Bank of America’s report reveals a decline in prospective homebuyers’ patience, with only 62% willing to wait for improved prices or rates—down from 85% six months ago. This shift is evident in increased new single-family house sales, reaching 759,000 in September 2023, compared to 679,000 in April 2023.

When it comes to buying a home, timing aligns with financial readiness and finding the right fit. Despite current interest rates, there are benefits to building equity through homeownership,” says Matt Vernon, Head of Consumer Lending at Bank of America.

The research delves into what buyers are willing to forgo for a quicker purchase and what motivates current homeowners to sell. Approximately 80% of U.S. mortgages have rates below 5%, creating reluctance to move. Millennials, especially, feel the impact.

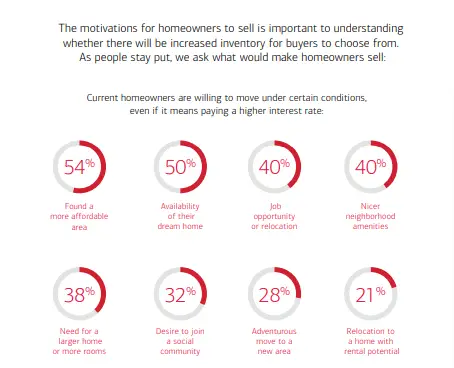

What inspires homeowners to sell in today’s environment?

- 50% for a dream home

- 54% for a more affordable area

- 40% job opportunity or relocation

- 40% nicer neighborhood amenities

- 38% need for a larger home

- 32% desire for a social community

- 28% adventurous relocation

- 21% moving to a home with rental potential

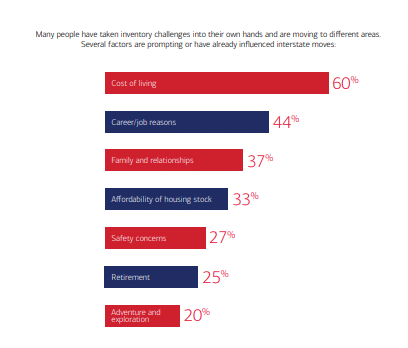

Motivations for moving to a new state

- 60% cost of living

- 44% career/job reasons

- 37% family and relationships

- 33% affordability of housing

- 27% safety concerns

- 25% retirement

- 20% adventure and exploration

Work-related reasons are a key driver for homeowners to sell. Increased job opportunities, job relocation requirements, and the ability to work remotely are influencing factors. Regional labor markets and migration trends show close correlation, with cities like Austin, San Antonio, Las Vegas, and Tampa experiencing significant population inflow.

In the face of scarce inventory, prospective buyers are willing to make sacrifices. The report finds differences between generations:

- Gen Z (15%) less likely to give up space than baby boomers (40%)

- Gen Z (24%) more willing to compromise on location than baby boomers (6%)

Top sacrifices across all generations:

- 35% giving up a brand-new home

- 33% being near family

- 32% public transportation access

- 31% historical charm

The survey explores how respondents define success, with homeownership ranking high (48%). Respondents perceive their homes as valuable investments (91%) and view homeownership as liberating (81%). While challenges exist, Bank of America remains committed to providing affordable homeownership solutions, including grants for down payments and closing costs, with no repayment required.

Related posts:

Europe’s Housing Market Squeezed Amidst Cost-of-Living Crisis

Europe’s Housing Market Squeezed Amidst Cost-of-Living Crisis

Increase in US Home Construction in 2023 Signals Robust Market Recovery

Increase in US Home Construction in 2023 Signals Robust Market Recovery

Increased Housing Confidence Brightens 2024, But Buying a Home Still Tough

Increased Housing Confidence Brightens 2024, But Buying a Home Still Tough

Canada Bans Foreign Homeownership Until 2027 to Help People Afford Homes

Canada Bans Foreign Homeownership Until 2027 to Help People Afford Homes

Housing Market Crash in 2024: Unpacking the Truth Behind Rising Concerns

Housing Market Crash in 2024: Unpacking the Truth Behind Rising Concerns