Condo HOA fees are a critical aspect of condominium ownership that many buyers often overlook until it’s too late. These fees, typically paid monthly, go toward maintaining shared spaces, amenities, and covering other operational costs within the condo community. Recently, however, condo HOA fees have surged, particularly in states like Florida, where rising insurance costs and new safety regulations have drastically impacted homeowners. Understanding the factors driving these increases and their implications is essential for any current or prospective condo owner.

The Rise of Condo HOA Fees in Florida

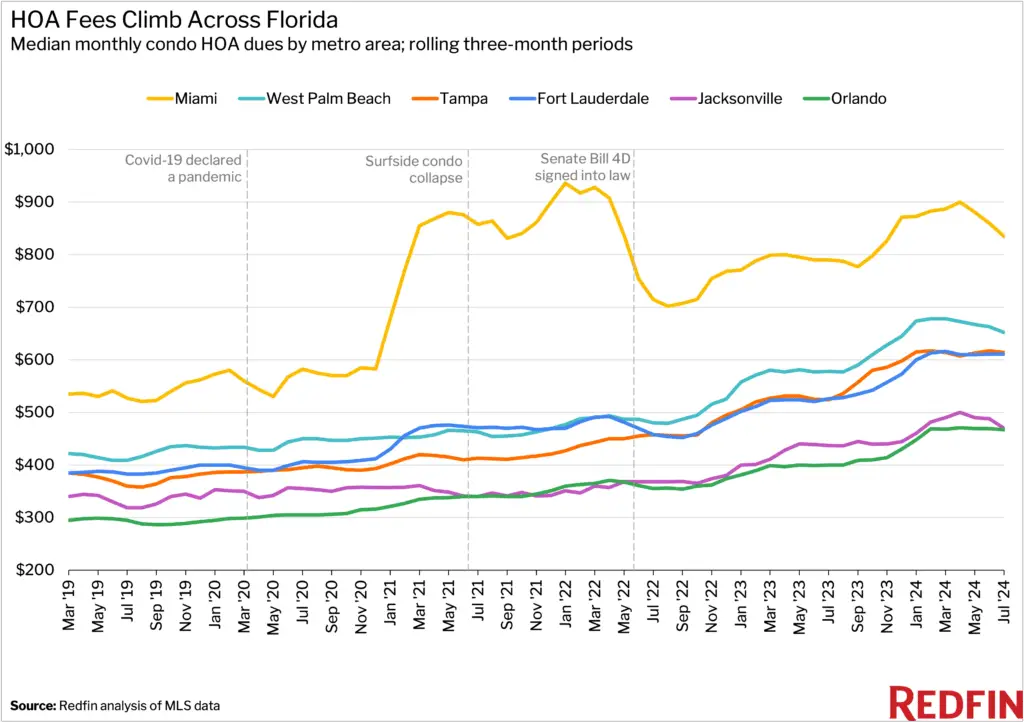

Florida has seen a significant spike in condo HOA fees, particularly in cities like Tampa, Orlando, and Fort Lauderdale. These increases are largely attributed to two primary factors: skyrocketing insurance costs and new safety regulations following the tragic Surfside condo collapse in 2021. The median HOA fees in Tampa, for instance, jumped by 17.2% year over year, the steepest increase among major U.S. metropolitan areas. In Orlando and Fort Lauderdale, the fees rose by 16.7% and 16.2%, respectively. These hikes are forcing many condo owners, especially those on fixed incomes, to reassess their ability to afford staying in their homes.

Why Are Condo HOA Fees Increasing?

The sharp rise in condo HOA fees can be traced back to a few key issues. First, the Surfside condo collapse prompted Florida to implement stringent safety regulations, requiring more frequent structural inspections and higher reserve funds for repairs. To comply, many homeowners associations (HOAs) have had no choice but to raise their fees and impose special assessments.

Secondly, Florida’s insurance crisis has driven up premiums across the state. Natural disasters have intensified, and as a result, many insurers have pulled out of the state, leaving HOAs to shoulder the burden of increased insurance costs. Nearly three-quarters of Florida homeowners reported higher insurance premiums, with some of these costs being passed down to condo owners through increased HOA dues.

Inflation has also played a role, pushing up the costs of maintenance, repairs, and other services covered by HOA fees. Combined, these factors have made condo ownership less attractive in many parts of Florida, contributing to a drop in condo sale prices even as HOA fees continue to climb.

The Broader Impact of Rising Condo HOA Fees

The Broader Impact of Rising Condo HOA Fees

The surge in condo HOA fees isn’t just a Florida problem; it’s being felt across the country. Cities like Seattle and Denver have also reported significant increases. This trend is causing concern among both current condo owners and potential buyers, who must now factor these rising costs into their purchasing decisions. As fees rise, some condo owners are finding it increasingly difficult to sell their units, further complicating the real estate landscape.

Lenders are also paying closer attention to the financial health of HOAs. Prospective buyers need to research whether a condo’s HOA is on the Fannie Mae approved list and ensure that the HOA is adequately insured and free from special litigation. Failing to do so could result in financing issues and unexpected costs down the road.

Preparing for the Future of Condo HOA Fees

As the landscape of condo ownership continues to evolve, it’s more important than ever for buyers to understand the implications of condo HOA fees. With fees rising due to insurance crises, safety regulations, and inflation, potential buyers must be diligent in their research to avoid unpleasant surprises. For those already owning condos, staying informed and actively participating in HOA meetings can provide a better understanding of where their money is going and how future increases might be mitigated.

Whether you’re considering buying a condo or currently own one, keeping a close eye on condo HOA fees will help you make informed decisions in this challenging market.