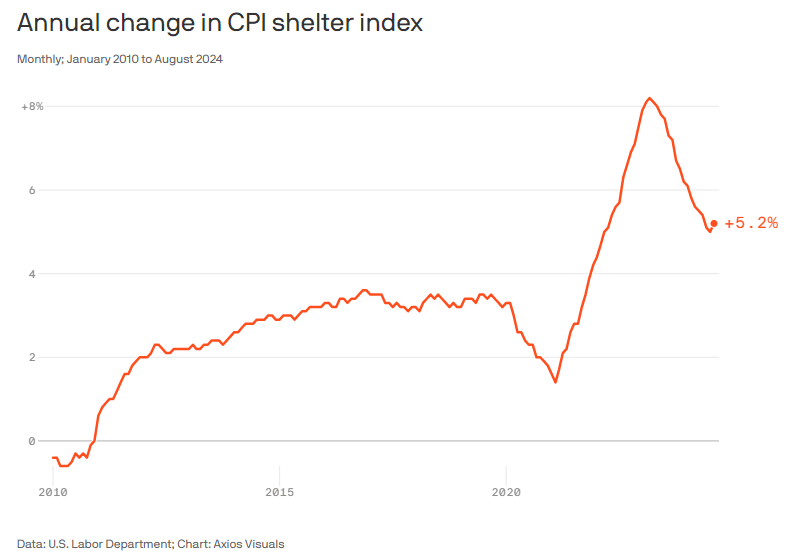

Housing inflation remains a significant obstacle in the broader fight against rising costs, particularly when other sectors of the economy have shown signs of stabilization. As shelter costs continue to climb, they play a disproportionate role in driving up the Consumer Price Index (CPI), making it clear that housing inflation is one of the last strongholds of inflationary pressure.

The Role of Housing Inflation in CPI

The overall CPI rose by 0.2% in August, consistent with the previous month’s increase. However, without the significant contribution from shelter prices, the CPI would look far more promising. According to recent data from the U.S. Labor Department, shelter costs accounted for over 70% of the core CPI’s annual gain, demonstrating the powerful influence of housing inflation on overall economic performance.

Rent prices and owners’ equivalent rent (the cost homeowners would pay to rent their homes) have both risen at an accelerated pace. This uptick has continued despite expectations that housing costs would cool off, based on private sector data. Unfortunately, those predictions have yet to materialize, leaving housing inflation as a primary driver of concerns within the Federal Reserve and economic circles.

Impacts of Housing Inflation on Federal Reserve Decisions

Housing inflation also affects monetary policy. While the Federal Reserve has made strides in controlling broader inflation, housing price pressures complicate their efforts. Analysts suggest that the Fed is still cautious in its approach to interest rate cuts due to the persistent inflationary impact of housing.

This is echoed by Seema Shah, chief global strategist at Principal Asset Management, who notes that housing costs are the “last mile” of inflation that must be addressed with precision. While there is growing hope that the Fed may lower interest rates soon, the hawks within the committee are likely to cite housing inflation as a reason for caution.

Why Housing Inflation Persists

The ongoing housing inflation can be attributed to the tight housing market and a shortage of affordable homes that has been building for over a decade. White House economists have acknowledged that the pressure from the housing market is a major contributor to overall inflation, largely due to the supply and demand imbalance in the sector.

The lack of new affordable housing developments is a significant part of the problem. The slow pace of construction, combined with increased demand, has put upward pressure on both home prices and rental costs, causing shelter prices to rise faster than other CPI components.

Addressing Housing Inflation

Housing inflation stands out as a stubborn element of the broader inflation problem, even as other sectors show signs of relief. The impact of rising shelter costs cannot be ignored, particularly in policy decisions regarding interest rates. Until the housing market sees significant relief in terms of affordability and supply, housing inflation will likely remain a key issue in the economy.