A recent survey by Redfin reveals a stark reality: half of U.S. homeowners and renters are struggling to keep up with their housing payments, with many resorting to significant sacrifices to manage costs. Here’s how the high cost of housing is affecting Americans.

Survey Insights

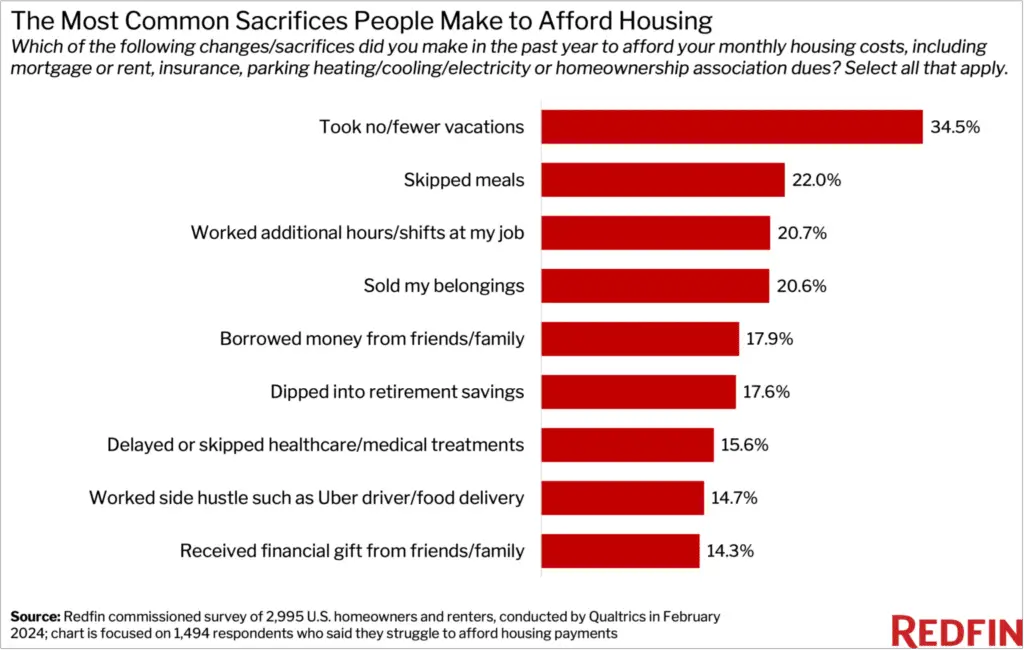

In February 2024, a survey conducted by Qualtrics on behalf of Redfin encompassed 2,995 U.S. homeowners and renters, unveiling that 49.9% of them face difficulties affording their housing payments.

This group has had to make various adjustments or sacrifices in the past year to afford monthly expenses, including mortgage or rent, utilities, and homeowners association dues.

Common Sacrifices for Housing Affordability

The survey highlighted a trend towards sacrificing leisure and health to afford housing:

- Vacations: The most frequently foregone luxury, with 34.5% of respondents opting out to manage housing payments.

- Meals and Work Hours: About 22% of those struggling skipped meals, and 20.7% worked additional hours.

- Selling Personal Belongings: 20.6% took this route to cover costs.

- Delaying Medical Care: A concerning 15.6% postponed or skipped medical treatments to prioritize housing payments.

The Financial Burden of Housing

Chen Zhao, Redfin Economics Research Lead, emphasizes the severity of the situation, noting that the financial strain of housing is forcing American families to compromise on essentials like food and healthcare. There is a glimmer of hope, though, with potential relief on the horizon if the Federal Reserve decides to cut interest rates in June, potentially lowering mortgage costs.

The Millennial Dilemma

An alarming trend among millennials sees 13.5% dipping into retirement savings to afford their housing, a strategy not typically advisable. This generation, which is not yet retired, faces unique challenges with housing affordability, prompting unconventional methods to cope with the financial strain.

The Racial and Generational Divide

The survey also sheds light on the varying sacrifices made by different demographic groups:

- Work Hours: Black respondents were most likely to increase their work hours to afford housing costs.

- Selling Belongings: This was a more common strategy among Hispanic respondents.

- Vacations: Skipping vacations was prevalent across most racial groups, with white and Asian respondents most likely to forgo them.

Policy Responses and the Path Forward

In response to the growing housing affordability crisis, President Biden recently proposed several initiatives aimed at easing the burden for Americans. These include tax credits for first-time homebuyers and plans to increase the housing supply by building over 2 million homes.

Conclusion

The Redfin survey paints a concerning picture of the sacrifices Americans are making to afford housing. As the country grapples with near-record mortgage payments and a significant affordability gap, the need for effective policy solutions has never been more urgent.

Related posts:

Surge in US Housing: A Close Look at the November 2023 Boom

Surge in US Housing: A Close Look at the November 2023 Boom

Seattle Fort Lawton Housing Plan Revision: A New Vision for Affordable Living

Seattle Fort Lawton Housing Plan Revision: A New Vision for Affordable Living

2024 Real Estate Recession Warning: A Closer Look at the Housing Market Dynamics in Arizona

2024 Real Estate Recession Warning: A Closer Look at the Housing Market Dynamics in Arizona

Affordable Housing in Highland Park: A Sustainable Approach to Homeownership

Affordable Housing in Highland Park: A Sustainable Approach to Homeownership

White House Initiative for Office-to-Housing Conversions Faces Hurdles, Developers Report Delays

White House Initiative for Office-to-Housing Conversions Faces Hurdles, Developers Report Delays