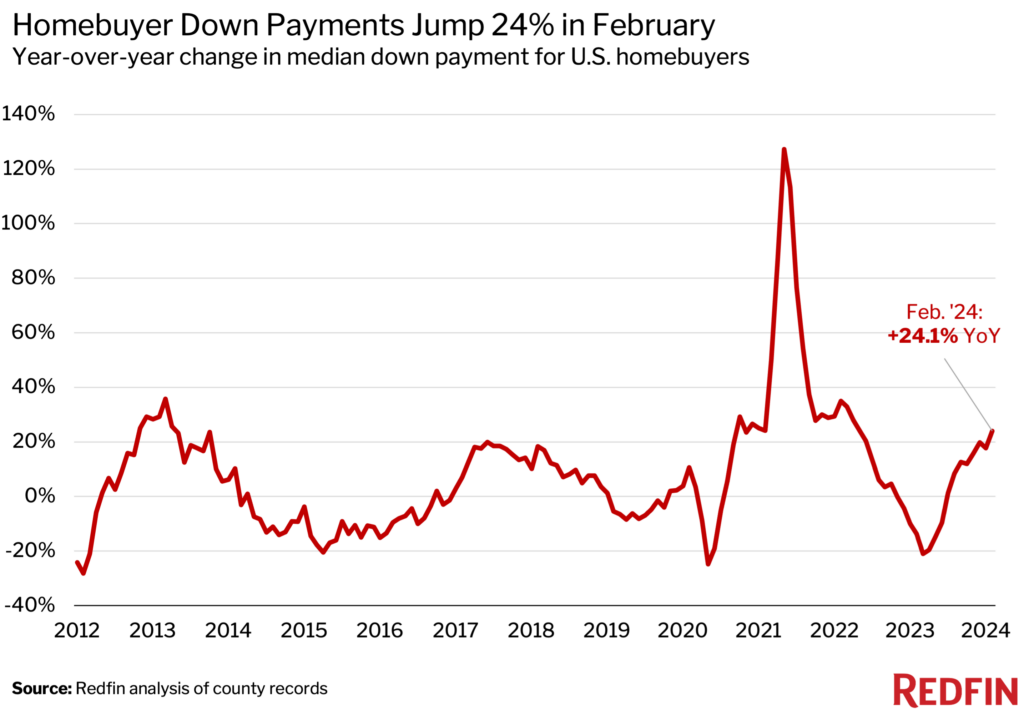

The landscape of homebuying has seen a notable shift, with the typical homebuyer’s down payment witnessing a significant surge to $56,000, marking a 24% elevation from the previous year. This homebuyer downpayment increase is not just a statistic; it’s a reflection of the evolving dynamics in the housing market, spotlighting the challenges and opportunities faced by today’s buyers.

All-Cash Deals on the Rise

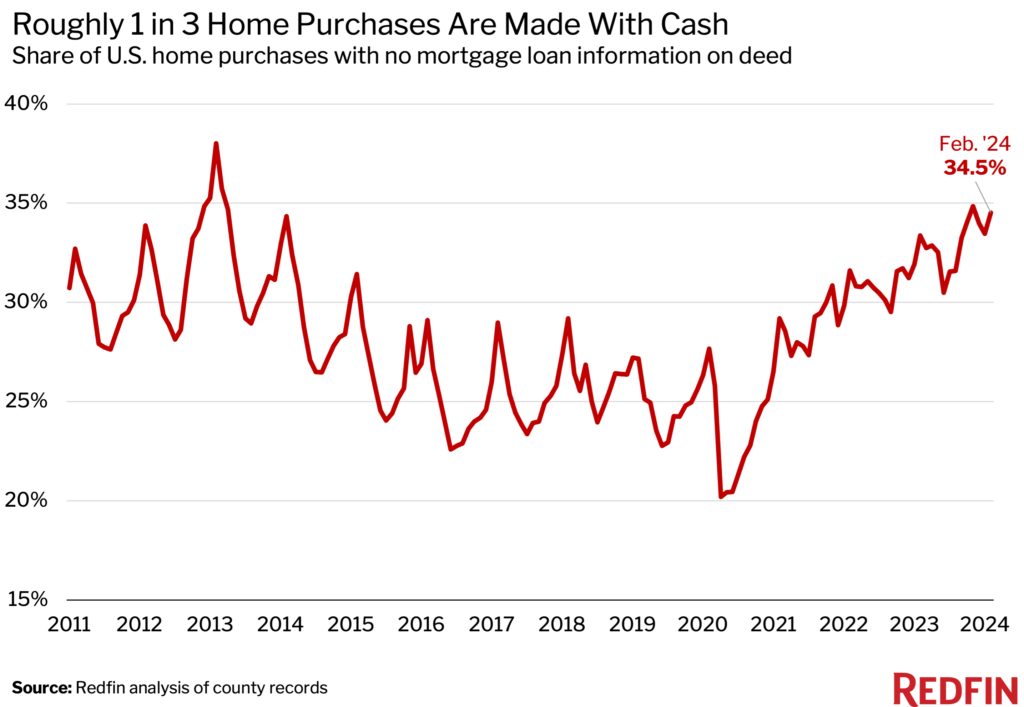

Interestingly, the trend extends beyond down payments. Over one-third of home purchases in February were conducted entirely in cash, a strategy not far removed from record highs. This phenomenon underscores a competitive housing market where liquidity is king, and buyers aim to stand out in a sea of offers.

Redfin’s Chen Zhao highlights how high mortgage rates exacerbate wealth disparities across races, generations, and income levels, especially since the pandemic’s home price surge. This trend favors affluent buyers capable of all-cash purchases, sidelining others from wealth-building through homeownership. Interestingly, all-cash sales have increased, indicative of a market where wealth plays a pivotal role in homebuying accessibility. However, there’s optimism as mortgage rates are predicted to decline, potentially easing the affordability challenge for prospective buyers.

Homebuyer Downpayment Increase by 24%

The median down payment of $55,640 in February represents more than just an uptick; it’s the largest year-over-year leap in percentage terms since April 2022. Such figures are emblematic of a broader narrative: high home prices and mortgage rates are pushing buyers to frontload their investments, securing their stakes in a market that’s as challenging as it is rewarding.

Related posts:

Affordable Rental Provider Repays $710K to Arlington County

Affordable Rental Provider Repays $710K to Arlington County

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

Reduce Your Environmental Footprint: Simple Water Conservation Tips for Your Home

10 Precautions to Stay Safe During a Home Renovation

10 Precautions to Stay Safe During a Home Renovation

Surge in US Housing: A Close Look at the November 2023 Boom

Surge in US Housing: A Close Look at the November 2023 Boom

Seattle Fort Lawton Housing Plan Revision: A New Vision for Affordable Living

Seattle Fort Lawton Housing Plan Revision: A New Vision for Affordable Living