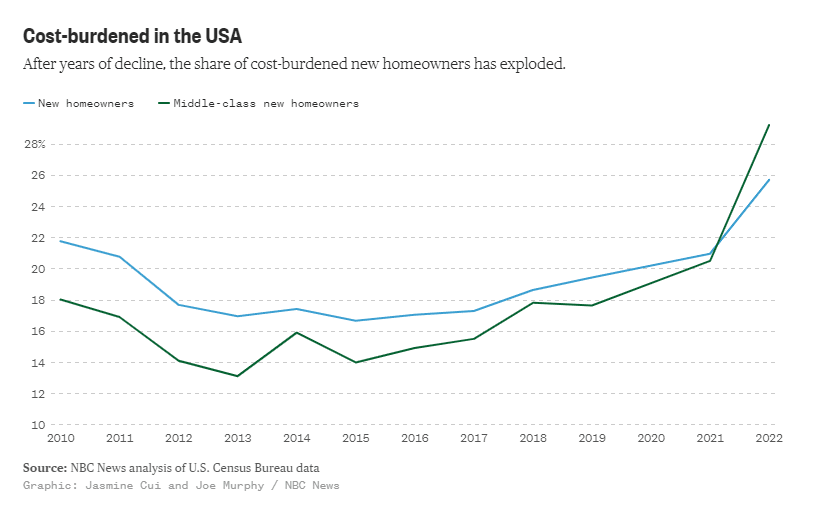

The housing cost for middle class families has reached alarming levels in 2024. Over the past decade, the share of middle-class homeowners who are “cost-burdened” — spending more than 30% of their income on housing — has doubled. In states like California, where housing prices are notoriously high, more than two-thirds of middle-income homebuyers find themselves struggling with monthly housing costs, leaving little room for other essentials like food and healthcare.

Housing Cost for Middle Class in 2024

Here is a list of average home costs for middle-class families in various states in 2024:

- California: $782,695

- Texas: $303,352

- Florida: $396,318

- New York: $458,072

- Hawaii: $856,327 (highest in the U.S.)

- West Virginia: $160,044 (lowest in the U.S.)

- Arizona: $429,787

- Colorado: $548,602

- Georgia: $326,078

- Pennsylvania: $260,153

- Illinois: $256,138

- Ohio: $221,816

- Washington: $588,986

- Michigan: $238,220

- Mississippi: $177,699

- Oregon: $497,249

- North Carolina: $328,181

- Virginia: $384,026

- Alabama: $225,579

- Montana: $453,732

These figures highlight the wide disparity in housing prices across the United States, with coastal states like California and Hawaii being significantly more expensive compared to states like West Virginia and Mississippi. The national median home price is around $420,800, slightly declining from previous years as part of broader market adjustments. Rising interest rates and demographic shifts are key factors affecting home prices.

The Impact of Rising Home Prices

The rise in housing cost for middle class families can largely be attributed to skyrocketing home prices and interest rates, which have created financial strain on new homeowners. In 2023, many middle-class families found themselves spending more than they could afford on mortgages. NBC News highlights that nearly 30% of middle-class buyers in 2022 paid over 30% of their income on housing costs, a sharp increase compared to just 10 years ago. This strain is especially felt in areas like Elkhart, Indiana, where average household income hasn’t kept pace with the surging housing market.

Why Middle-Class Homeowners Are Struggling

Various factors contribute to the ballooning housing cost for middle class Americans. Rising property taxes, insurance premiums, and increased mortgage rates all play a role. For example, a couple in Indiana recently purchased a $265,000 home with an 8.125% mortgage rate, leading to a significant financial burden. Experts, such as those from the Harvard Joint Center for Housing Studies, point out that despite a 50% rise in median household income over the past decade, housing costs have grown even faster, leaving many families struggling.

Regional Disparities in Housing Costs

The situation varies by region, with some areas experiencing more significant burdens than others. California stands out as a key example, where 67% of middle-class homebuyers exceed the 30% income threshold on housing costs. However, even in more affordable regions like the Midwest, housing affordability remains a concern for middle-income earners.

Solutions for the Middle-Class Housing Crisis

Addressing the housing cost for middle class households requires innovative policy changes and adjustments. Financial experts suggest that increasing affordable housing supply and offering tax incentives for middle-class buyers could provide some relief. Additionally, federal efforts to stabilize interest rates and reduce property taxes could help alleviate the strain on families.

The growing housing cost for middle class Americans is becoming an urgent issue. In 2024, more families find themselves in financially precarious positions, unable to afford homes without sacrificing other necessities. Solutions to this crisis are crucial for ensuring a stable future for the middle class.

Related posts:

California WUI: Unpacking the Risks and Challenges

California WUI: Unpacking the Risks and Challenges

September Pending Home Sales See Biggest Increase Since 2023

September Pending Home Sales See Biggest Increase Since 2023

Supply Skepticism: The Complex Puzzle in US Housing 2023

Supply Skepticism: The Complex Puzzle in US Housing 2023

Mortgage Rates Drop Below 7%: A Ray of Hope for the Housing Market?

Mortgage Rates Drop Below 7%: A Ray of Hope for the Housing Market?

Buffalo Housing Market: A 2024 Success Story of Growth and Affordability

Buffalo Housing Market: A 2024 Success Story of Growth and Affordability