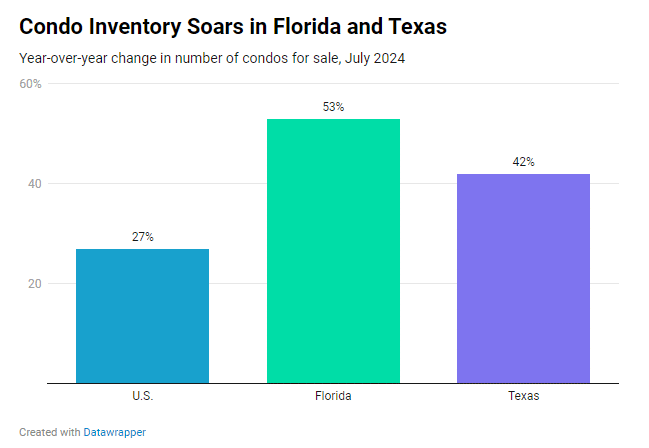

The Florida and Texas condo supply has seen a dramatic surge in 2024 as sales slow due to rising HOA fees, insurance costs, and the increasing risk of natural disasters. Major metro areas in these states, such as Miami, Jacksonville, Austin, and San Antonio, are experiencing significant increases in inventory while pending sales are plummeting, leaving many buyers hesitant to invest in condos. As a result, condo prices have begun to decline, making the market even more challenging for sellers.

Rising Condo Inventory and Declining Sales

The sharp increase in Florida and Texas condo supply is a result of several factors converging. In cities like Tampa, the number of condos for sale surged by 57.2% in July 2024 compared to the previous year, while pending sales dropped by 18.9%. Similarly, Houston saw condo inventory increase by 35.9%, with pending sales down 35.3%. This trend is not isolated to these cities, as similar patterns are observed across both states.

According to Redfin, homeowners’ association (HOA) fees and insurance costs are at the heart of the problem. In Florida, for instance, HOA dues have risen more than 15% from last summer due to stricter maintenance requirements following the Surfside condo collapse and escalating insurance costs. This has made it difficult for potential condo buyers to justify the expense, leading to a backlog in the market.

Impact of Natural Disasters and Insurance Costs

The increased risks associated with natural disasters in Florida and Texas have also played a significant role in the growing Florida and Texas condo supply. Frequent hurricanes, floods, and other natural disasters have led to skyrocketing insurance premiums, making condos located in coastal areas particularly expensive to insure. Many insurance companies have either left these states or raised premiums to a level that makes condo ownership unaffordable for many.

The combination of these high costs has deterred buyers and caused some current owners to sell, further exacerbating the oversupply issue. In many cases, single-family homes—while still facing high insurance costs—are faring slightly better due to their appeal to wealthier buyers who are more capable of handling these added expenses.

Investor Retreat and New Construction Boom

Another factor contributing to the oversupply is the retreat of real estate investors from the condo market. Many investors who previously bought condos to rent out are now looking to sell as the costs of ownership and the potential for declining values make it less appealing as a long-term investment.

Additionally, new construction is flooding the market, particularly in Florida and Texas. The building boom in these states includes many multifamily developments, adding even more condos to an already saturated market. This influx of new units is compounding the challenges of selling existing condos, especially older buildings that may need significant upgrades or repairs to meet current safety and maintenance standards.

The Future of Florida and Texas Condo Markets

As the Florida and Texas condo supply continues to rise, many experts believe the market is nearing a tipping point. Condo prices in major metros are already declining, and some industry analysts predict further price drops as inventory continues to pile up and buyers remain cautious.

The Florida and Texas condo supply is currently outpacing demand, driven by high HOA fees, escalating insurance costs, and an oversupply of new units. These factors are creating a challenging environment for both sellers and buyers, with no immediate relief in sight. However, those looking for a bargain may find opportunities as prices continue to adjust downward.