Asking rents fall—a phrase that may bring a sigh of relief to many renters across the United States. For the first time in four years, the nationwide median asking rent has declined across all bedroom counts, marking a significant shift in the rental market. This decrease, reflected in a report from Redfin, signals potential opportunities for renters and raises questions about the future trajectory of the housing market.

A Closer Look at the Numbers

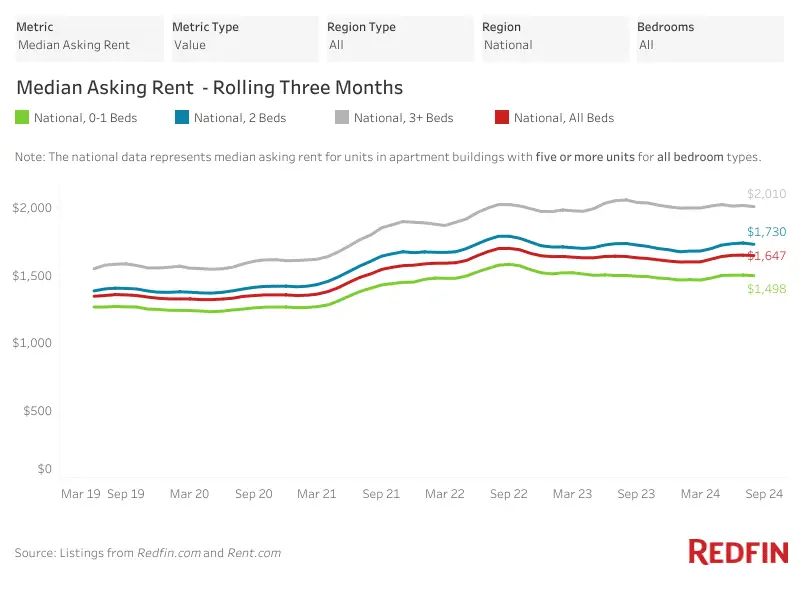

In July 2024, the nationwide median asking rent was $1,647, which is $53 less than the all-time high recorded in 2022. Notably, the largest decline was seen in rents for three-bedroom apartments, which fell by 2.4% year over year. This drop is particularly significant as it represents the first time since June 2020 that the median asking rent has decreased across all bedroom categories.

Specifically, rents for 0-1 bedroom apartments fell by 0.1% to $1,498, while two-bedroom apartments saw a 0.3% decrease to $1,730. The steepest decline occurred in the three-bedroom category, where the median asking rent dropped to $2,010—a 2.4% decrease. All these figures are at least $50 below the all-time highs posted in recent years.

Regional Variations: Sun Belt Takes a Hit

While the overall trend shows that asking rents fall, the impact has been felt unevenly across different regions. The Sun Belt metros, particularly in states like Florida and Texas, experienced some of the most significant declines. For instance, Austin, TX, saw a staggering 16.9% drop in median asking rent, while Jacksonville, FL, followed closely with a 14.3% decrease.

This decline in rent prices is largely attributed to the increased supply of new apartment constructions in these regions. Since the pandemic, there has been a surge in construction, leading to an oversupply in certain areas. The increased availability of 3+ bedroom apartments, in particular, has outpaced demand, pushing prices down faster in these larger, more expensive units.

Understanding the Broader Market Dynamics

Despite the fact that asking rents fall across many regions, the overall rental market remains complex. For example, while rents are dropping in the Sun Belt, other areas like Virginia Beach, VA, and Baltimore, MD, have seen significant increases in asking rents, with Virginia Beach experiencing a 13.7% year-over-year rise.

Additionally, the overall rental vacancy rate has remained steady at 6.6% for four consecutive quarters—the highest level since 2021. However, buildings with five or more apartments have seen a slight increase in vacancy rates, rising to 7.8% in the second quarter of 2024, up from 7.4% the previous year.

What This Means for Renters

For renters, the current period presents an opportunity to secure better deals, especially for those seeking larger apartments. According to Redfin Senior Economist Sheharyar Bokhari, the recent dip in rents can be attributed to the large number of new apartments built over the past two years. While construction is expected to slow down, potentially leading to a resurgence in prices, renters may still find favorable conditions in the near term.

However, the situation remains nuanced. Even though asking rents fall across various categories, affordability continues to be a pressing issue. The median rent, while down from its peak, still poses a financial challenge for many households. Renters, especially those earning below the median income, may still struggle to afford the typical apartment.

Asking Rents Fall: A Moment of Relief or a Temporary Dip?

The fact that asking rents fall across the nation is undoubtedly a noteworthy development in the housing market. This trend offers some relief to renters, particularly those in regions where prices have dropped significantly. However, with construction slowing down and vacancy rates stabilizing, it’s uncertain how long this trend will last. Renters and market watchers alike will need to keep a close eye on the evolving dynamics to understand whether this is a temporary dip or the beginning of a more sustained decrease in rental prices.