A Deep Dive into the Least Affordable Year in Redfin’s Records and the Promising Outlook for 2024

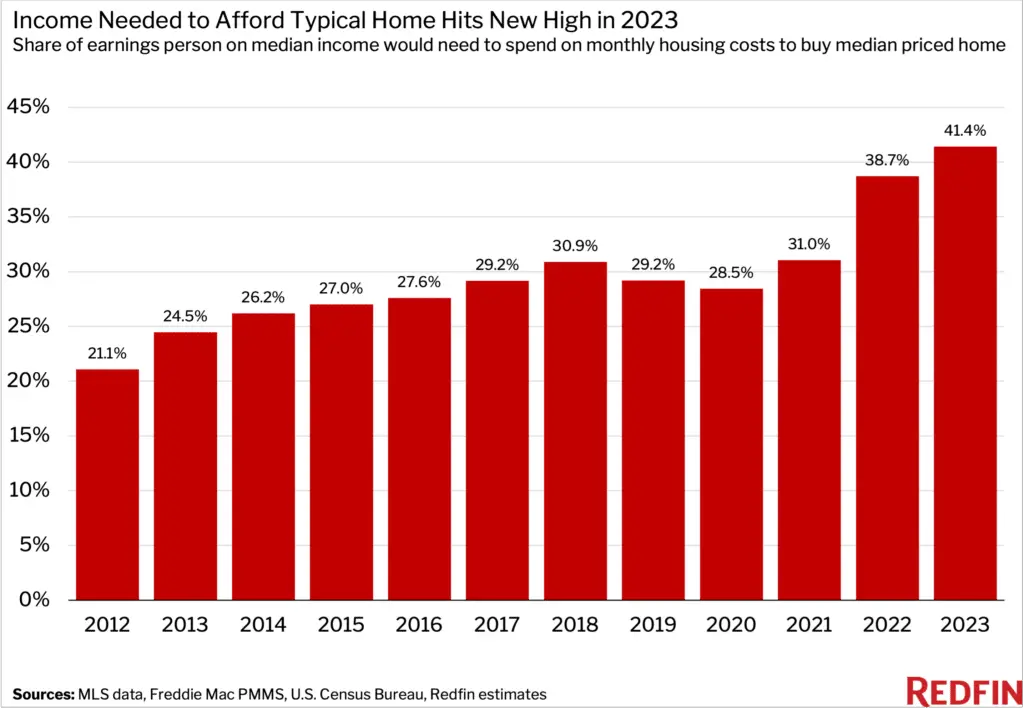

As we bid farewell to 2023, Redfin’s housing affordability analysis reveals startling insights. With a record 41% of median income spent on monthly housing costs, this year has posed unprecedented challenges for homebuyers. However, amidst the struggle, a glimmer of hope emerges as we anticipate positive shifts in 2024.

Overview of 2023 Affordability Trends

-

Record Highs and Lows:

- A median U.S. income homebuyer spent 41.4% on monthly housing costs in 2023, the highest on record.

- Anaheim and San Francisco topped the list with over 80% of local income required for housing, while Detroit and Pittsburgh stood as the most affordable markets.

-

Austin’s Anomaly:

- Austin bucked the trend, offering increased affordability in 2023 compared to the previous year.

-

Affordability Struggle:

- The rule of spending no more than 30% of income on housing became less realistic, given elevated mortgage rates and soaring home prices.

-

Record-High Income Requirements:

- A median 2023 homebuyer needed an annual income of at least $109,868 to stay within the 30% affordability threshold, a record high.

Factors Driving Affordability Challenges

-

Wage Lag:

- Homebuyers’ monthly payments surged 12.6%, outpacing the 5.2% rise in median household income.

-

Mortgage Rate Surge:

- Federal Reserve actions raised the average 30-year-fixed mortgage rate to a 23-year high of 7.79% in October.

-

Supply-Demand Imbalance:

- Elevated mortgage rates cooled demand, but limited housing supply maintained high prices.

2024: A Beacon of Relief

-

Anticipated Improvements:

- Redfin predicts affordability improvements in 2024 with falling mortgage rates, increased listings, and a 1% drop in prices.

-

Rising Supply and Falling Costs:

- Monthly payments decreased to $2,575 in late November, marking a positive trend.

Metro-Level Affordability Insights

-

California’s Conundrum:

- Anaheim, San Francisco, and Los Angeles dominated the least affordable metros, with shares exceeding 70%.

-

Midwest’s Affordability Oasis:

- Detroit, Pittsburgh, Cleveland, and St. Louis ranked among the most affordable metros, boasting shares below 26%.

Conclusion: Navigating the Housing Landscape

As we reflect on 2023’s affordability challenges, the potential for a brighter 2024 emerges. With strategic shifts in mortgage rates, housing supply, and pricing, the coming year promises a more balanced and accessible housing market. Stay tuned for updates on the evolving dynamics of the real estate landscape.

Related posts:

Affordable Rental Provider Repays $710K to Arlington County

Affordable Rental Provider Repays $710K to Arlington County

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

10 Precautions to Stay Safe During a Home Renovation

10 Precautions to Stay Safe During a Home Renovation

Increase in US Home Construction in 2023 Signals Robust Market Recovery

Increase in US Home Construction in 2023 Signals Robust Market Recovery

“Sign & Save Program” Goes Nationwide in 2024: A New Era for Homebuyers with Redfin

“Sign & Save Program” Goes Nationwide in 2024: A New Era for Homebuyers with Redfin