All-cash home purchases have become an increasingly significant trend in the US housing market. As of June 2024, nearly one-third of all home sales were made without the need for a mortgage, a clear indication of the growing preference among buyers to avoid the financial burden of long-term loans. This article explores the factors driving this trend, the implications for the housing market, and what it means for both buyers and sellers.

Why All-Cash Home Purchases Are on the Rise

One of the primary reasons for the rise in all-cash home purchases is the volatility in mortgage rates. With rates reaching some of the highest levels in the past two decades, more buyers are opting to pay in cash to avoid the high interest rates associated with traditional mortgages. This trend is particularly noticeable among investors and affluent buyers who have the financial resources to make such purchases without financing.

In addition to mortgage rate concerns, the increase in home prices has also played a role. The median-priced home in the U.S. hit a record $442,525 in June 2024, a 4% year-over-year increase. Higher home prices naturally lead to higher down payments, pushing some buyers to make all-cash home purchases to gain a competitive edge in a tight market. All-cash offers are often more attractive to sellers as they eliminate the uncertainty and delays that can come with mortgage approvals.

The Impact of All-Cash Purchases on the Housing Market

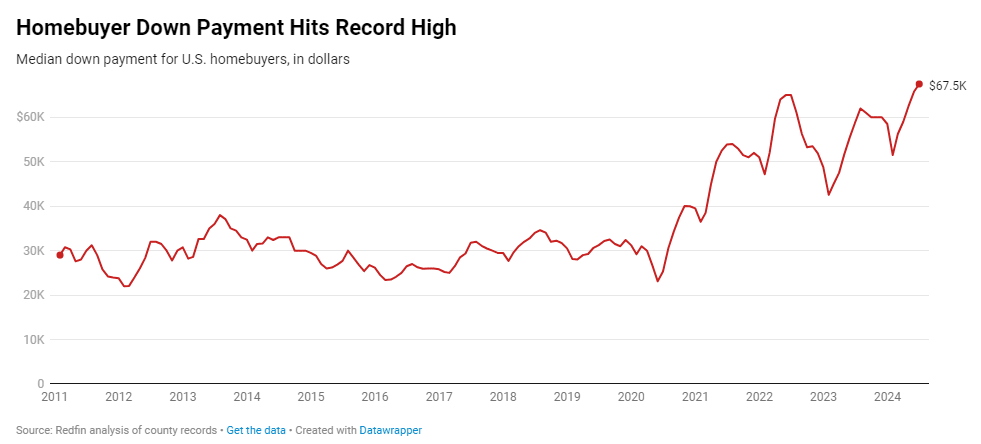

The rise of all-cash home purchases has several implications for the housing market. For one, it has contributed to the increase in the median down payment, which reached a record $67,500 in June 2024. This figure represents an 18.6% share of the purchase price, up from 15% a year earlier. With more buyers paying in cash or making substantial down payments, the barrier to entry for first-time homebuyers—who typically rely on financing—is becoming increasingly high.

Furthermore, the growing prevalence of all-cash transactions is reshaping the dynamics of home sales. In markets like West Palm Beach, FL, where over 50% of sales were all-cash, investors and buyers with significant cash reserves are dominating, leaving little room for those dependent on financing. This trend could exacerbate housing inequality, as those without access to large sums of money are pushed out of desirable markets.

What This Means for Buyers and Sellers

For buyers, the trend of all-cash home purchases presents both opportunities and challenges. On the one hand, paying in cash can give buyers a competitive edge, allowing them to close deals faster and often at a lower price. On the other hand, it raises the stakes, particularly for first-time buyers who may find it difficult to compete with cash-rich investors.

Sellers, meanwhile, benefit from the security and simplicity that all-cash offers provide. These transactions are less likely to fall through due to financing issues and typically result in a quicker closing process. However, sellers must also consider the potential for market distortions, as an influx of all-cash buyers can drive up home prices and reduce the pool of eligible buyers.

All-cash home purchases are becoming an increasingly common feature of the U.S. housing market. This trend is driven by high mortgage rates, rising home prices, and the financial strategies of investors and affluent buyers. While this shift presents challenges for first-time homebuyers and those reliant on financing, it also offers advantages for sellers and cash-rich buyers. As this trend continues to shape the housing market, understanding its implications will be crucial for anyone looking to buy or sell a home.