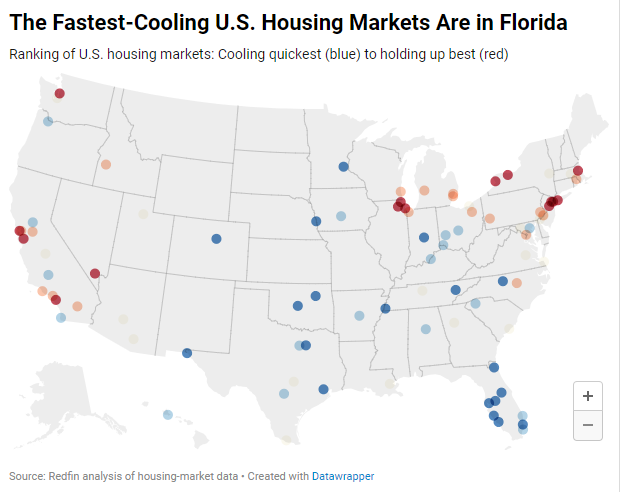

The cooling housing markets in Florida are becoming a significant trend as various factors contribute to this shift. From natural disasters to a surge in new construction, Florida’s real estate landscape is undergoing notable changes. This article will explore the key reasons behind this trend, focusing on the west coast of Florida, where the cooling effect is most pronounced.

Cooling Housing Markets in Florida’s West Coast

The cooling housing markets in West Florida are notable for their rapid changes in home buying demand and competition. The following areas are among the fastest cooling housing markets in the region:

North Port:

- Supply of homes for sale is up 68% year over year.

- Median price per square foot is down 1.2%.

- 42.6% of sellers are dropping their asking price, up from 36% a year earlier.

Tampa:

- Significant increase in inventory levels.

- Median price per square foot trends and seller behavior indicating cooling.

Cape Coral:

- Inventory is up 64%.

- Median price per square foot is down 2.9%.

- 37.5% of sellers are dropping their price, up from 32.9% a year earlier.

Orlando:

- Notable changes in home buying demand and inventory levels.

- Cooling measures similar to other markets in West Florida.

Lakeland:

- Increased supply of homes.

- Changes in median price per square foot and seller pricing strategies.

These markets have been influenced by a combination of natural disasters, new construction surges, rising insurance costs, and high home prices, contributing to the cooling trend.

The Impact of Natural Disasters

One of the primary reasons for the cooling housing markets in Florida is the increasing intensity of natural disasters. Hurricanes, floods, and other severe weather events have become more frequent and intense in the state. The destruction caused by these disasters is substantial, with Hurricane Ian in 2022 alone destroying 5,000 homes and damaging nearly 30,000 more in the Cape Coral metro area. This devastation not only leads to a surge in new construction as builders replace lost homes but also scares away prospective homebuyers, contributing to the cooling effect.

Surge in New Construction

Florida is experiencing a building boom, with more new homes being constructed than in any other state except Texas. This surge in new construction comes at a time when high prices and mortgage rates are dampening homebuying demand. The oversupply of inventory is cooling competition, further contributing to the cooling housing markets in Florida. For instance, North Port, the fastest cooling market, has seen a 68% increase in the supply of homes for sale year over year.

Rising Insurance Costs

Sky-high insurance costs are another significant factor in the cooling housing markets in Florida. Natural disasters have pushed up home insurance costs, with many homeowners reporting increases of thousands of dollars. A recent Redfin survey found that 70% of Florida homeowners have seen their insurance costs rise recently. These elevated insurance costs, combined with high home prices and mortgage rates, are pricing out many locals and discouraging some older Americans from moving to Florida.

Soaring Home Prices

Although prices in some parts of Florida have started to decline in recent months, homes remain much costlier than before the pandemic home buying boom. Prices in North Port are up 60% since 2019, and in Tampa, they are up nearly 70%, much higher than the national increase of about 40%. These elevated prices, along with high insurance costs and mortgage rates, are contributing to the cooling housing markets in Florida.

The cooling housing markets in Florida are being driven by several key factors, including the increasing intensity of natural disasters, a surge in new construction, rising insurance costs, and soaring home prices. While this trend may be disappointing for sellers, it offers some relief to homebuyers as more supply becomes available and prices start to stabilize. The cooling housing markets in Florida reflect broader trends in the real estate market and highlight the complex interplay of various economic and environmental factors.

Related posts:

Tenant-Based Rental Subsidies: A $7.9M Initiative in Montgomery County, Dayton

Tenant-Based Rental Subsidies: A $7.9M Initiative in Montgomery County, Dayton

Mortgage Rate Surge: Navigating the April 2024 Increase

Mortgage Rate Surge: Navigating the April 2024 Increase

New Home Sales in March 2024 Increase

New Home Sales in March 2024 Increase

KBIS 2024’s DesignBites 10 Kitchen and Bath Innovators

KBIS 2024’s DesignBites 10 Kitchen and Bath Innovators

Kentucky Rental Investment: $223 Million Boost for Housing in Four Counties

Kentucky Rental Investment: $223 Million Boost for Housing in Four Counties