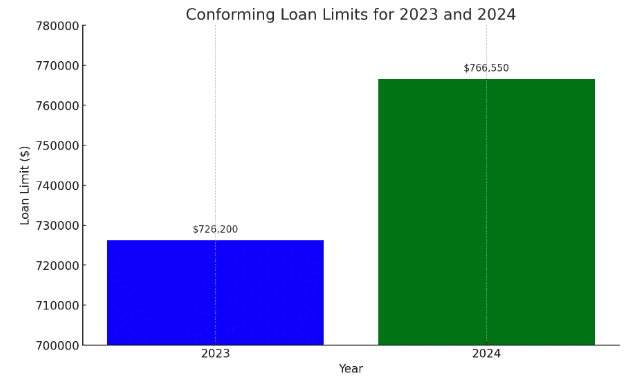

The Federal Housing Finance Agency (FHFA) has announced a significant adjustment in the conforming loan limit for 2024. This change, setting the new baseline at $766,550, represents a 5.5% increase from the previous year, impacting the scope and accessibility of home financing across the United States.

Understanding the Conforming Loan Limit

What is the FHFA Conforming Loan Limit?

The conforming loan limit is the maximum loan amount Fannie Mae and Freddie Mac, government-sponsored enterprises (GSEs), can guarantee. It influences loan approval processes and interest rates, offering advantages over non-GSE-guaranteed mortgages.

The 2024 Adjustment

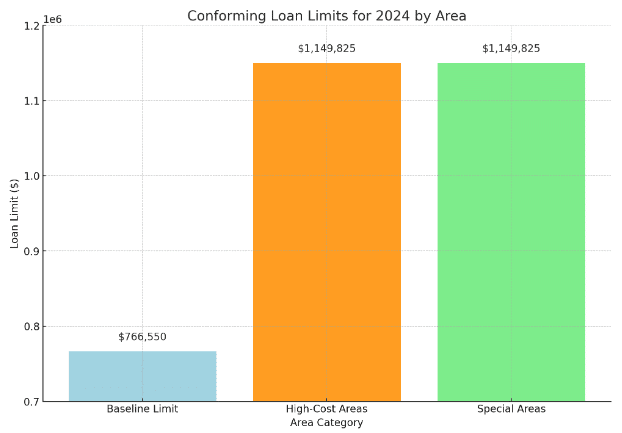

For 2024, the FHFA has set the baseline limit at $766,550, a $40,350 increase from 2023. This limit is significant for one-unit properties in most of the U.S., with higher limits in more expensive areas.

The Impact on the Housing Market

The Impact on the Housing Market

Market Dynamics and Loan Limit Calculation

The FHFA bases the limit on home-price data from the third quarter of each year, comparing year-over-year changes. Despite a market cooldown, average home prices rose by 5.56% between the third quarters of 2022 and 2023, influencing the new limit.

Implications for High-Cost Areas

In regions where the median home value exceeds 115% of the baseline limit, the ceiling is 150% of the baseline, reaching $1,149,825. Special provisions apply to Alaska, Hawaii, Guam, and the U.S. Virgin Islands, with baseline limits equal to the ceiling.

Lender Responses and Future Trends

Lender Responses and Future Trends

Early Adoption and Market Competition

Lenders vary in adopting new limits, with some offering increased limits in anticipation of official announcements. Nonbank lenders, in particular, have been proactive, adjusting limits to stay competitive in a challenging market.

Long-Term Loan Limit Trends

Since 2016, when the baseline limit was first raised post-recession, it has increased by $342,450. The continuous rise reflects ongoing housing market dynamics and economic factors.

Conclusion

The FHFA’s conforming loan limit increase to $766,550 for 2024 marks a pivotal shift in the housing finance landscape. This change not only reflects the state of the housing market but also plays a crucial role in shaping homebuyer capabilities, especially in high-cost areas. As the market continues to evolve, these limits will remain a key factor in homeownership accessibility and affordability.

References

- Mortgage News Daily: Overview of the new FHFA conforming loan limit and its implications.

- Calculated Risk Blog: Details on the FHFA’s announcement of the baseline conforming loan limit for 2024.

- HousingWire: Analysis of the FHFA conforming loan limit increase and its impact on the housing market.

Related posts:

Personal Loan vs. Equity Loan: 5 Main Differences You Need to Know Now

Personal Loan vs. Equity Loan: 5 Main Differences You Need to Know Now

Supply Skepticism: The Complex Puzzle in US Housing 2023

Supply Skepticism: The Complex Puzzle in US Housing 2023

World Architecture Festival 2023: A Convergence of Innovation and Design in Singapore

World Architecture Festival 2023: A Convergence of Innovation and Design in Singapore

Modular Construction Market: Revolutionizing the Building Industry

Modular Construction Market: Revolutionizing the Building Industry

20 Hottest Housing Markets in America as of May 2024

20 Hottest Housing Markets in America as of May 2024