing costs, many renters will likely continue to juggle multiple jobs, seek family support, or dip into retirement savings to keep a roof over their heads.

The findings from the Redfin-commissioned survey shed light on how renters afford rent in an increasingly difficult market, with some turning to extreme measures to meet their monthly obligations.

Navigating the Challenges of Renting

The challenges highlighted by the Redfin survey emphasize the financial sacrifices renters make to afford housing in the U.S. For many, working extra jobs or dipping into savings are temporary solutions to a systemic affordability crisis. As the rental market evolves, understanding how renters afford rent offers crucial insights into the broader challenges of housing affordability.

Related posts:

September Pending Home Sales See Biggest Increase Since 2023

September Pending Home Sales See Biggest Increase Since 2023

October 2024 National Rent Trends: What’s Happening Now in the U.S. Rental Market

October 2024 National Rent Trends: What’s Happening Now in the U.S. Rental Market

Presidential Housing Policy: A Vision for Affordable and Accessible Housing in the U.S.

Presidential Housing Policy: A Vision for Affordable and Accessible Housing in the U.S.

Homes With Low Natural Disaster Risk Are Rising in Value Faster Than High-Risk Properties

Homes With Low Natural Disaster Risk Are Rising in Value Faster Than High-Risk Properties

2024 Election Impact on the Housing Market

2024 Election Impact on the Housing Market