When it comes to tapping into your home equity, you have several options, including Home Equity Loans (HEA) and Home Equity Lines of Credit (HELOC). Understanding the differences between these can help you make an informed decision. This article will dive into the key aspects of HEA vs HELOC, covering their pros and cons, and providing you with the information you need to choose the best option for your financial needs.

What is a Home Equity Loan (HEA)?

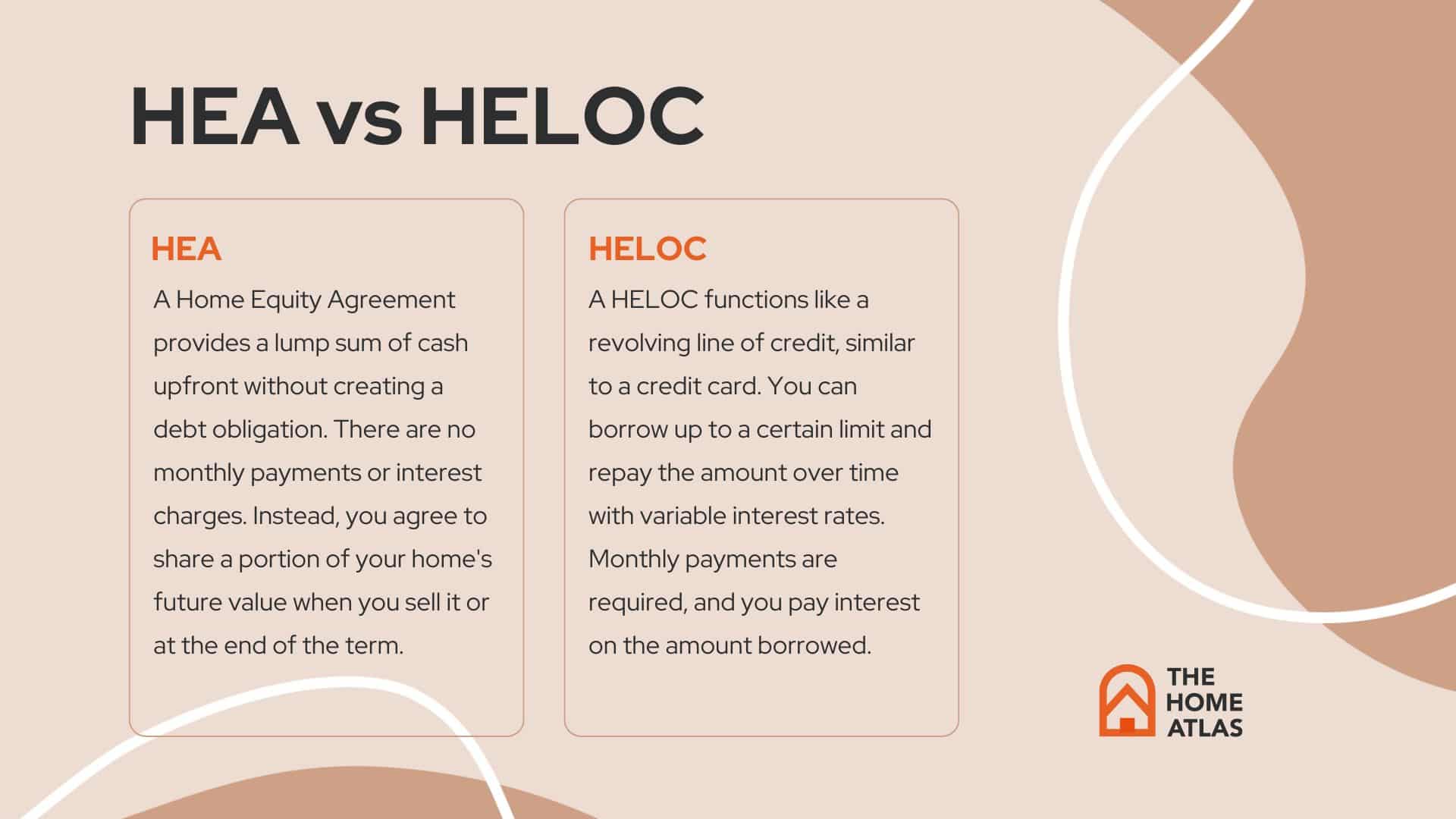

A Home Equity Agreement (HEA) allows you to access your home equity without taking out a loan. Instead of borrowing money, you receive a lump sum in exchange for a portion of your home’s future value. This means there are no monthly payments or interest charges. At the end of the HEA term, typically around 10 years, you can either sell your home and share the proceeds with the HEA provider or buy back their share.

Pros:

- Lump sum of cash without taking out a loan

- No monthly payments or interest charges

- Easier qualification, suitable for those with lower credit scores or high debt-to-income ratios

Cons:

- You need to buy out the HEA provider if you want to keep your home after the term

- Requires enough equity in your home, typically at least 25%.

What is a Home Equity Line of Credit (HELOC)?

A HELOC works like a credit card, allowing you to borrow money as needed, up to a certain limit, using your home as collateral. HELOCs typically have variable interest rates, meaning your monthly payments can fluctuate. You only pay interest on the amount you borrow, and as you repay the principal, the funds become available for you to borrow again.

Pros:

- Access to a revolving line of credit

- Interest rates typically lower than those of home equity loans

- Flexibility to borrow as needed, making it ideal for ongoing expenses like home renovations

Cons:

- Variable interest rates can lead to higher payments over time

- Risk of foreclosure if you default on payments

- Annual fees and possible early closure or pre-payment penalties.

HEA vs HELOC: Which is Right for You?

Choosing between an HEA and a HELOC depends on your financial situation and goals. If you prefer a lump sum and want to avoid monthly payments and interest charges, an HEA might be a better fit. It’s particularly useful if you have a lower credit score or high debt-to-income ratio. On the other hand, if you need flexibility and access to funds over time, and you are comfortable with variable interest rates, a HELOC could be more suitable.

For those unsure about the exact amount of money needed or the timing of expenses, a HELOC offers the flexibility to draw funds as required. However, if you are debt-averse or need a significant amount of money upfront, an HEA provides a straightforward solution without the burden of monthly repayments.

In the debate of HEA vs HELOC, the right choice hinges on your specific financial needs and situation. Both options provide unique benefits and have their own sets of requirements and drawbacks. Carefully consider your financial circumstances, the amount of equity in your home, and your future plans before making a decision.

Related posts:

Refinancing Your Mortgage in 2024: Is It the Best Move for You?

Refinancing Your Mortgage in 2024: Is It the Best Move for You?

2023 Pennsylvania Housing Landscape: Is A Decline on the Horizon?

2023 Pennsylvania Housing Landscape: Is A Decline on the Horizon?

DIY Solutions: An All-Inclusive Guide on Draft Proofing Your Home

DIY Solutions: An All-Inclusive Guide on Draft Proofing Your Home

15 Free Kitchen Design Software: Your Gateway to Dream Kitchens

15 Free Kitchen Design Software: Your Gateway to Dream Kitchens

25 Most Affordable Beach Towns for Summer Rentals in 2024

25 Most Affordable Beach Towns for Summer Rentals in 2024