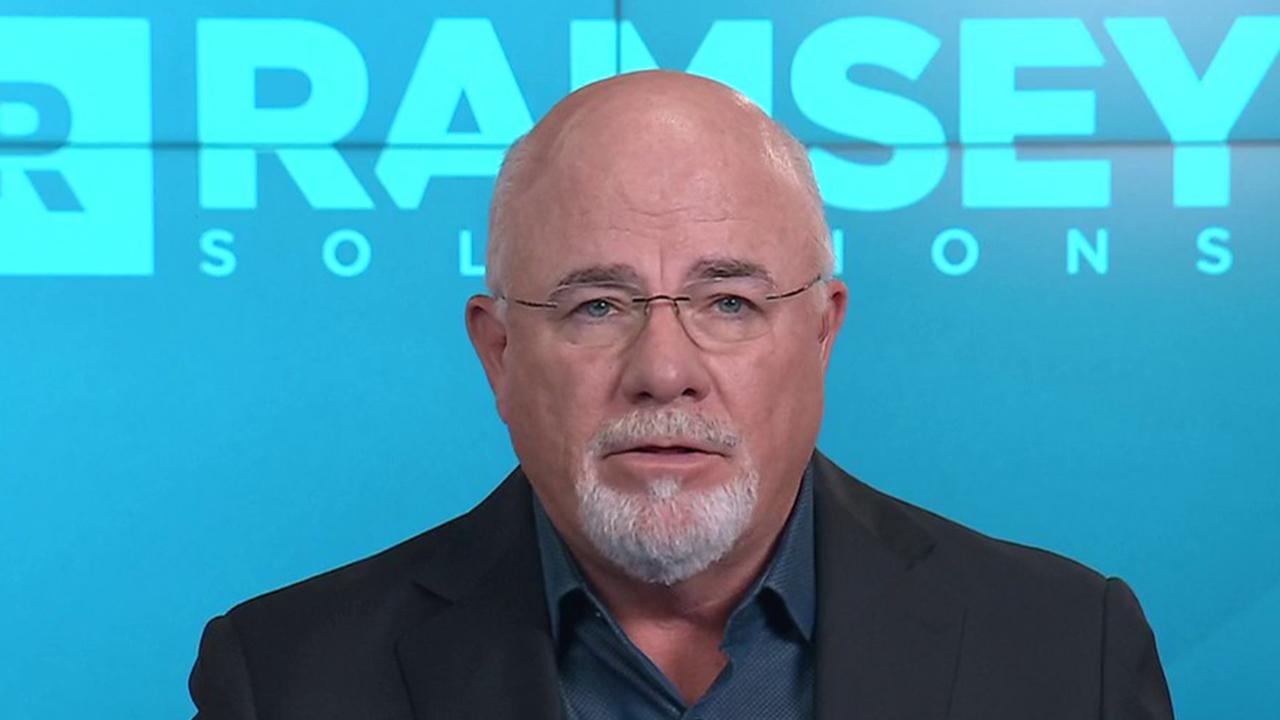

Dave Ramsey, with his deep-seated experience in real estate, confidently debunked the housing crash fears two years ago. His prediction of a resilient housing market, despite the uptick in interest rates, showcased his understanding of economic fundamentals. Ramsey’s assertion that a supply crunch would sustain or elevate home prices has proven accurate, as evidenced by the steady increase in home values.

The Dynamics of Supply and Demand

Ramsey’s analysis hinged on basic economic principles: a shortage in housing supply amidst growing demand would inevitably push prices higher. This viewpoint was not universally shared at the time, given fears that rising interest rates would dampen the housing market. However, Ramsey’s insight into the supply-demand dynamics has been vindicated, as home prices have continued to rise, albeit at a pace that has made affordability a pressing concern.

Looking Ahead: Housing Market Forecast

As we peer into the future, Ramsey’s outlook remains unwavering. He anticipates further price increases, driven by a persistent shortfall in housing construction relative to the formation of new households. This imbalance suggests that the housing market will remain tight, with prices on an upward trajectory. Ramsey advises potential buyers to focus less on fluctuating interest rates and more on the price of the home, suggesting that rates can always be refinanced, but the opportunity to purchase at a reasonable price may not persist.

Navigating the Housing Market with Dave Ramsey’s Advice

Dave Ramsey‘s mantra, “Marry the house, date the rate,” encapsulates his approach to navigating the current housing market. It’s a reminder that while interest rates may fluctuate, the value of choosing the right home at the right price remains paramount. As we look back on Ramsey’s accurate predictions and forward to his current advice, it’s clear that understanding the underlying economic principles can provide a solid foundation for making informed decisions in the real estate market.

Related posts:

Surge in US Housing: A Close Look at the November 2023 Boom

Surge in US Housing: A Close Look at the November 2023 Boom

Seattle Fort Lawton Housing Plan Revision: A New Vision for Affordable Living

Seattle Fort Lawton Housing Plan Revision: A New Vision for Affordable Living

2024 Real Estate Recession Warning: A Closer Look at the Housing Market Dynamics in Arizona

2024 Real Estate Recession Warning: A Closer Look at the Housing Market Dynamics in Arizona

Affordable Housing in Highland Park: A Sustainable Approach to Homeownership

Affordable Housing in Highland Park: A Sustainable Approach to Homeownership

White House Initiative for Office-to-Housing Conversions Faces Hurdles, Developers Report Delays

White House Initiative for Office-to-Housing Conversions Faces Hurdles, Developers Report Delays