The 2008 housing bubble burst was a seismic event that not only shook the financial world but also left an indelible mark on the real estate landscape across the United States. As we revisit this critical moment, it’s essential to understand the factors that led to the bubble, the impact on housing markets like Punta Gorda, Florida, and the lessons learned that continue to influence today’s market dynamics.

The Build-Up to the 2008 Housing Bubble Burst

In the years leading up to the 2008 housing bubble burst, the U.S. housing market experienced an unprecedented boom. Fueled by easy access to credit, low-interest rates, and speculative investments, home prices soared to unsustainable levels. The belief that real estate values would continue to climb indefinitely encouraged risky borrowing and lending practices, setting the stage for a catastrophic collapse.

However, this rapid appreciation of home prices was built on shaky foundations. As adjustable-rate mortgages began to reset and the subprime mortgage market unraveled, a wave of foreclosures swept across the nation. This triggered a downward spiral in home prices, leading to the 2008 housing bubble burst that devastated homeowners and investors alike.

The Impact on Local Markets: Punta Gorda’s Story

One of the most severely affected areas during the 2008 housing bubble burst was Punta Gorda, Florida. Known for its idyllic waterfront properties and appeal to retirees, Punta Gorda saw a dramatic rise in home prices during the early 2000s. But when the bubble burst, the market in this Southwest Florida city was hit particularly hard.

From its peak in 2006 to the bottom in 2011, home prices in Punta Gorda plummeted by 47.8%. The overvaluation of homes, combined with a sudden decline in demand, left many homeowners underwater, with mortgages exceeding the value of their properties. This period of correction was a harsh reminder of the dangers of speculative investments and the consequences of an overheated market.

Lessons Learned and the Road to Recovery

The 2008 housing bubble burst taught both homeowners and the financial industry valuable lessons about the risks of unchecked growth and the importance of market fundamentals. In the years that followed, stricter lending standards were implemented, and new regulations were introduced to prevent a similar crisis from occurring again.

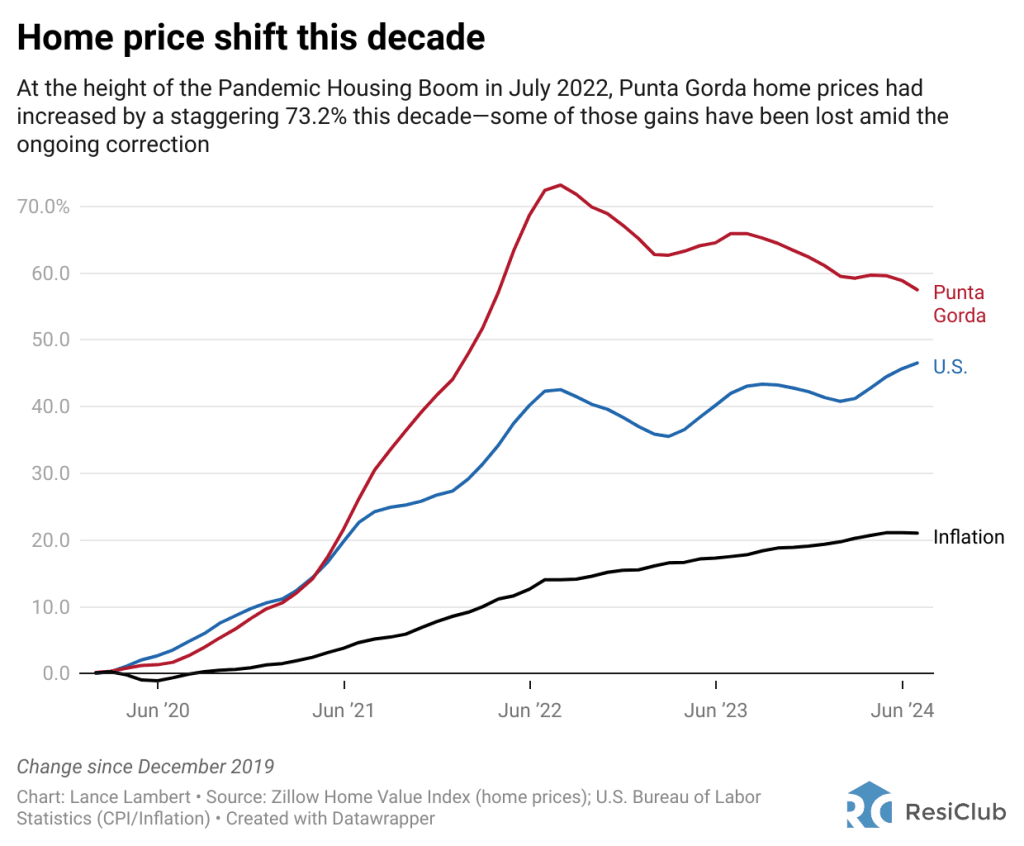

Despite these measures, some markets, like Punta Gorda, Florida are still experiencing the effects of the burst. Even today, the city’s housing market is undergoing a correction, with prices down 9.1% from their 2022 peak. This ongoing adjustment highlights the long-term impact of the 2008 housing bubble burst and the challenges faced by regions that were once at the epicenter of the crisis.

The Lasting Legacy of the 2008 Housing Bubble Burst

The 2008 housing bubble burst remains a pivotal moment in U.S. economic history, serving as a cautionary tale for both current and future generations. The repercussions of this event continue to influence housing markets, shaping the way we approach real estate investment, lending practices, and market regulation. As we move forward, it’s crucial to remember the lessons learned from this crisis to avoid repeating the mistakes of the past.