The housing market in 2024 continues to face challenges as home sales decline, even with the recent drop in median U.S. housing payments. Although declining mortgage rates have brought relief to some buyers, many are still waiting on the sidelines. A combination of factors, including potential further mortgage rate cuts by the Federal Reserve and uncertainties about new NAR rules, has contributed to the hesitation among prospective homebuyers. This article delves into the reasons behind the home sales decline and examines what lies ahead for the housing market.

Home Sales Decline in 2024

Mortgage Rates Drop, But Buyers Remain Cautious

As of September 2024, the median monthly U.S. housing payment has fallen to $2,534, a significant drop from April’s record high. This decrease is largely due to declining mortgage rates, which have reached their lowest levels since early 2023. Despite the relief provided by these lower rates, the housing market continues to see a home sales decline, with pending home sales falling 8.4% year over year.

The decline in sales is driven by several key factors. First, many buyers are holding out for further mortgage rate reductions, anticipating that the Federal Reserve’s upcoming interest rate cuts could lead to even lower borrowing costs. Additionally, changes to real estate agent fees under the new NAR rules have created uncertainty, with some buyers waiting for clarity before committing to a purchase.

Market Trends and Buyer Behavior

While mortgage payments have become more affordable, home prices remain high, keeping some potential buyers priced out of the market. This has been a major contributing factor to the ongoing home sales decline, as affordability continues to be a concern despite the easing of mortgage rates.

Redfin agents report that while there is demand for move-in-ready listings, many buyers are adopting a wait-and-see approach. This trend is reflected in Redfin’s Homebuyer Demand Index, which has increased modestly but remains down 7% year over year. Buyers are carefully weighing market conditions, hoping for more favorable rates or clarity on industry changes before making a decision.

Supply and Demand Imbalance

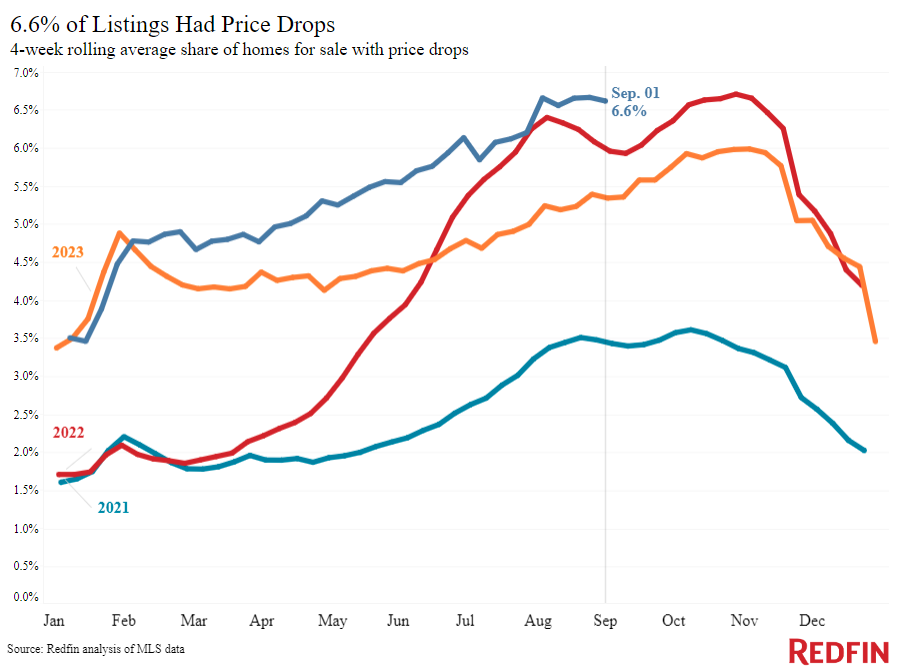

In addition to the hesitancy among buyers, the housing market is also grappling with rising supply. New listings have increased by 3.7% year over year, and total active listings have risen by 16.6%. This growth in supply is partly due to homeowners who had previously been locked in by higher mortgage rates now choosing to sell as rates come down. However, the increase in supply has not been met with corresponding demand, as home sales decline continues to suppress buyer activity.

What’s Next for the Housing Market?

Looking ahead, the future of the housing market remains uncertain. The pace at which the Federal Reserve cuts interest rates will play a crucial role in determining the direction of mortgage rates and, subsequently, home sales. If the Fed’s rate cuts are smaller and slower than expected, mortgage rates could rise again, further cooling the market. On the other hand, faster rate cuts could lead to more substantial reductions in mortgage rates, potentially spurring demand.

However, even if rates do fall further, there is no guarantee that home sales will rebound quickly. Many buyers remain cautious, waiting for additional factors, such as the outcome of the presidential election and the finalization of NAR rule changes, to provide more clarity.

While the recent drop in housing payments has brought some relief to potential homebuyers, it has not been enough to counter the ongoing home sales decline. As the market continues to evolve, both buyers and sellers will be closely watching the Federal Reserve’s actions and other key developments to determine their next steps.