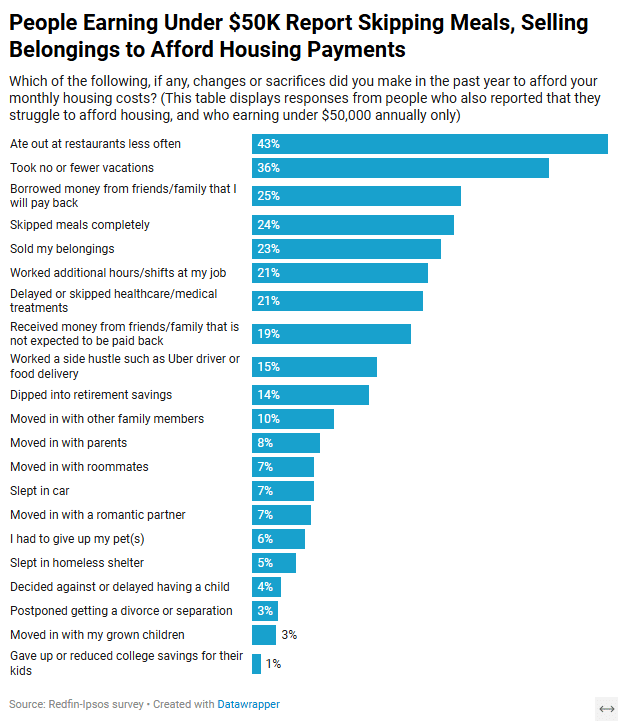

Gen Z is facing a stressful challenge when it comes to housing. Many young adults are finding it harder than ever to afford rent or mortgage payments. The Gen Z housing challenges are real, as highlighted by a recent survey from Redfin and Ipsos, which found that nearly three-quarters of U.S. residents earning under $50,000—many of whom are Gen Z—struggle with housing costs. From cutting back on dining out to skipping vacations, Gen Z is making serious sacrifices to keep a roof over their heads.

Sacrifices Gen Z Is Making to Afford Housing

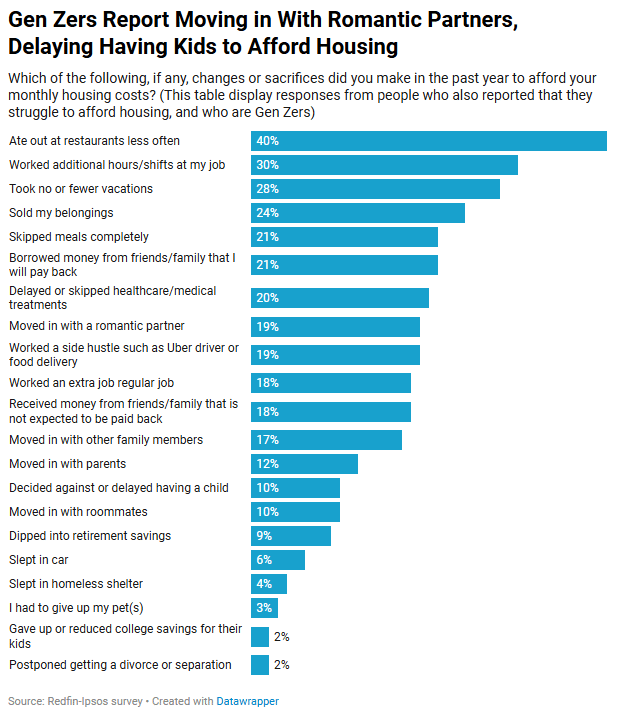

In today’s economic climate, young adults are constantly making adjustments to meet their monthly housing costs. According to the survey, many Gen Zers are reducing their spending on luxuries like eating out and vacations. In fact, 40% of Gen Z respondents reported eating out less frequently, while 28% skipped vacations altogether to save money.

But these sacrifices don’t end with lifestyle changes. The survey also revealed that nearly one in four Gen Zers have sold their belongings to make housing payments, and 21% have even skipped meals. Additionally, 19% of Gen Z respondents moved in with a romantic partner to cut housing costs, a trend that speaks volumes about the lengths they’re willing to go to afford basic housing.

Moving in with Family or Taking on Extra Jobs

Beyond lifestyle cuts, some Gen Zers are seeking more drastic solutions. For example, 12% of those surveyed have moved back in with their parents, and 17% have moved in with other family members. This shift back to family homes is becoming a more common trend, as housing costs continue to rise while wages lag behind.

To make ends meet, many Gen Zers are also taking on extra work. The survey shows that 30% of Gen Z respondents worked additional hours or shifts, and 19% turned to side hustles, such as driving for Uber or delivering food, to supplement their income. These side jobs have become essential for those who struggle to meet their monthly housing obligations.

Impact of High Housing Costs on Life Decisions

The high cost of housing is affecting more than just finances for Gen Z; it’s shaping their life choices as well. In the Redfin survey, 10% of Gen Z respondents reported delaying or deciding against having children to prioritize housing expenses. Others, including those who delayed medical treatments, are making difficult decisions that will likely have long-term impacts.

With the economic landscape making homeownership increasingly difficult, Gen Z is rethinking the traditional milestones associated with adulthood. Just over a quarter of Gen Z adults currently own a home, and many feel it’s far harder to achieve financial stability compared to previous generations.

Concluding Thoughts on Gen Z Housing Challenges

These Gen Z housing challenges are not just about high prices but also about how these costs influence personal choices and mental well-being. As Redfin’s survey reveals, Gen Zers are adapting to the economic reality by making sacrifices, rethinking relationships, and even changing their plans for the future. Whether it’s selling belongings, moving in with partners, or delaying major life events, Gen Z is reshaping what it means to afford a place to live in today’s world.

Related posts:

California WUI: Unpacking the Risks and Challenges

California WUI: Unpacking the Risks and Challenges

September Pending Home Sales See Biggest Increase Since 2023

September Pending Home Sales See Biggest Increase Since 2023

California Housing Market Under Trump: What to Expect

California Housing Market Under Trump: What to Expect

Affordable Cities for Gen Z Buyers: Where to Find Your Dream Home Without Breaking the Bank

Affordable Cities for Gen Z Buyers: Where to Find Your Dream Home Without Breaking the Bank

Presidential Housing Policy: A Vision for Affordable and Accessible Housing in the U.S.

Presidential Housing Policy: A Vision for Affordable and Accessible Housing in the U.S.